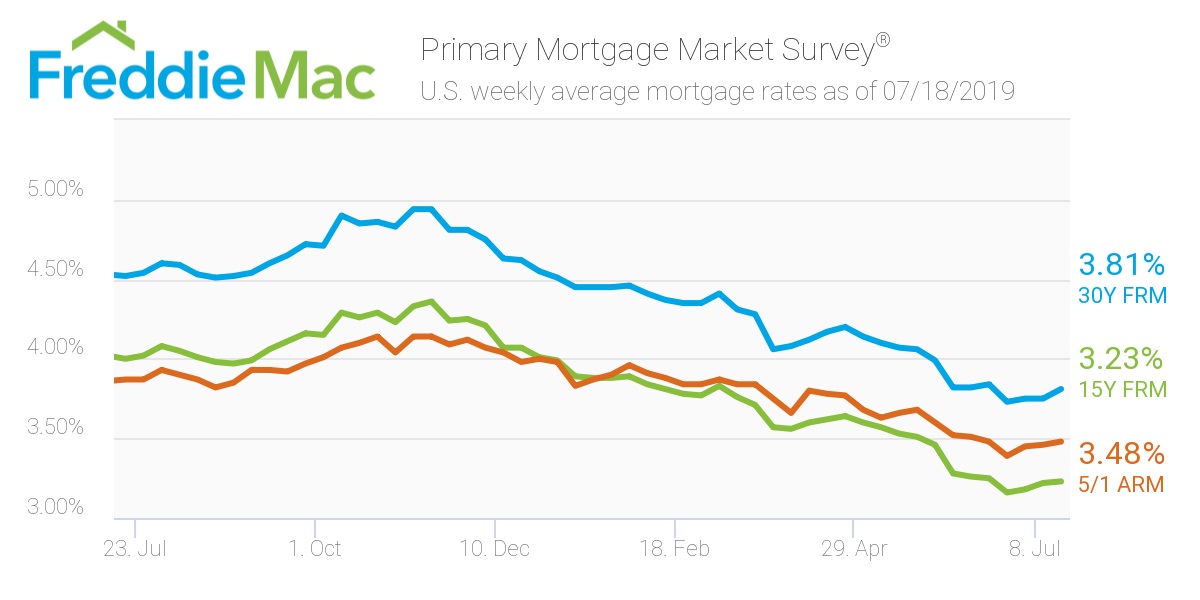

This week, the 30-year, fixed-rate mortgage averaged 3.81%, moderately rising from last week’s 3.75%, according to the Freddie Mac Primary Mortgage Market Survey.

The rate is still much lower than the same time period in 2018 when it averaged 4.52%.

Freddie Mac Chief Economist Sam Khater said mortgage rates moved higher after remaining at around the same level for about three weeks.

“The rise in rates was driven by continued improvement in consumer spending and partly due to optimism around a forthcoming cut in short term interest rates, which should provide support for business and investor sentiment,” Khater said.

The 15-year FRM averaged 3.23% this week, slightly up from last week’s 3.22%. This time last year, the 15-year FRM came in at 4%.

Lastly, the five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.48%, crawling forward from last week’s rate of 3.46%. This rate is lower than the same time period in 2018 when it averaged 3.87%.

“Despite this slight increase in rates, homebuyers are taking advantage of the multi-year low rates in droves, which is evident in the consistently higher refinance and purchase application volumes,” Khater said. “The improvement in housing demand should provide sufficient momentum for the housing market and economy during the rest of the year.”

The image below highlights this week’s changes: