Last year marked the 10th consecutive year of population declines for Illinois. According to estimates from the U.S. Census Bureau, the state lost 32,826 residents from July 2022 to July 2023.

Despite the population decline, Illinois’ housing market remains relatively strong. The state has an Altos Research Market Action Index score of 44, which is above the national score of 39. Altos considers anything above 30 to be indicative of a seller’s market.

Real estate professionals throughout the state attribute the resilience of the state’s housing market to its perpetually low inventory problem.

“Inventory is almost nonexistent,” said Melissa Kingsbury, a Redfin agent who works in the southwest suburbs of Chicago. “If a home is priced correctly, we are seeing multiple offers coming in within a few days, and all over asking (price) and some appraisal gap clauses.”

Kingsbury said homes at lower price points have the largest buyer pools and are frequently subject to the stiffest competition. Although the competition remains strong, Kingsbury noted that it is slower than at the height of the post-pandemic market.

“During COVID, I was getting some crazy numbers, like 20 to 30 offers per property, but now it is more like five to 10 offers,” Kingsbury said.

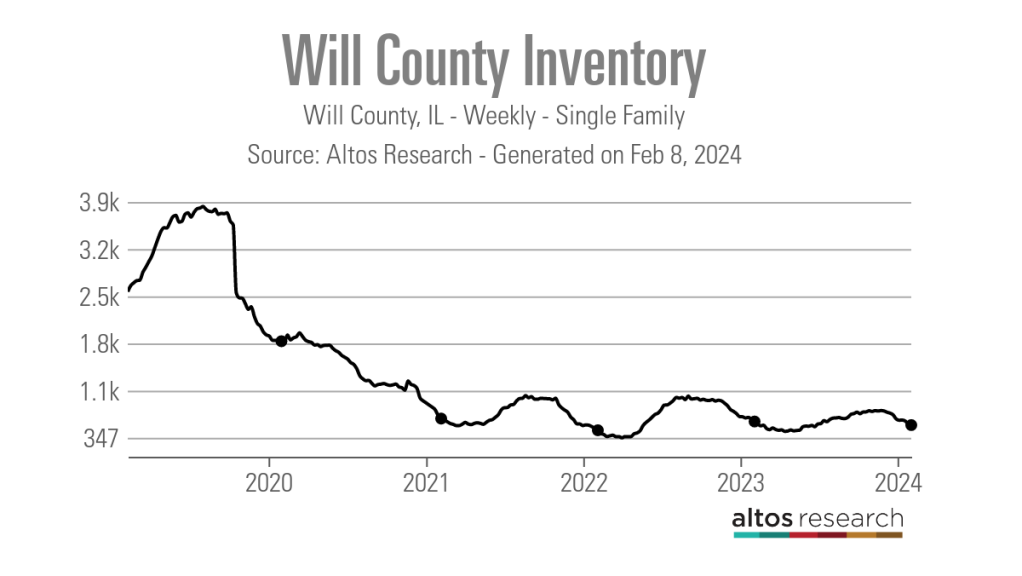

As of Feb. 7, Will County, Illinois — which is where Kingbury’s home base of Frankfort lies — had a 90-day rolling average of 670 active single-family listings, according to Altos Research. During the same week in 2020, just prior to the onset of the COVID-19 pandemic, the county had a 90-day average of 1,972 active single-family listings. The county’s low inventory situation has contributed to its Market Action Index score of 48, four points higher than the statewide score.

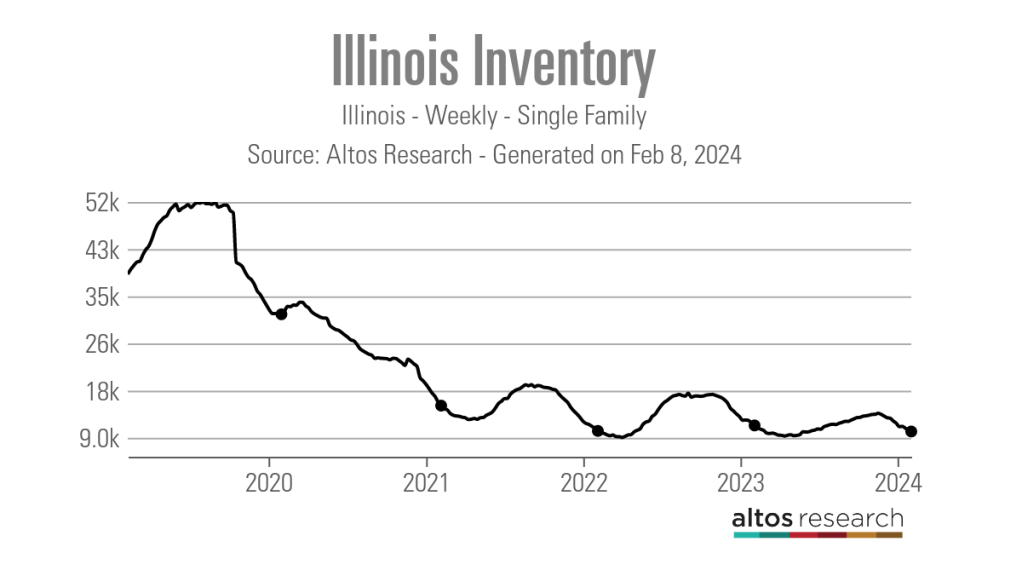

Across the state, as of Feb. 2, Altos data shows that Illinois had 11,974 active single-family listings, markedly lower than the 33,960 single-family listings reported in early February 2020.

“A Tale of Two Cities”

While the housing market in Chicago’s suburbs may be strong, things look a bit different in the city’s downtown area.

“It’s like ‘A Tale of Two Cities,’” said Matt Laricy, team leader of medium-sized Chicago brokerage Laricy. “In downtown Chicago, with the high rises, it’s a buyer’s market — maybe the biggest buyer’s market in history if it’s a luxury property.

“In most parts of the country, if you said you had high inventory, it would mean maybe a month or two of supply, but in some segments of our downtown market, we have 18 months of inventory, which is crazy.”

Laricy attributes some of the slowdown in downtown Chicago to the lingering effects of COVID-era policies.

“Only 61.5% of people are back to working in the office, which is up from like 35% last year, but it’s still not good,” Laricy said.

In addition to fewer employees in downtown offices, Laricy also believes the city’s crime rate is also partially to blame. A CBS Chicago analysis of police data from Jan. 1 through Dec. 11 of last year found that 27,700 violent crimes had been reported in the city, marking the highest level of violent crime in Chicago since 2011.

“When I talk to clients and they are wondering why their $3 million condo isn’t selling, I’m like, ‘I don’t know, dude, maybe it has to do with the three people who got killed in front of your building last night.’ That is a pretty tough sell for someone who has a $3 million budget,” Laricy said.

The downtown area’s slower housing market conditions have caused many agents and firms to open offices in the hotter suburban markets, or leave the state altogether, according to Laricy.

“It’s depressing,” Laricy said of the downtown market. “People are just defeated and the thing that pisses us off the most is that it’s things that we can’t control. We can’t just change the political environment overnight and get the crime rate to come back down.”

Job growth is making Peoria a hot market

Southwest of Chicago, in the central Illinois city of Peoria, things look a bit more optimistic.

“We are seeing an investment by both small and large businesses in our economy,” said Mike Van Cleve, a Peoria-based agent for RE/MAX Traders Unlimited. “All of that means good things for our local economy and for the stability of jobs in our economy.”

In addition to a strong jobs market, Van Cleve also noted the city’s relatively low cost of living (the median list price is $99,900, according to Altos Research). Peoria’s expansive parks and trail system, which is the largest in the state, is another reason why people are moving there.

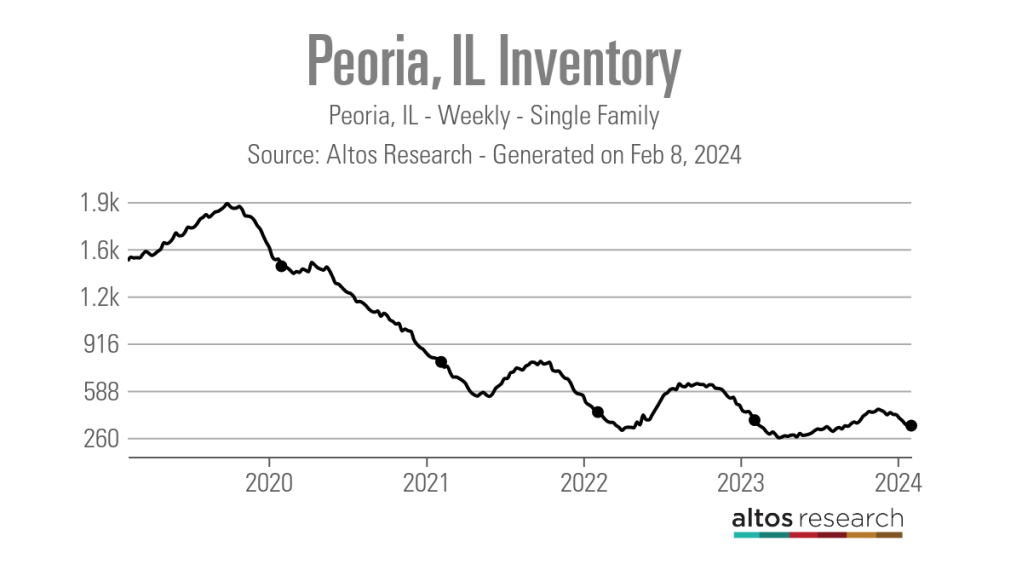

Like the Chicago suburbs, Peoria’s desirability has put a strain on the city’s already tight housing inventory.

“We have a lack of inventory, like a lot of communities, and it goes back to around 2019,” Van Cleve said. “Then, we would typically have 2,100 to 2,300 homes on the market in the county this time of year. And when I checked earlier this week, we had about 500.”

According to Altos Research, the city of Peoria had only 345 active single-family listings as of Feb. 8. In comparison, Chicago has 1,545 listings.

“When you have a property that is highly desirable, it can have 12 to 24 showings in 48 hours and end up with multiple offers,” Van Cleve said. “What we are telling sellers right now is that homes that are properly priced and well prepared are averaging seven to 15 days on the market, compared to an average of 31 days for the greater Peoria area.”

The heat of the market is reflected by the city’s Market Action Index score of 41, again besting Chicago by five points. Additionally, Redfin ranked Peoria as the Illinois metro with the fastest-growing sales price in December 2023. Redfin found that the city’s median sales price was up 6.9% year over year to $122,900.

While there is no doubt it is a seller’s market in Peoria, Van Cleve said many potential sellers are hesitant to list.

“One of the main differences between now and 2006 to 2008 is that there is a concern, because when we put a home on the market, we know it is going to sell, so people are afraid of then being homeless, or they don’t want to do a double move and rent for a few months while they look for their next home,” Van Cleve said.

“There is just this uncertainty that they know they can sell their house, but they don’t know where they are going to live next.”

Although housing market conditions may be challenging heading into the spring season, agents in the inventory-strapped state are optimistic that new listings will soon be coming to market.

“Just in the last couple of weeks, I’ve had a lot of people saying they’re ready to list,” Kingsbury said. “Our typical spring market starts the weekend after the Super Bowl and I am already getting a lot more calls about listing, which is great.

“I think I launched maybe six or seven listings in the last week, and I hadn’t done that in probably five months.”