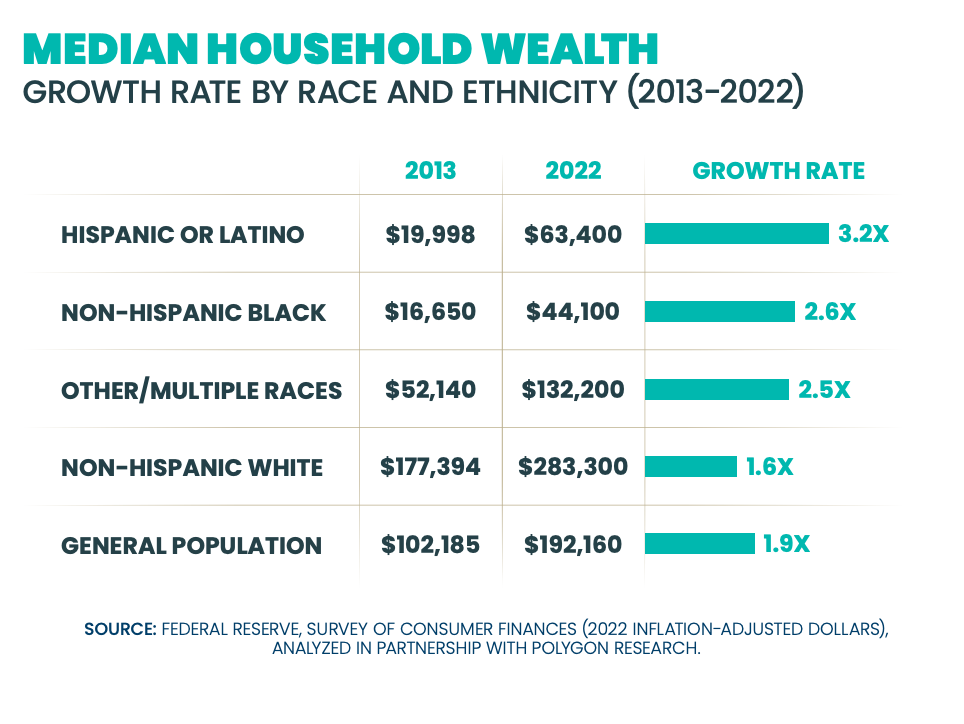

Hispanic household wealth ballooned to $63,400 in 2022, growing more rapidly than any other demographic group in the country, according to a recent report published by Hispanic Wealth Project, a nonprofit established by the National Association of Hispanic Real Estate Professionals (NAHREP).

While other racial and ethnic demographics have seen an increase in household wealth during that same period, Latinos were the only racial or ethnic demographic to increase their wealth by more than threefold over the last decade from $19,998 in 2013.

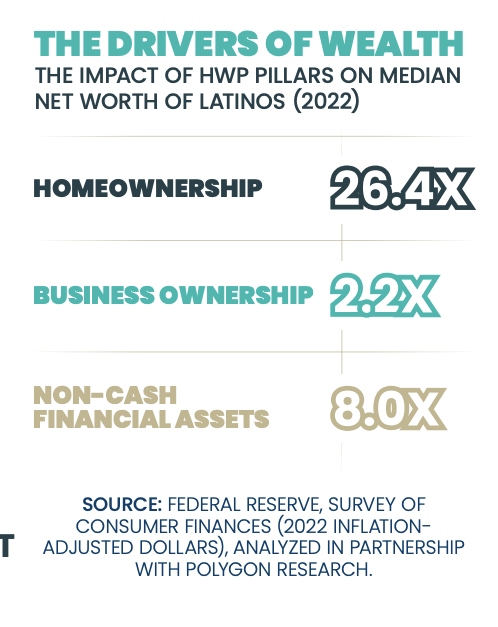

Homeownership led Hispanic household wealth growth, which is the single greatest contributor to wealth for most American families, the report noted.

Hispanic families who own their homes have on average 26.4 times the net worth of those who rent.

As of late 2023, Latinos had a homeownership rate of 49.5%, just shy of NAHREP’s goal of 50%.

“Continued Hispanic homeownership rate increases, in combination with recent home price appreciation, has substantially boosted Hispanic household wealth,” said the report.

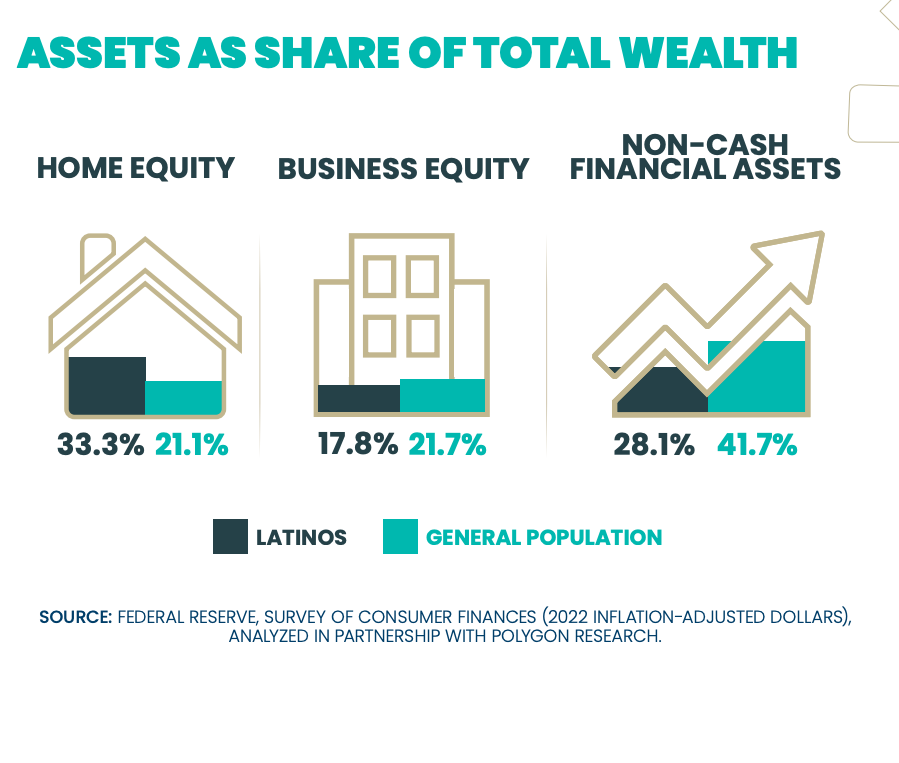

One-third of Hispanic household wealth could be attributed to home equity, or equity held in a primary residence in 2022. This was a substantial increase from 2013 when Latinos held just 26.7% of their net worth in their homes.

In 2019, homeowning Latino families had a median $109,081 in home equity — calculated as value of primary residence minus mortgage debt.

By 2022, Latino’s home equity increased by nearly 40% to $150,000 driven by home prices that skyrocketed during the COVID-19 pandemic.

When considering all property holdings, including equity in residential and non-residential investment properties, real estate consists of 45.5% of Hispanic household wealth.

Beyond homeownership, real estate served as a strong investment vehicle for Latino families.

Between 2013 and 2022, the share of Hispanic households owning investment properties increased from 7.3% to 9.5%.

Despite a significant Hispanic household wealth growth, a sizable wealth gap between Hispanic and non-Hispanic White households persists.

In 2022, non-Hispanic White households held an additional $219,900 in median net worth over their Latino counterparts. Similarly, the general population holds more than twice the wealth of Hispanic households.

Latinos still have a lower share of investment property ownership than the general population at 13% and the non-Hispanic White population at 14.4%.

In the past, the Hispanic community’s over-investment in real estate and limited diversification left it “particularly vulnerable during the economic crises,” the report pointed out.

“Asset diversification is critical to the creation of wealth and financial security … Fortunately, the proportion of Latinos investing in various asset categories, particularly non-cash financial assets is increasing.”

“Education is crucial to understanding the value of diversification, and mandating financial education in public schools is an important first step in teaching younger members of the community the fundamentals of financial security,” said the Hispanic Wealth Project.