Top officials at the U.S. Department of Housing and Urban Development are looking to chart a new course to win back banks that have fled the Federal Housing Administration lending program following a series of multimillion-dollar False Claims Act settlements.

In the past, HUD has partnered with the U.S. Department of Justice to pursue settlements under the False Claims Act that left lenders and servicers facing treble damages plus penalties for what the government said were false certifications made in connection with deficient FHA loans. While current HUD leadership has said the government is looking to move away from the act, the steps it has outlined — including FHA’s proposals to revise its loan- and lender-level certifications — may not translate into decreased HUD enforcement risk for FHA lenders and servicers.

In the past, HUD has partnered with the U.S. Department of Justice to pursue settlements under the False Claims Act that left lenders and servicers facing treble damages plus penalties for what the government said were false certifications made in connection with deficient FHA loans. While current HUD leadership has said the government is looking to move away from the act, the steps it has outlined — including FHA’s proposals to revise its loan- and lender-level certifications — may not translate into decreased HUD enforcement risk for FHA lenders and servicers.

False Claims Act actions declining but HUD enforcement increasing

HUD’s access to enforcement mechanisms is much broader than the False Claims Act and, in some cases, other tools are easier to use. They include lender monitoring reviews and post-endorsement loan reviews by HUD’s Quality Assurance Division, post-claim reviews by HUD’s single-family post insurance division, administrative actions and civil money penalties by HUD’s Mortgagee Review Board and litigation and administrative actions by HUD’s Office of General Counsel, including under the Program Fraud Civil Remedies Act, the agency’s own “mini False Claims Act.”

Recent information suggests that HUD’s reliance on these agency enforcement mechanisms may be increasing. In November, FHA announced it has recommended statutory changes to enhance the authorities of MRB. It is also revising its defect taxonomy to enhance its enforcement regime, and data from QAD shows that the number of single-family loans reviewed by FHA is increasing quarter over quarter.

Use of new technology and old regulations make HUD enforcement more efficient

The apparent increase in HUD enforcement may, in part, be explained by enhanced efficiencies at HUD. Specifically, the deployment of new technology has made it easier to identify potential violations of FHA requirements, while increased reliance on old regulations could magnify the amount of payments HUD seeks.

New technology makes identification of material violations easier and quicker

The deployment of the Lender Electronic Assessment Portal in 2014 and Loan Review System in 2017 has made it easier for HUD to identify potential violations of FHA requirements. This has resulted in an uptick in certain types of MRB actions. Take the following examples:

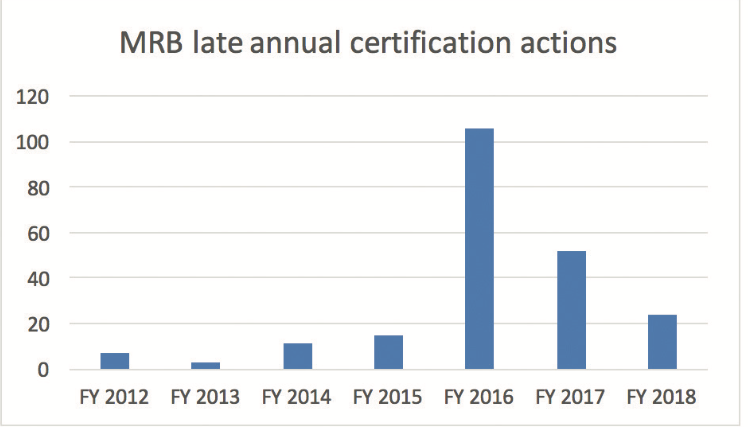

Late Annual Certifications: All FHA mortgagees must annually certify within 90 days of their fiscal year-end to compliance with certain statements.

Since 2014, that submission must occur through LEAP. Prior to 2014, MRB took action against only a handful of mortgagees each year for failure to complete their annual certification timely. Since then, that number has climbed, reaching 106 in fiscal year 2016.

While such actions have started to taper off as mortgagees have realized the consequences of late submission, they remain historically high.

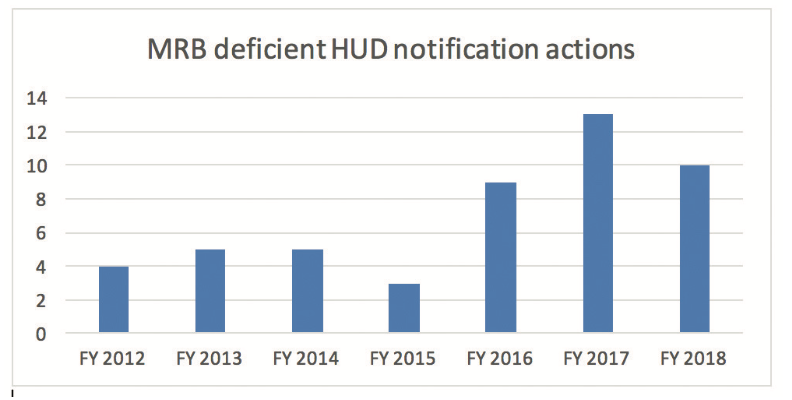

Deficient HUD Notifications: FHA mortgagees must also notify HUD, generally within 10 business days, whenever there are changes to information outlined in their application for FHA approval or that may affect their compliance with FHA’s eligibility requirements — such as being sanctioned by a government entity. FHA mortgagees must also attest to compliance with FHA’s eligibility requirements as part of their annual certification, including that they were not sanctioned by a government entity.

Since 2014, both the notification reporting function and annual certifications have been consolidated through LEAP, highlighting discrepancies between the mortgagee’s annual certification and intra-year notifications.

Not coincidentally, MRB actions related to failure to notify HUD in a timely manner have also climbed over the years from a few notification-related actions each year from fiscal year 2012 to 2015 to nine in fiscal year 2016, 13 in fiscal year 2017, and 10 in fiscal year 2018.

Not coincidentally, MRB actions related to failure to notify HUD in a timely manner have also climbed over the years from a few notification-related actions each year from fiscal year 2012 to 2015 to nine in fiscal year 2016, 13 in fiscal year 2017, and 10 in fiscal year 2018.

Further, the LRS’s implementation of HUD’s defect taxonomy and consolidation of most quality control functions have made it easier and faster for HUD to identify potential program violations warranting indemnification. FHA reports the results of its reviews through the LRS, using its defect taxonomy to categorize the severity of such defects. Mortgagees may respond only to “unacceptable” findings. If the mortgagee fails to sufficiently cure or respond to “unacceptable” findings, HUD may request or demand indemnification.

FHA mortgagees have reported increased indemnification demands since the LRS was deployed. That number may rise further once HUD implements its revised defect taxonomy.

Old regulations make violations more costly

Beyond the efficiencies made possible by recent technology, HUD is seemingly looking to older regulations to seek larger payments for the same conduct.

For example, a regulation enacted in 1992 allows HUD to use statistical sampling to select FHA claims for post-claims review and to extrapolate the amount of overpayment on the reviewed claims to all FHA claims paid during the review period when calculating the amount due to HUD because of overpayment.

Likewise, HUD regulations for over two decades have allowed the MRB to consider each day of a continuing violation to be a separate violation for purposes of calculating CMPs. Reports from some mortgagees suggest that HUD may be taking a more aggressive stance based on these old regulations to demand payments.

Prompt action necessary to minimize potential business impact

In light of HUD’s increased enforcement activity, absent exiting the FHA program, what should FHA mortgagees do to minimize their potential liability?

First, mortgagees should re-acquaint themselves with current expectations and requirements, ensuring that they have a strong understanding of HUD statutes, regulations, handbooks and mortgagee letters.

Signing up for FHA’s emails and participating in free webinars offered by FHA can help with this understanding, as can reaching out directly to FHA when in doubt.

Tracking deficiencies identified in file reviews or audits and incorporating them into one’s processes is also a sound risk management tool. However, mortgagees should not assume they are complying simply because they have always done something a certain way.

Second, mortgagees should understand HUD’s enforcement mechanisms and allocate sufficient time and resources to respond to HUD when the need arises, commensurate with the different authority and enforcement powers of each respective arm of HUD.

For example, QAD has authority to request or demand indemnification or refer mortgagees to MRB, whereas MRB has authority to impose CMPs close to $2 million per year and withdraw a mortgagee’s FHA lending authority.

And of course, HUD’s Office of Inspector General operates independent of HUD entirely, and a request from the OIG — which often works with the DOJ — is not a standard audit or review.

Given HUD’s enforcement mechanisms, and the ease with which they can be used, decreased emphasis on the False Claims Act does not necessarily translate into decreased enforcement of FHA requirements.

Lenders and servicers should place sufficient emphasis on responding to any HUD inquiry or allegation in a fulsome and timely manner, with a strong understanding of FHA requirements, the particular facts at issue, and any potential defenses that may be available.