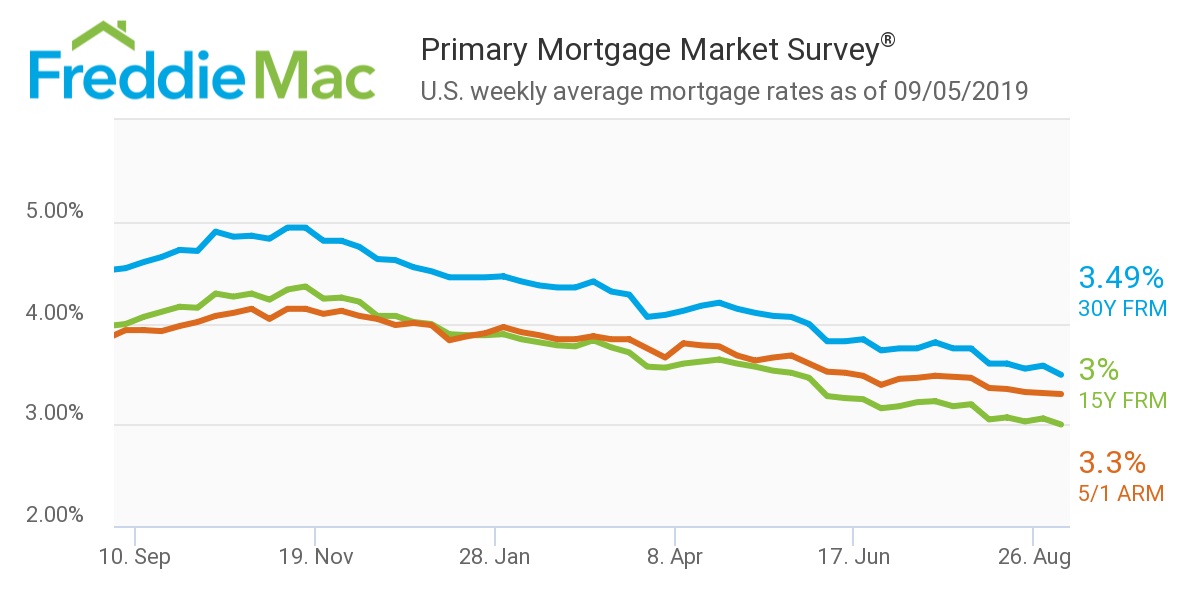

Once again, the average U.S. rate for a 30-year fixed mortgage fell to another three-year low this week, according to the latest Freddie Mac Primary Mortgage Market Survey.

According to the company’s data, the 30-year fixed-rate mortgage averaged 3.49% for the week ending Sept. 5 2019, down from last week’s rate of 3.58%. Unsurprisingly, this average is nearly an entire percentage point lower than its 2018 rate of 4.54%.

Freddie Mac Chief Economist Sam Khater said that mortgage rates continued the summer swoon due to weaker economic data.

“While economic growth is clearly slowing due to rising manufacturing and trade headwinds, economic fundamentals are still solid for U.S. consumers,” Khater said. “The unemployment rate is low, housing affordability is improving, homebuyer demand is rising, and home price growth is stable.”

The 15-year FRM averaged 3% this week, falling from last week’s 3.06%. This time last year, the 15-year FRM came in at 3.99%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.3%, sliding from last week’s rate of 3.31%. This rate sits significantly lower than the same week in 2018 when it averaged 3.93%.

The image below highlights this week's changes: