Construction finance software company Built Technologies announced that it would be releasing a limited version of its flagship Construction Loan Administration software in an effort to help lenders impacted by the coronavirus.

With this software, lenders who are struggling to effectively manage and monitor construction and renovation loans due to the spread of coronavirus have an alternative to keeping track.

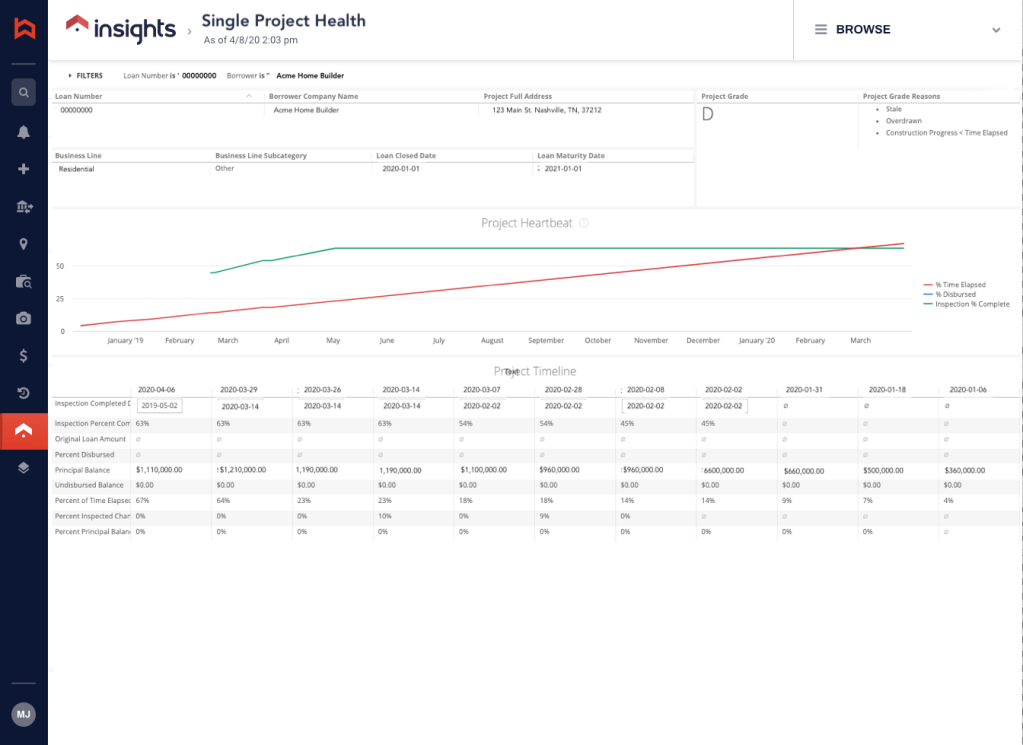

“This crisis is unprecedented, and we want to ensure that financial institutions that aren’t already working with us have the tools they need,” said Chase Gilbert, chief executive officer and co-founder at Built. “Offering lenders our Built Insights product, ongoing inspection monitoring, and an automated data import from their core/servicing platform provides financial institutions with an immediate ability to identify loans impacted by COVID-19 events.”

The company said it suggests that any financial institution with more than 100 active construction loans in its HFI or HFS portfolio to take advantage of the product.

The program has been set up to require less than 20 data points per loan from a core/servicing platform to reduce time and complexity of adoption, according to the company.

Lenders will have access to the Built Insights reporting product with its associated interactive and downloadable dashboards and detailed schedules; automated inspection ordering and fulfillment, utilizing Built’s national network of trusted inspection vendors; real-time dashboard of local Covid-19 construction halts with an overlay of their financial institution’s portfolio, highlighting impacted projects and property types; ongoing monitoring of projects where progress has stalled, percent funded has surpassed percent complete, and those nearing maturity and daily import of key data points from the lender’s core/servicing platform to keep all projects up to date.

“These are difficult times and remind me of lessons learned in the 2008 downturn. Lenders must have key data points collected via frequent inspections to know the status of each construction loan, ultimately generating an aggregated portfolio condition that supports critical financial decisions,” said Jim Fraser, Built’s director of CRE strategy.

“To help triage loans in process, the team has engineered an extremely light lift for a financial institution to go from manual, email, and spreadsheet-based data gathering, to ongoing loan automation and condition monitoring,” Fraser continued. “Unfortunately, as loans are impacted by the COVID-19 crisis, lenders need to know exactly where their collateral stands so they can answer the hard questions and proactively, rather than reactively, mitigate their risk.”