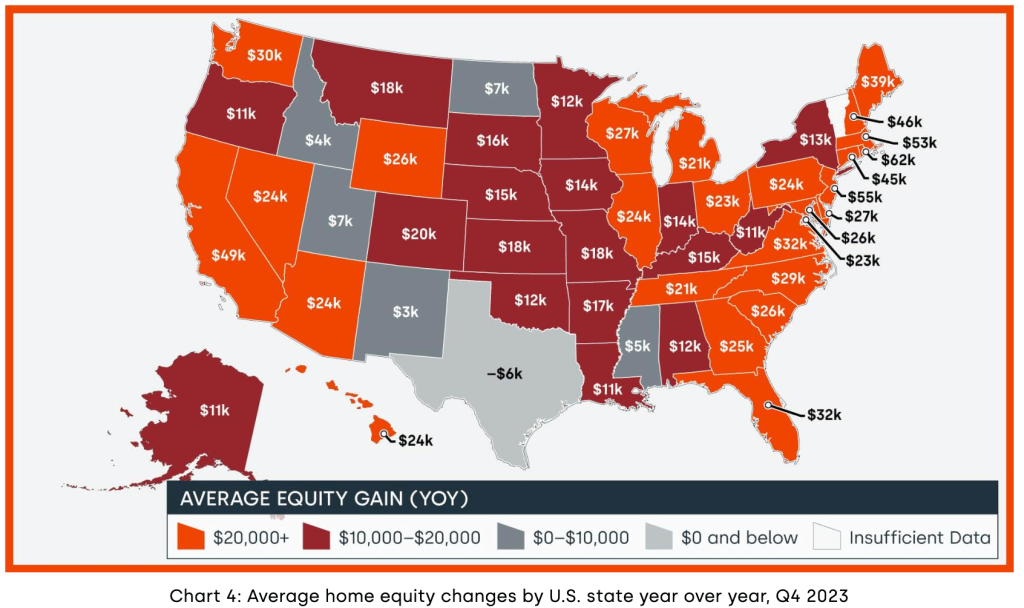

Buoyed by a rise in home prices, U.S. homeowners with mortgages saw their home equity increase by 8.6% year over year in fourth-quarter 2023.

Homeowners saw an average increase of slightly more than $24,000 compared to Q4 2022, adding up to a collective gain of $1.3 trillion, according to CoreLogic’s newest homeowner equity report. Net homeowner equity totaled more than $16.6 billion at the end of 2023.

“Rising home prices continue to fuel growing home equity, which, at $298,000 per average borrower, remained near historic highs at the end of 2023,” Selma Hepp, chief economist at CoreLogic, said in a statement.

“By extension, at 43%, the average loan-to-value ratio of U.S. borrowers has also remained in line with record lows, which suggests that the typical homeowner has notable home equity reserves that can be tapped if needed.”

Rhode Island posted the country’s highest annual equity gains of $62,000, followed by New Jersey ($55,000) and Massachusetts ($53,000). The equity growth in the three Northeast states was attributed to “the recent healthy home price increases” in that area of the country.

In January, home equity increased by 13.2% year over year in Rhode Island and by 11.6% in New Jersey, as the two states led the nation in annualized appreciation.

Texas was the only state that posted an annualized equity loss (-$6,000) in Q4 2023.

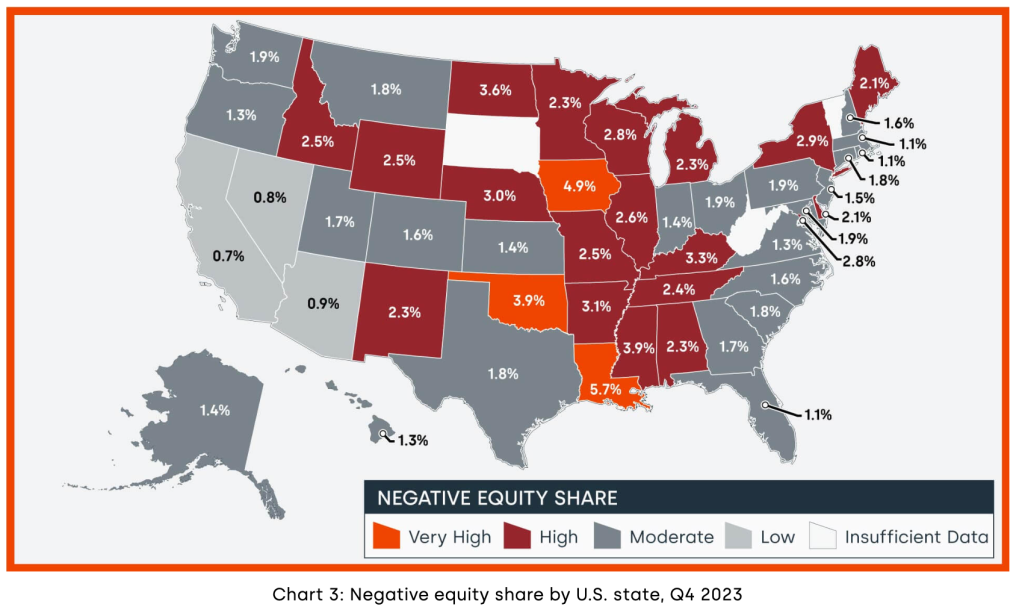

Home price growth over the past year helped lift the equity of homeowners who were underwater due to price declines in 2022, meaning their mortgage debt exceeded the value of their properties.

As of fourth-quarter 2023, the total number of mortgaged homes with negative equity decreased by 1.1% from the previous quarter to 1 million homes, or 1.8% of all mortgaged properties.

Compared to 12 months earlier, that figure dropped by 15%, from 1.2 million homes or 2.1% of all mortgaged properties.

The national aggregate value of negative equity was approximately $323 billion at the end of last year. This was up by $9 billion (3%) from the $314 billion figure in third-quarter 2023 but down by $12.4 billion (4%) from the $336 billion total in fourth-quarter 2022.

Because home equity is affected by home prices, borrowers with equity positions near the break-even point are most likely to move into or out of underwater status as prices change.

If home prices increased by 5%, 114,000 properties would have regained positive equity status as of Q4 2023. If prices declined by 5%, however, 162,000 homes would have fallen underwater, CoreLogic projected.

The real estate analytics company expects U.S. home prices to increase by 2.8% from December 2023 to December 2024.