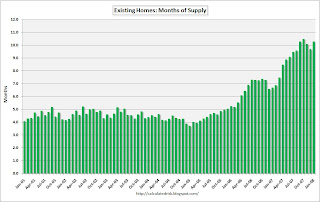

The pace of sales for existing homes continued to fall in January, dropping 0.4 percent overall to a seasonally-adjusted annual rate of 4.89 million units — the slowest sales pace since 1999. In spite of the drop, resales of single family homes rebounded slightly in January. Single-family home sales rose 0.5 percent to a seasonally-adjusted annual rate of 4.34 million, the NAR said, up from 4.32 million in December. According to data released Monday by the National Association of Realtors, January’s median home price slid to $201,100, down from $206,500 in December and the fifth straight month of price declines reported by the trade organization. Last month, the NAR reported the first annual price decline in at least 40 years — although the group said that the slowdown in sales is greater in high-cost markets, dragging down the overall median price measure. The group contended again Monday that half of the metro areas in the U.S. are showing price gains — a claim that has not been adjusted for population. Adjusted for population, the slowest housing markets are affecting 10 times the number of people living in markets posting annual gains (see HW’s original report on the MSA data here). Nonetheless, NAR economist Lawrence Yun characterized the housing market as “soft,” but said that he expects sales to rebound later this year. “Subprime loans and other risky mortgage products have virtually disappeared from the marketplace, and over the past five months, this has been reflected in soft but fairly stable home sales,” he said. “As the increased limits for FHA and conventional loans are implemented, more buyers will have access to safer FHA loans and lower interest rate loans in high-cost areas, which could lead to steadily higher home sales later in the year.” The NAR also reported that total housing inventory rose 5.5 percent at the end of January to 4.19 million existing homes for sale, which represents a 10.3 month supply level at the current sales pace.

Calculated Risk offers strong analysis of historical data of both inventory and months of supply, and says that existing inventory is likely to hit record levels this spring and summer. The graph to the right, used with permission, shows months of supply for the past six years. “Even if inventory levels stabilize,” the blog’s author wrote, “the months of supply could continue to rise — and possibly rise significantly — if sales continue to decline.” Notes NAR president Richard Gaylord is pegging a lot of the group’s hopes on the expected impact of new conforming loan limits, saying that he believes “relief is on the way” … Gaylord said he expects the new loan limits will take a few months to translate into higher sales.