The premise of a mortgage rate lockdown is simple: so many American households have such low mortgage rates that some will never move once rates rise, which then locks up housing inventory. This is something I’ve never believed in because we hadn’t had a period where mortgage rates moved up so quickly and then held higher for an extended period. But now this is a real risk.

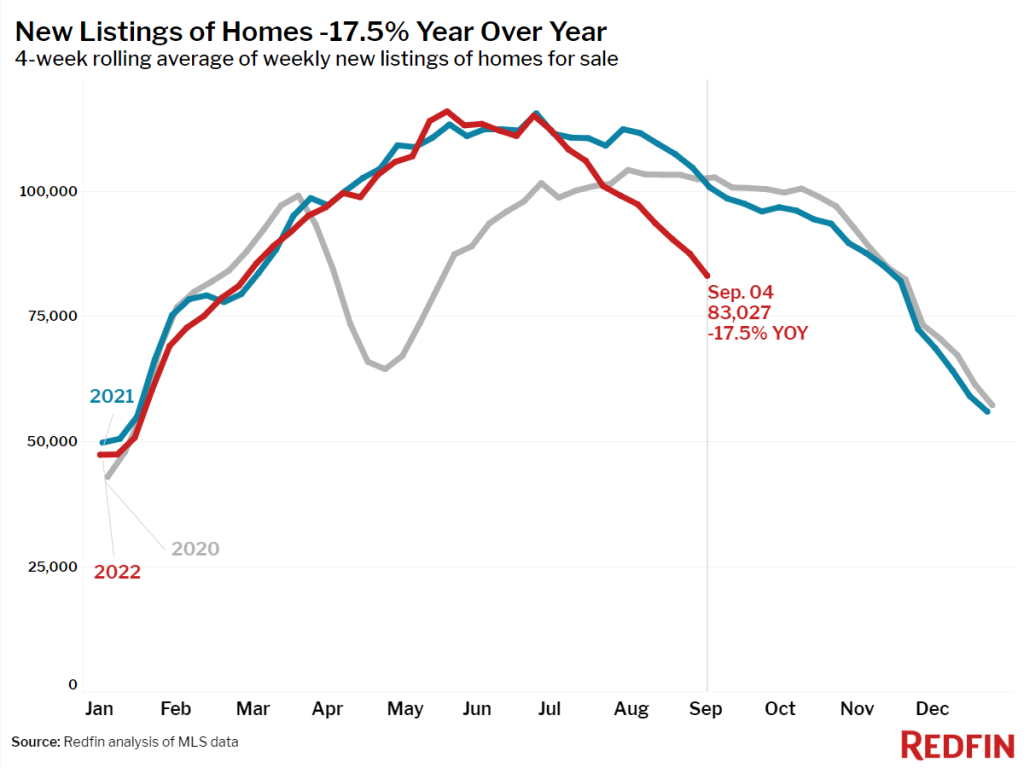

Typically we have a natural set of new listings each year; inventory rises in the spring and summer and then falls in the fall and winter. We are getting closer to that period where total inventory traditionally falls.

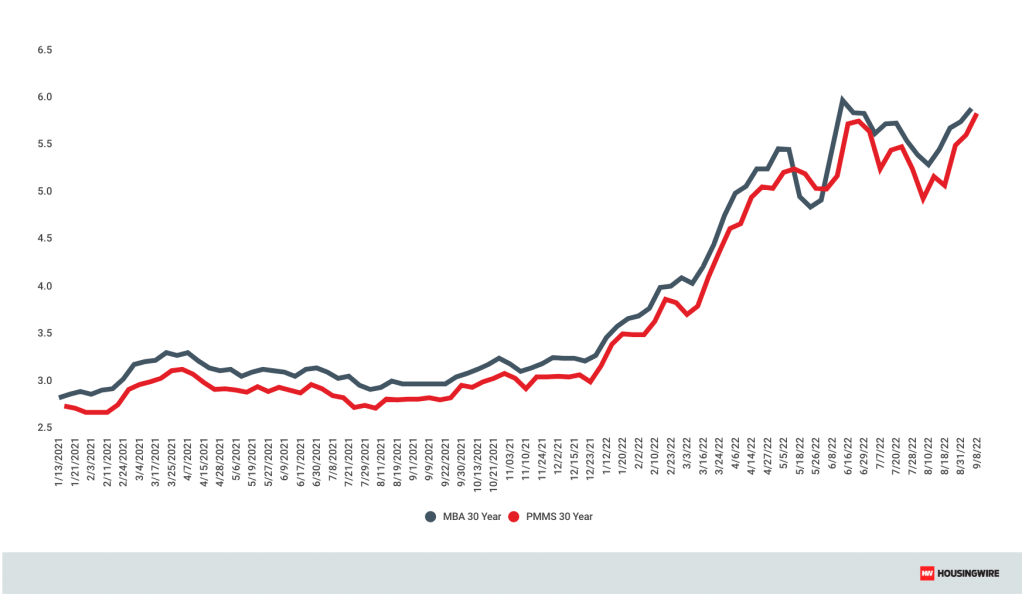

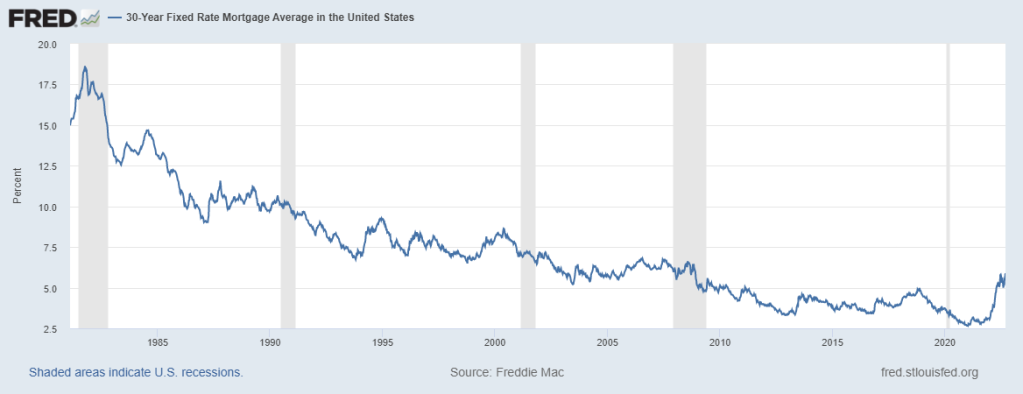

However, we have entered a tricky period in housing economics where we might have to take this premise more seriously since mortgage rates recently got as low as 2.5% in 2021 and as high as 6.25% in 2022.

It wasn’t the rate move that caught my attention — it was the new listing data.

It all started when mortgage rates jumped from 5.25% to 6.25% this year and I saw how home sellers reacted to that move. As you can see below, that sharp move to 6.25% caused new listing data to stall at first. (This is the exact opposite of panic selling, by the way.)

However, what caught my eye, even more, is that mortgage rates made a 1.25% move lower, and the new listings data still fell. The fact that this data line fell earlier this year and was sharper made me think that this could be what a mortgage rate lockdown looks like.

From Redfin:

However, what happens when rates spike sharply can also be temporary, and we are in the seasonal timeframe where new listings and soon total inventory data declines. I will surely keep my eye out for new listings data for the rest of the month before the traditional fall in inventory happens.

What I don’t want to see in 2023, if mortgage rates stay high, is we start the year with more negative year-over-year declines in listings. The parts of the U.S. housing market that have 2019 inventory levels or higher are off my savagely unhealthy housing market list; those areas see effective pricing as demand gets weaker. But the rest of the country hasn’t had much inventory growth.

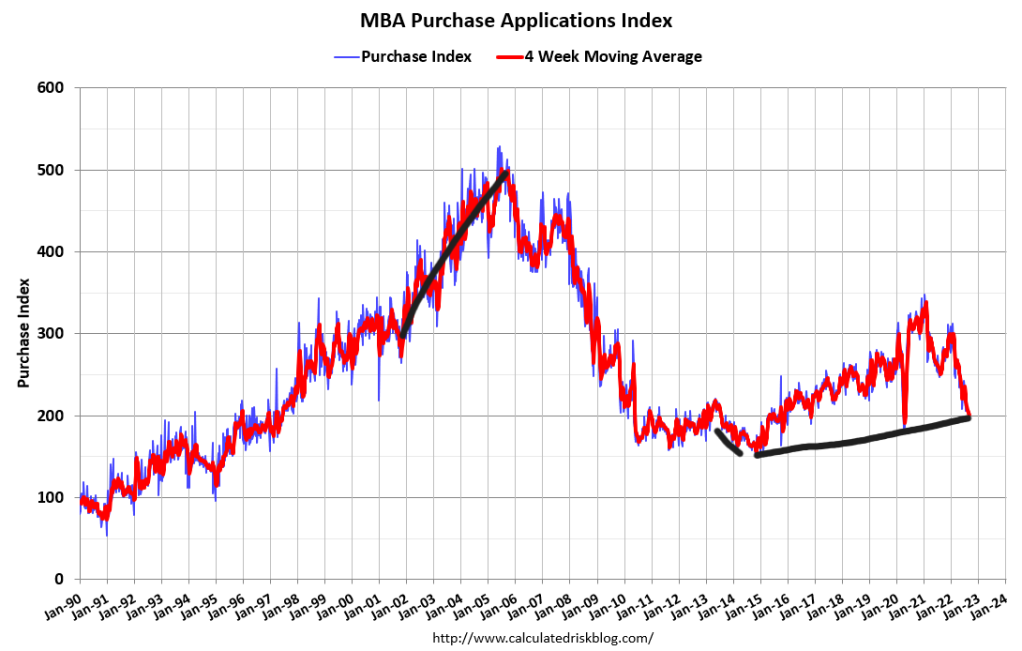

My concern is that if mortgage rates fall in the future, it will stall, pause or even reverse the inventory growth we have seen in 2022. Traditionally speaking, post-2012, inventory growth came in years where demand was weaker from mortgage buyers: 2014 and 2022. Those were the only years we have had negative mortgage demand growth in the purchase application data. Adjusting to population, 2014 was the lowest level in the index ever, and in 2022 we have seen a noticeable hit in this index, taking it below 2008 levels.

As you can see, even though purchase application is below 2008 levels, total inventory is far from the peak levels we saw in 2007 of over 4 million listings, currently we’re at 1,310,000.

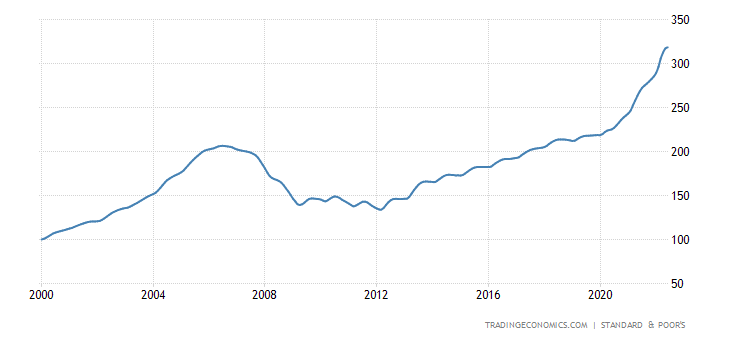

Now one thing that could have happened this year to push down new listing data more aggressively is simply that homes are less affordable. We haven’t had to deal with 6% mortgage rates in a long time and we have had massive home-price growth since 2020, continuing nationally in 2022.

Case-Shiller Home Price Index

This is why 2023 will be key to the mortgage rate lockdown question. The nation’s inventory needs to get back to 2019 levels, and that will only happen with positive year-over-year new listing data going into spring 2023. The healthy parts of the U.S. housing market — where people have choices and buyers have some power again — are those near or above 2019 levels. We just need the entire country to get back there for me to remove the label of a savagely unhealthy housing market.

Can you blame home sellers?

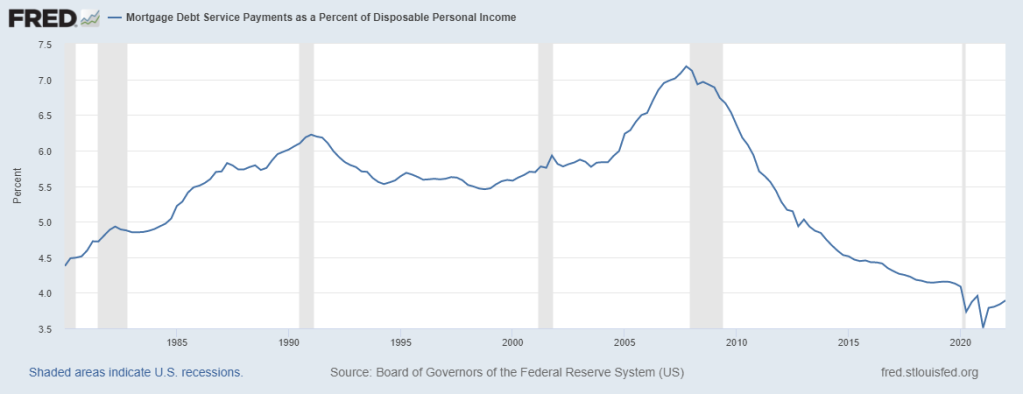

One of the things that people forget about low mortgage rates is that we have people living in their homes much longer now. The epic wave of refinancing we saw during 2020 and 2021 improved homeowners’ cash flow much more than people think because their wages have risen over the years while their mortgage payment got lower.

MBA Refinance Index

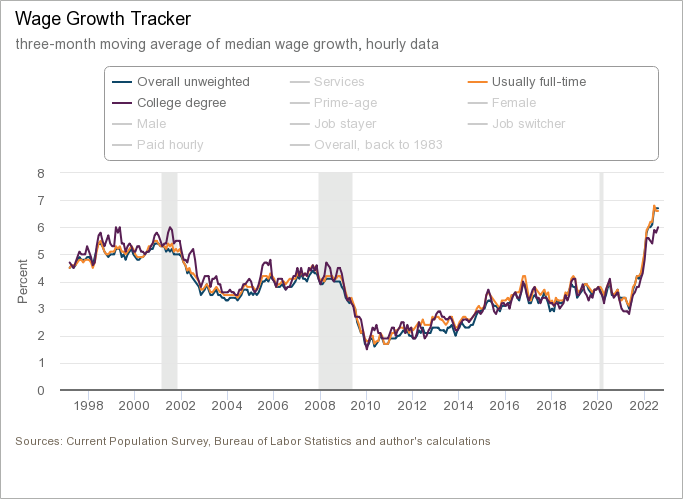

Wage growth has picked up in America. One of the best hedges against inflation is a fixed mortgage rate. As your wages increase, your cash flow looks great versus your shelter payment. Renters don’t have this luxury, but homeowners do.

Atlanta wage growth data

- Overall unweighted wage growth of 6.7%

- Usually, Full-time wage growth is 6.6%

- College Degree 6.0%

So, you can understand why some households didn’t want to pull the trigger when rates raced up toward 6.25% and why even 5%-6% mortgage rates on top of massive home-price growth has made them think twice about listing. Homeowners have excellent cash flow, and they are unlikely to make their financial life harder unless there’s a good reason.

While I have been skeptical of the mortgage rate lockdown premise over the years, it was more because rates didn’t stay high enough to have the premise genuinely tested. If mortgage rates head back toward 4%, that should entice some sellers to move, but at 6%, it makes sense why some sellers won’t pull the trigger.

Always remember, traditional sellers, for the most part, are homebuyers as well. So, to list their homes, they want to feel comfortable with mortgage rates to finance their next home.

As someone who didn’t believe in the mortgage rate lockdown premise ever, even I have to acknowledge that we are in a historically unique backdrop where we can finally test this premise out.

Mortgage rates, which have been falling since 1981, hit rock bottom at 2.5%, and many Americans have rates between 2.5%-4%. Rates spiking higher has a tone of what we saw in the 1990s, but rates had room to go much lower then, as you can see below.

Just the raw speed of the mortgage rate rise could have also taken traditional sellers off guard. This is a problem when you don’t have a functional mortgage market, because buying and selling your home is the biggest financial decision you will make. We need to be mindful of this when looking at housing data in 2022. When things settle down we might see more choices being made.

Every new housing cycle since 1980 has seen mortgage rates drop 2% lower than what occurred in the previous expansion to help with demand. Considering that recent mortgage rate lows were between 2.5%-3.5%, for this to occur in the next cycle’s recovery phase, we would have to see mortgage rates get as low as 0.5%-1.5%. That seems very unlikely. However, mortgage rates getting back to 4% is much easier to imagine.

The question for me is, what happens next year?

Part of my position that housing needs more balance is based on total inventory levels getting back toward the 2019 levels of 1.52-1.93 million. When I said this can occur in 2023, that’s based on the traditional yearly listing happening, with weakness in demand allowing inventory to accumulate over time.

I still believe in this premise because we get new listings every year. However, due to the nature of the mortgage rate rise and the fact that new listing data fell earlier and faster, I have raised the possibility of a mortgage rate lockdown premise in the future if mortgage rates stay higher than normal.

The other issue with the possible delay in listings until rates fall is that this can hinder the recent inventory growth we have seen here in the U.S. Sellers will wait for lower rates and once that happens, demand improves. That could slow down, pause, or reverse the inventory growth we have seen in 2022. Total inventory levels falling back down again is not what I want (and not what the Federal Reserve wants either).

If the mortgage rate lockdown premise is real, it can complicate things in housing.