The pandemic has changed everything. We no longer shop for groceries, clothes or TVs as we did in March. The same is true of home shopping. And we may never go back to the old ways.

“Consumer shopping behavior has permanently changed; the customer expectation has changed,” Jornaya Head of Consumer Finance Mike Eshelman said at HousingWire Annual on Thursday. “And we need to adapt to those changes.”

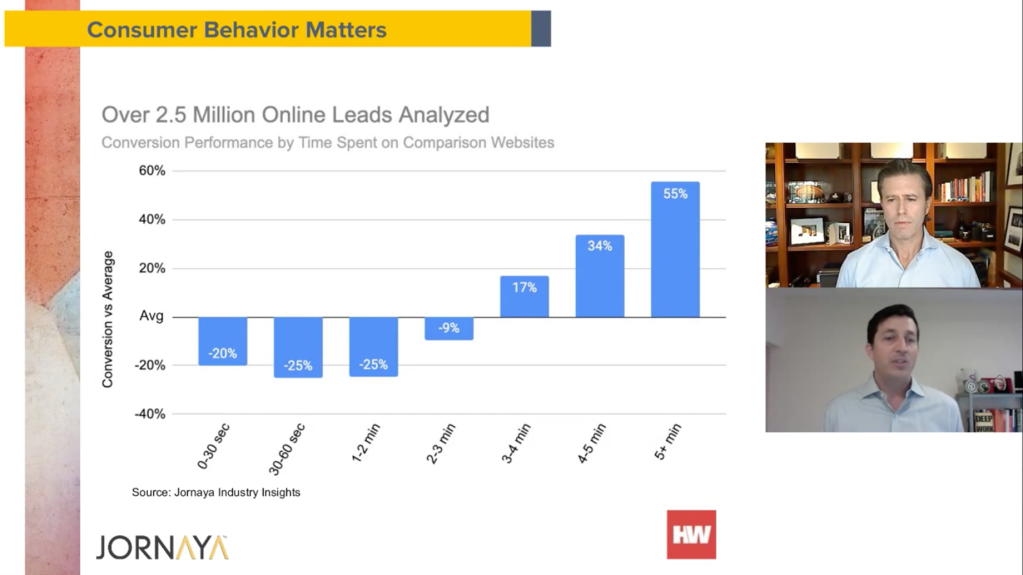

At the HousingWire Annual panel, experts from Jornaya, a behavioral data intelligence company with a proprietary view of more than 400 million consumer journeys each month, explained that the longer a “lead” spends on a mortgage comparison page, the more likely they are to be serious buyers.

The chart below illustrates that a lead becomes much more valuable after spending more than two minutes on the page:

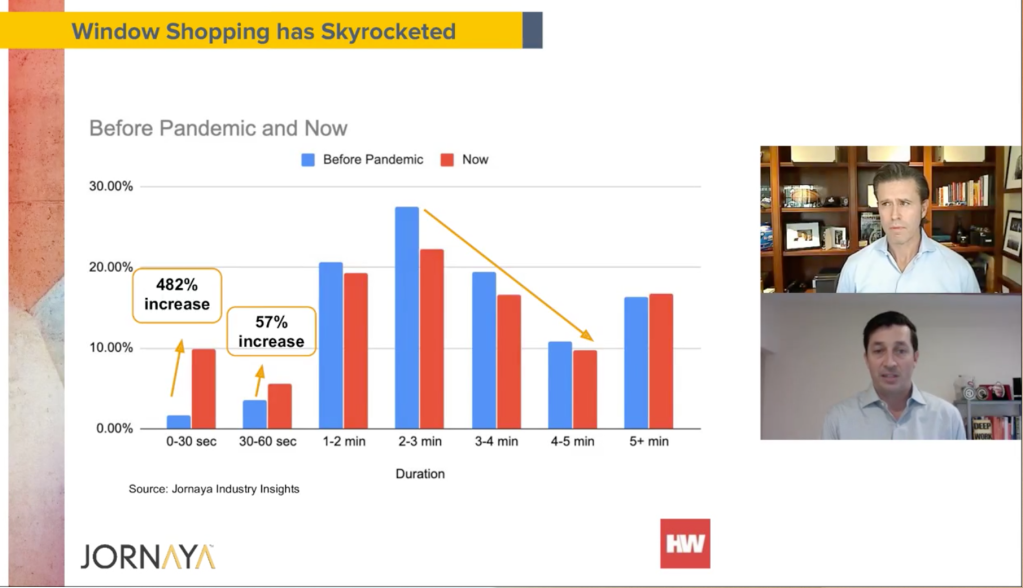

During the pandemic, however, consumers spending just 0 to 30 seconds on a page surged a full 481%, and those spending 30 to 60 seconds on a page saw a 57% increase, according to Jornaya. The company’s Chief Marketing Officer, Rich Smith, said the increase could be attributed to low interest rates and more curiosity brought on by the low-rate environment.

And while these leads that spent less time on the page may see a lower conversion rate, they still hold value.

“Those leads aren’t worthless, there’s definitely value there,” Smith said. “But understanding that that consumer is dramatically different than someone who is engaged for more than three minutes is really important in how you treat those leads.”

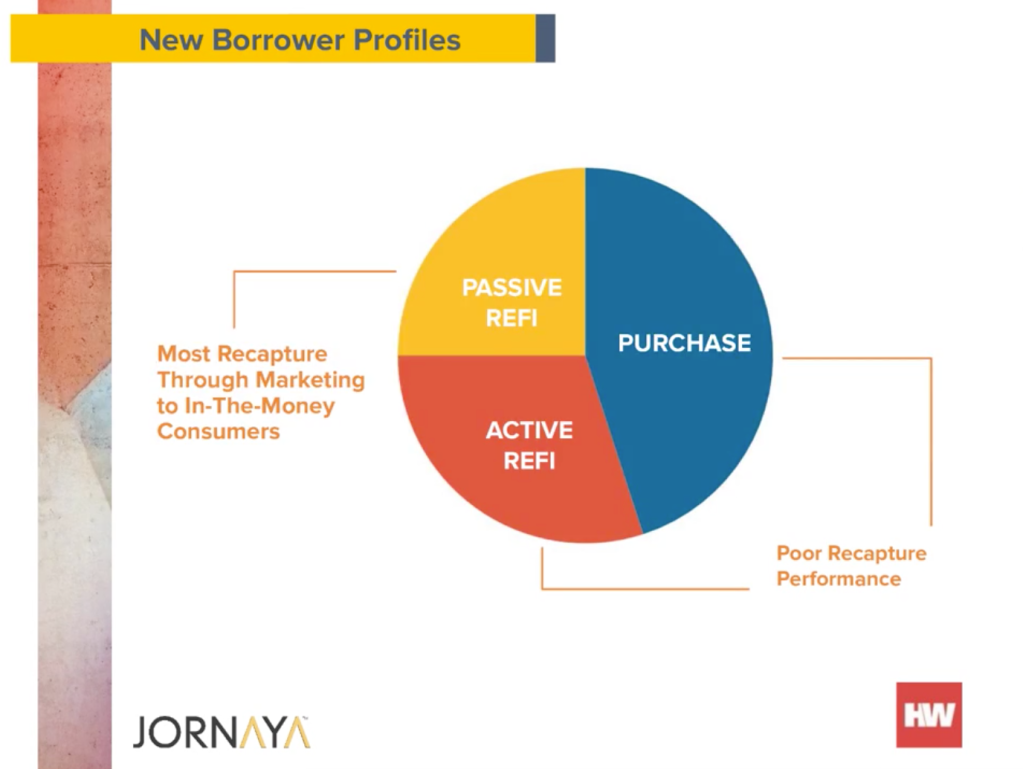

As lenders look to capture new leads, many are also leaning in on recapture, especially as the low-rate environment spurs all-time highs for refinances. However, Jornaya’s data shows while lenders can market well to passive consumers, they are struggling to recapture consumers that are truly looking shopping for a mortgage refinance.

A recent survey from Jornaya shows about 80% of executives think they provided an “excellent” experience. But when asked, just 8% of their customers believe their overall experience was “excellent.” Smith explained that focusing on that experience is key to improving recapture rates.

“Customer experience is whatever the consumer says it is, it’s in the mind of the consumer,” he said. “At any of these points if you’re not running the experience, you’re risking customers drop out all along the way.”

Another way to improve on recapture rate is to use consumer predictive data to determine when a borrower is likely to be mortgage shopping, and marketing to them with the right content, at the right time, Smith explained.

COVID-19 has changed the game, and lenders should be prepared to move with it in order to continue reaching borrowers.

“Whether it is digital transformation or anything else, anything you had planned for the beginning of the year for 2020, any plans pre-COVID, pretty much was destroyed by a wrecking ball that is COVID once it came and hit,” Eshelman said.