The Department of Justice, the Office of the Comptroller of the Currency and the Consumer Financial Protection Bureau are teaming up in a new initiative to combat redlining.

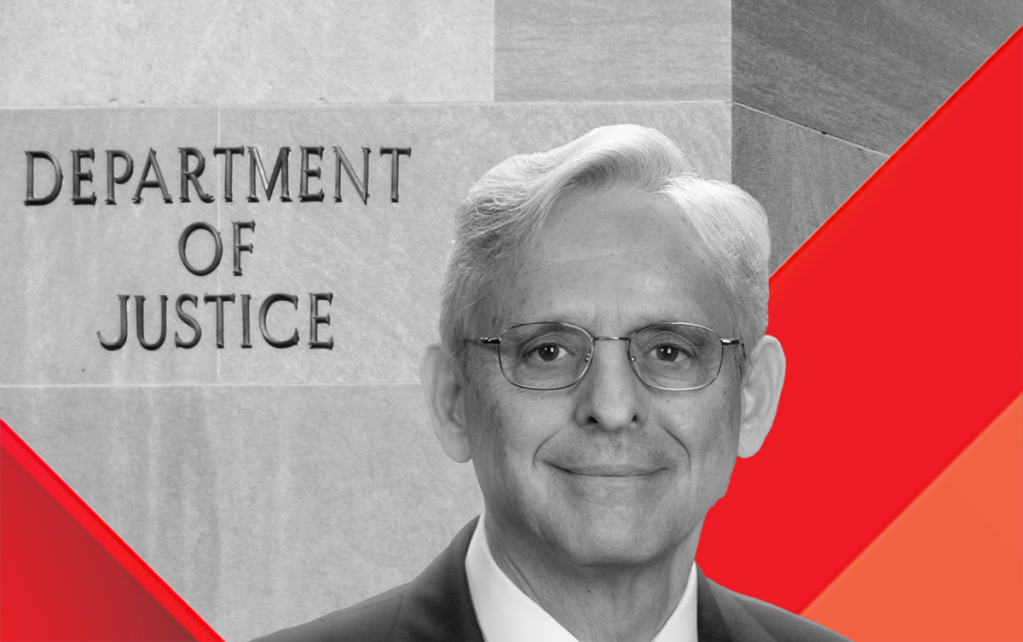

The Civil Division of the DOJ will partner with U.S. Attorneys offices in its “most aggressive and coordinated effort” yet, Attorney General Merrick Garland said.

“Much has changed since the federal government engaged in Depression-era redlining, but discriminatory lending practices by financial institutions still exist,” Garland said. “Unfortunately, redlining remains a persistent form of discrimination that harms minority communities.”

The initiative will “seek to address fair lending concerns on a broader geographic scale than the DOJ has ever before,” Garland said. The DOJ will also draw on and strengthen its partnership with CFPB, and with financial regulatory agencies like the OCC.

The all-hands-on-deck effort has already resulted in a settlement with a bank for alleged redlining — the second in two months’ time — and Garland said more are on the way.

The Civil Division of the Western District of Tennessee, the CFPB and the OCC on Friday announced a settlement with Trustmark National Bank, a retail bank based in Jackson, Mississippi which has 196 locations in Alabama, Florida, Mississippi, Tennessee and Texas. The settlement resolves allegations that Trustmark engaged in redlining in Black and Hispanic neighborhoods in the Memphis, Tennessee area.

The agencies alleged that Trustmark violated the Fair Housing Act, the Equal Credit Opportunity Act and the Consumer Financial Protection Act of 2010, by avoiding locating branches in minority communities, although half of Memphis’ census tracts are majority minority.

Per the lawsuit, Trustmark did not assign a single mortgage loan officer to any of its majority-minority branches. The agencies also accused Trustmark of failing to monitor its fair lending compliance, and underperforming in minority neighborhoods relative to its lender peer group

A spokesperson for Trustmark declined to comment on the settlement.

Under the terms of the settlement, the bank will pay $3.85 million in a loan subsidy fund to increase credit opportunities for residents of predominantly Black and Hispanic areas in Memphis area, pay $400,000 to develop community partnerships and $200,000 per year for advertising and outreach. That amount will be credited toward a $5 million penalty to the CFPB.

CFPB director Rohit Chopra said that he is especially interested in investigating whether “black box algorithms” that make underwriting decisions are exacerbating bias, but he did not specify which models he is concerned with. A recent investigation by The Markup showed that lenders gave fewer loans to Black applicants than White applicants even when incomes were high, and raised concerns about the underwriting engines the government sponsored enterprises use to make credit decisions.

The mortgage industry has criticized that analysis for not factoring in credit scores and loans made by the Federal Housing Administration and the Department of Veterans Affairs, which serve lower-income borrowers and more first-time homebuyers than the GSEs.

“We cannot have a new form of digital redlining,” Chopra said. “Algorithms can help remove bias, but black-box underwriting decisions are not necessarily creating a more level playing field, and may be exacerbating the bias.”

The CFPB has intensified its activities to identify and curb redlining in the past year. The Bureau is adding a significant number of attorneys to its enforcement division. In addition, the Bureau this year referred at least three redlining cases to the DOJ, and has a number of fair lending investigations underway.

The agency’s foray into redlining enforcement started last year. In March 2020, it filed the first redlining lawsuit ever filed against a non-bank lender. The CFPB’s authority to bring redlining cases stems from its interpretation of the Equal Credit Opportunity Act, rather than the Fair Housing Act, which gives other financial regulators authority to pursue redlining cases.

That authority has not yet been proven in court, and a pending challenge could threaten it.

Townstone Financial Inc., the small Chicago-based nonbank retail mortgage lender the CFPB accused of redlining last year, has challenged the Bureau’s interpretation of ECOA. In October 2020, the lender filed a motion to dismiss the CFPB suit, arguing that it unreasonably expanded the scope of ECOA.