A key source of affordable housing inventory was cut in half over the last three years, resulting from well-intended but heavy-handed efforts to keep delinquent borrowers in homes.

That key source of affordable housing inventory: distressed properties sold to third-party buyers or repossessed by lenders at foreclosure auction. Once the transfer of ownership occurs at foreclosure auction, a distressed property can be renovated and returned to the retail market as affordable housing for homeowners or renters.

“[I am] renovating homes at a reasonable price so that people in our community can hopefully have good quality, affordable housing to purchase,” said Pam Franklin, a Kansas-based Auction.com buyer who purchases one to two distressed properties a year and resells them to owner-occupants after renovation. “[My renovated homes are] reducing the number of rental properties, which in our town has become a source of demise.”

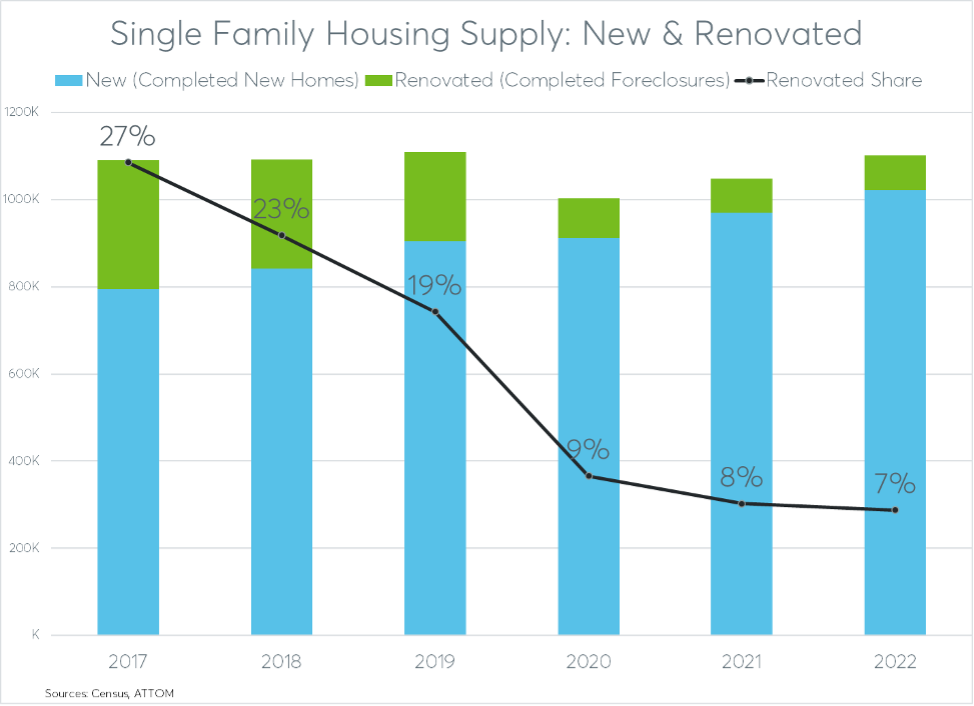

In the three years prior to the pandemic, completed foreclosure auctions represented a potential affordable housing supply of 250,000 homes a year on average, according to public record data from ATTOM. In 2019 the number was 200,000. When including the approximately 900,000 single family homes constructed by new homebuilders during the year, according to data from the Census and U.S. Department of Housing and Urban Development (HUD), that 200,000 represented close to 20% of all single-family homes supplied to the market in 2019.

More Affordable than New Homes

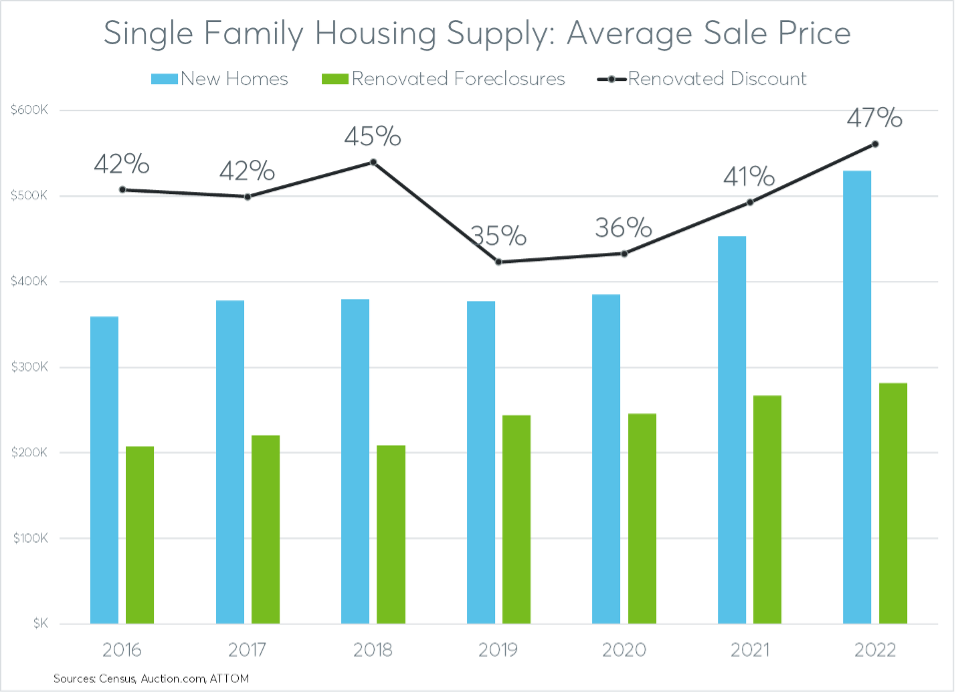

Not surprisingly, housing supplied by new homebuilders is higher priced than housing supplied by distressed property renovators. New single-family homes sold for an average price of more than $377,000 in 2019. By comparison, renovated foreclosures that sold in 2019 had an average sales price of $244,000 — $133,000 (35%) lower than the average price of new homes.

Affordable for Local Families

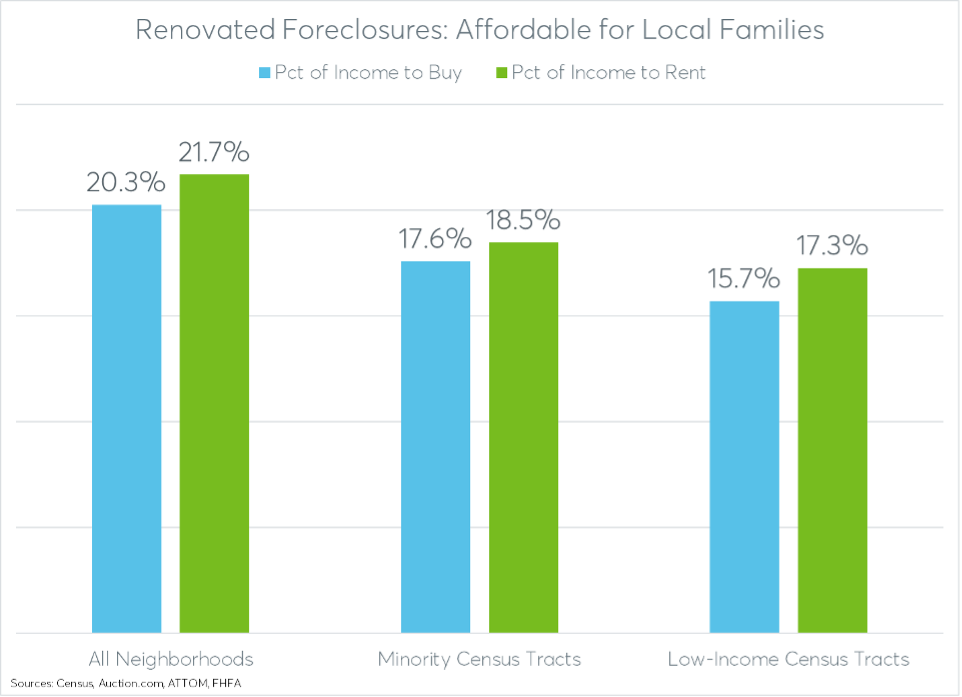

Renovated foreclosures aren’t just affordable relative to the overall retail market. They’re affordable for local families making the median income in the surrounding neighborhood.

The monthly house payment to buy a renovated foreclosure — assuming a 5% down payment, the going 30-year fixed mortgage rate at the time of sale and including property taxes and insurance — represented just 20% of the median family income in the surrounding Census tract. That’s according to an analysis of more than 275,000 properties brought to foreclosure auction on Auction.com in the last seven years, between 2016 and 2022.

“I pay the closing costs for veterans, first responders and educators to help expand homeownership among these groups,” said George Russell, a Texas-based Auction.com buyer.

A little more than half of renovated foreclosures end up as owner-occupied homes. The remainder provide a healthy supply of affordable rentals. The analysis of 275,000 homes brought to auction over the last seven years shows those held as rentals had an estimated rent that represented 22% of the median family income in the surrounding Census tract.

“I am providing safe and affordable housing in markets that have limitations of those offerings,” said Tiffany Bolen, a Georgia-based Auction.com buyer who said her primary investing strategy is renovating and holding properties as rentals. Bolen noted that she provides transition assistance to help current occupants of distressed properties exit gracefully.

The affordability of renovated foreclosures extended into underserved neighborhoods as defined by the Federal Housing Finance Agency. Buying a renovated foreclosure required 16% of the median family income in low-income Census tracts and 18% of the median income in minority Census tracts. Renting a renovated foreclosure required 17% of the median family income in minority Census tracts and 19% in minority Census tracts.

“I purchase homes in transitional neighborhoods. Then I renovate properties from the outside to the inside,” said James Barber, a Birmingham, Alabama-based Auction.com buyer who said his typical renovation budget is between $20,000 and $50,000. “This provides modern-feel homes to mostly newer homeowners. This also raises the properties and neighborhoods values. … Currently I am investing 30k of my own funds into a home I purchased on Auction.com. I will then sell it to a first-time homebuyer.”

Affordable Supply Disruption

But this critical supply of affordable housing was cut in half, if not more, over the last three years. Had foreclosure volume continued at the same pace as 2019, an additional supply of about 600,000 affordable homes would have been produced between 2020 and 2022. Instead, 250,000 completed foreclosure auctions — less than half of the expected volume — actually occurred during that timeframe, according to ATTOM data.

This sharp reduction in foreclosure auction volume was largely the result of well-intended and aggressive foreclosure prevention efforts enacted in the wake of the COVID-19 pandemic declaration in March 2020. A nationwide foreclosure moratorium on government-backed mortgages took effect in April 2020 and lasted through August of 2021. A nationwide mortgage forbearance program was legislated into reality by Congress through the CARES Act, also in April 2020.

Although the foreclosure moratorium expired more than a year ago and the forbearance program is winding down — slated to end in May 2023 along with the end of the national emergency triggered by the pandemic — foreclosure auction volume has been slow to return to pre-pandemic levels. Data from the Auction.com platform, which accounts for close to half of all U.S. foreclosure auctions, shows volume at just 60% of pre-pandemic (Q1 2020) levels in the first quarter of 2023.

The slow-to-return foreclosure volume is likely the result of a regulatory environment in which mortgage servicers are fearful of moving forward with foreclosure — particularly if there is a chance that a delinquent borrower has any equity in the home.

“My biggest fear is the amount of equity [that delinquent borrowers may have],” said a representative from one national mortgage servicer during a panel at the Five Star Government Forum in Washington, D.C., in April. “[We] don’t want to foreclose on people with equity … [but] people don’t know they have equity or put their head in the sand.”

The slow return of foreclosure volume has resulted in a growing backlog of pandemic-deferred distress. This backlog is comprised of delinquent mortgages that have exhausted all foreclosure prevention efforts but continue to languish in pre-foreclosure limbo.

More than half a million mortgages (520,000) had exited forbearance and were still delinquent with no loss mitigation program in place as of February 2023, according to the Black Knight Mortgage Monitor. That was an increase of 174,000 (50%) from a year ago.

“Who’s going to be the first one to open the floodgates?,” asked Bill Bymel, founder and CEO of First Lien Capital, at a default industry conference in March. Bymel said he knows of large mortgage servicers with tens of thousands of foreclosures being held back in fear of the headlines that might result. “There’s more skeletons in the forbearance closet than we think.”

But despite Bymel’s dire language, opening the floodgates would likely not result in a catastrophic flood of foreclosures that would drag down the overall housing market. Using historical pre-pandemic roll rates from seriously delinquent to foreclosure, the backlog of 520,000 delinquencies would translate into about 150,000 completed foreclosures over the next 12 months. That would keep total foreclosure volume under the 250,000-a-year average seen between 2017 and 2019.

A 12% Boost in Supply

Still, even a return to the relatively low pre-pandemic volume of foreclosures would make a non-trivial contribution to the nation’s affordable housing supply.

Given that 2022 foreclosure volume was at about 40% of 2019 levels, returning to 2019 levels in 2023 would mean an additional 127,000 homes entering the housing market supply chain. That would represent a roughly 12% boost to the overall supply of single-family homes that were produced by new home builders in 2022. And a disproportionately large share of that supply would be in the affordable segment of the market.

“We have a lack of housing in this area. We have a lot of military buyers here and it’s hard to find them affordable, updated homes in a timely manner,” said Julie Bridges, a New Mexico-based Auction.com buyer. “My investing is helping provide renovated, updated homes to people that would have to rent otherwise.”

In addition to supplying affordable housing inventory, renovated foreclosures also represent more opportunity for the local community developers who are buying and renovating the homes.

“My investing is helping me and my family,” said Kerry Wojtala, an Alabama-based Auction.com buyer who said she buys and renovates one or two properties a year. “I was a single mother for many years … Personally, investing affords me financial independence with a goal of creating a solid platform for my sons so they never have to rely on welfare or government sources.”