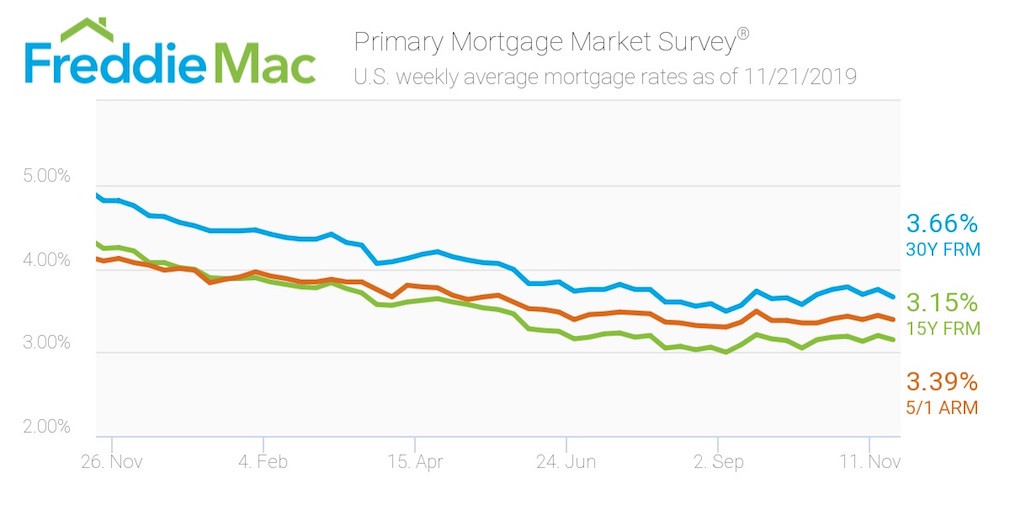

This week, the average U.S. fixed rate for a 30-year mortgage fell to 3.66%. That’s 9 basis points below last week’s 3.75% and more than a percentage point below the 4.81% of the year-earlier week, according to the Freddie Mac Primary Mortgage Market Survey.

“The housing market continues to steadily gain momentum with rising homebuyer demand and increased construction due to the strong job market, ebullient market sentiment and low mortgage rates,” said Sam Khater, Freddie Mac’s chief economist. “Residential real estate accounts for one-sixth of the economy, and the improving real estate market will support economic growth heading into next year.”

The 15-year FRM averaged 3.15% this week, declining from last week’s 3.2%. This time last year, the 15-year FRM came in at 4.24%.

The five-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.39%, retreating from last week’s rate of 3.44%. Last year, the 5-year ARM was much higher at 4.09%.

The image below highlights this week’s changes: