Monika DeRoussel was in a meeting, away from her phone and email, when a client messaged her that a property in their price range and desired neighborhood had a for-sale sign in the yard. When the meeting concluded, DeRoussel quickly reached out to the seller’s agent to see if her client could get in for a tour, but it was too late.

“I called the listing agent and it was listed three hours ago, but it was sold,” the Cincinnati, Ohio-based eXp Realty agent said. “We couldn’t even see it. There is no way you can stay on top of things unless you hire someone to watch new listings pop up every 10 minutes.

“And it was a solid cash offer, no contingency and was going to close within a week. It is so hard to compete with that.”

While DeRoussel’s experience sounds exactly like many of the stories that emerged from the pandemic-fueled homebuying frenzy of 2020 and 2021, this happened just a few weeks ago in early April 2024.

“It is extremely competitive,” DeRoussel said of the Cincinnati housing market. “We wrote five offers this weekend and out of five, four were rejected. Buyers are really struggling.”

According to data from Altos Research, the Cincinnati metro area (which includes portions of Ohio, Kentucky and Indiana) currently has a Market Action Index score of 54, while the state of Ohio has a score of 55. Altos considers anything above a 30 to be a seller’s market.

“Cincinnati is a great place to live,” said Julie Back, the executive sales vice president of Sibcy Cline Realtors. “The cost of living is low, it is a fabulous city with all the big city amenities — we have all the arts, the culture, so many Fortune 500 companies. … It is a wonderful area of the United States and people are starting to realize it.”

Although there is no doubt among local real estate professionals that demand is high in the Cincinnati housing market, agents say the area’s low inventory situation is only adding to the challenge facing consumers.

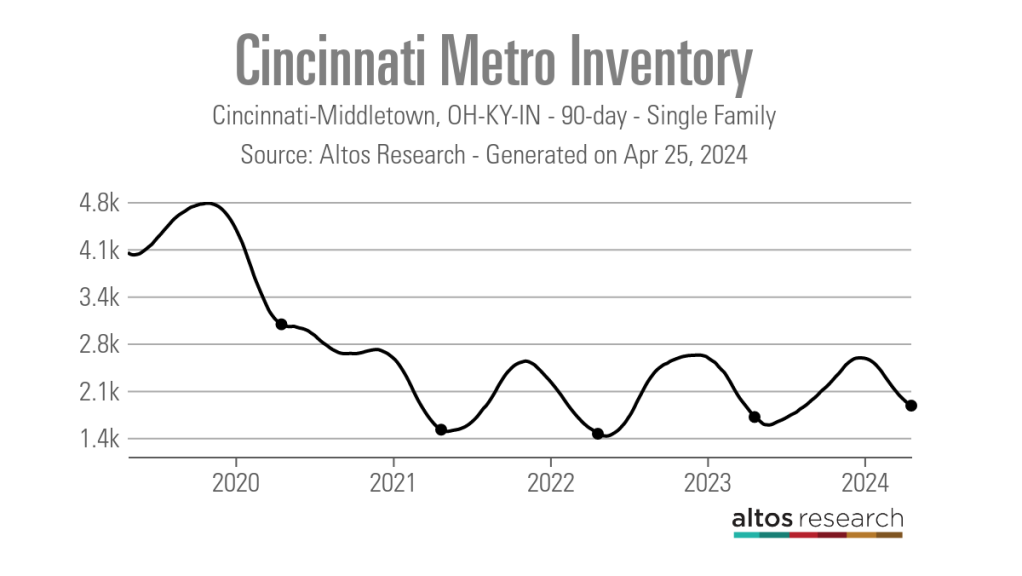

As of April 19, the Cincinnati metro area had a 90-day average of 1,864 single-family active listings, according to data from Altos Research. Although this is up from an all-time low of 1,429 active listings in early May 2022, it is down from the 3,021 listings recorded in late April 2020, a little over a month into the COVID-19 pandemic.

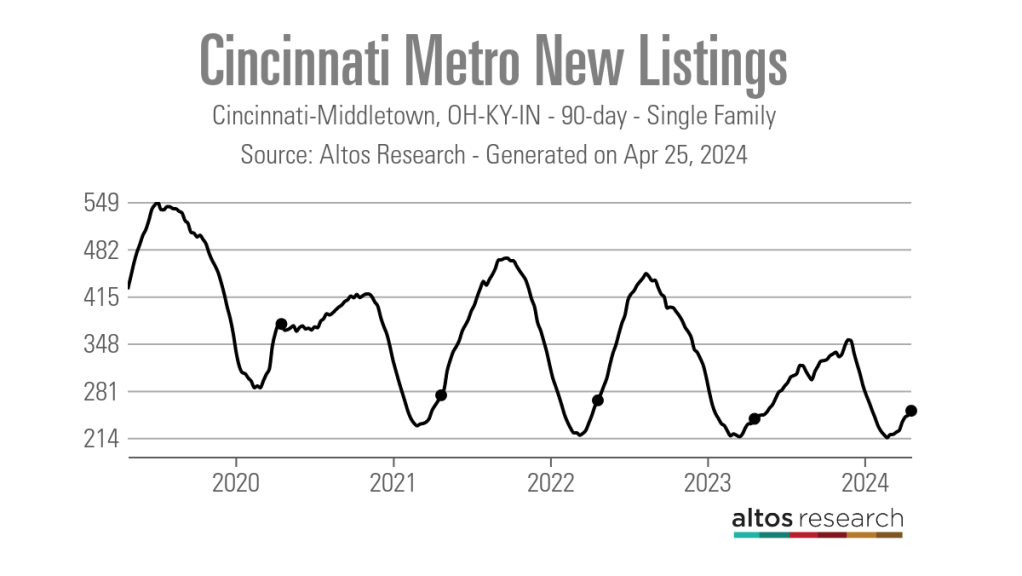

Additionally, while the number of new listings hitting the market each week in the Cincinnati metro area is certainly on the rise — jumping from a 90-day average of 214 in late February to 252 in late April of this year — the number is still well below the average of 367 new listings recorded in late April 2020.

“I think a lot of it has to do with there are just fewer houses available,” said Mark Meinhardt, a senior vice president at Sibcy Cline Realtors. “Baby boomers are not moving. They are staying put in their houses longer, plus you have a rate-lock effect. The interest rates are a huge factor.

“There are so many people who made a decision in the past 24 months to improve their house rather than move because it didn’t make sense with the interest rates unless they had to. So, they are just hunkering down.”

Looking further into the spring and summer months, agents are optimistic that more inventory will hit the market, but they do not believe it will be enough to satiate demand.

“We are going to see an increase in inventory. Cincinnati is a very predictable market since it has a lot of families,” DeRoussel said. “The typical Cincinnati consumer decides to list their house right before school gets out with this idea that they will sell their house, go on vacation and then move into their new house. So, we are expecting an additional two or three listings to hit the market each week now, but it is still extremely low.”

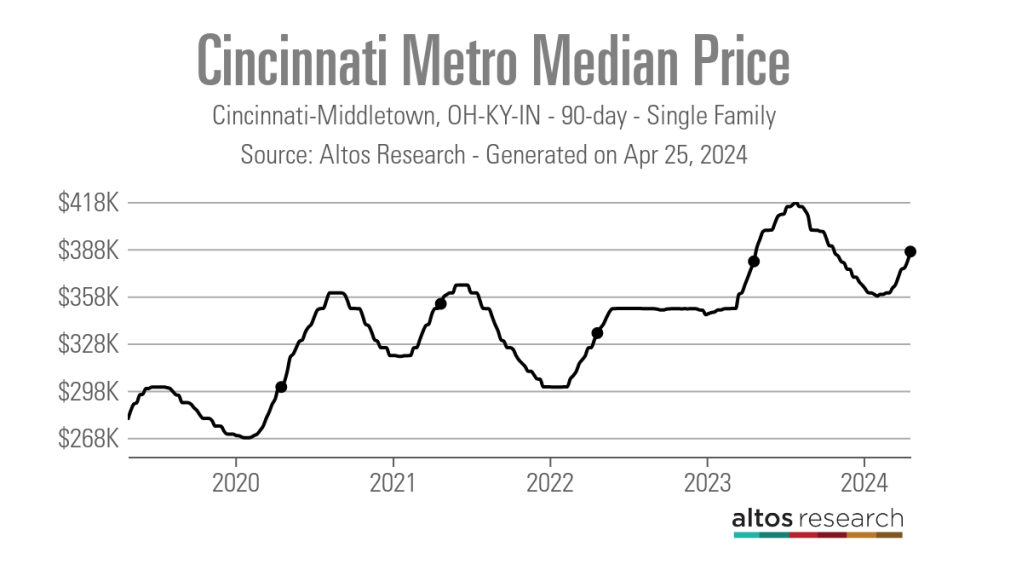

As would be expected, the tight inventory and high level of demand frequently results in bidding wars that drive up home prices. Data from Altos Research shows that the 90-day average median list price for single-family homes in the Cincinnati metro area has risen from $284,800 in April 2019, prior to the onset of the pandemic, to $389,250 as of April 24, 2024.

“I have some families that bought houses four or five years ago for $225,000, and they want something bigger and are excited that they can sell now for $300,000, but their budget for the new house is $350,000,” DeRoussel said. “With that budget, they aren’t really moving up. They are just getting the same house and maybe not even in as good of condition. If you want to move up at that price point, you have to be able to look at something that is like $500,000.”

Agents say they are also seeing a lot of appraisal gap clauses, inspection waivers and free leasebacks popping up in offers as buyers look to improve their chance of winning a house in the current market.

But rising prices are not the only financial challenge buyers are having to contend with right now. In addition to keeping prospective home sellers in their houses longer, higher mortgage rates are also taking a toll on buyers.

“Interest rates being higher hasn’t really necessarily slowed down demand,” Meinhardt said. “But buyers have had to adjust their expectations or their strategies when it comes to mortgage financing.”

Meinhardt and DeRoussel also noted the large number of investors currently active in the Cincinnati housing market. They are also making it hard for owner-occupant buyers, especially those looking in the $500,000-and-under price points.

“We are seeing a lot of investors and some flippers, but others are buying and holding,” Meinhardt said. “I think within the Midwest, our prices are certainly more conducive for investors than on one of the coasts. But it is really hard for those first-time homebuyers at the lower prices because they are competing with both institutional and mom-and-pop investors.”

Despite the challenges, local agents feel that things will continue to heat up as the market moves further into the spring.

“We are just getting fired up,” Back said. “It is not going to slow down. You are just going to have to learn to deal with it. Bankers are getting their interest rates, sellers are getting their prices and buyers are learning to step up to the plate.”