It’s no surprise to anyone in the real estate or mortgage industry that there’s a critical shortage of homes for sale – the four-month supply of homes for sale today is between 30-40% lower than the number of homes for sale in a normal, healthy market.

It’s also no surprise that a big part of this shortage is due to builders staying on the sidelines instead of gearing up production to meet demand. But what might be surprising are some of the other factors contributing to this lack of supply, and the impact these factors are having on prices, sales, and the housing market in general.

Supply and demand are two of the most basic components of economic theory. Too much supply, and products become commodities with falling prices. Too much demand, and scarcity creates bidding wars which drive prices higher. This, in an overly simplistic way, describes what’s happened over the last decade in the housing market.

The combination of an over-supply of new construction along with millions of foreclosed homes unexpectedly flooding the market while demand plummeted led to home values falling by over 35% nationally from peak to trough.

Some of the hardest-hit areas were those with a massive supply/demand imbalance: Las Vegas, South Florida, Phoenix, and the Central Valley of California. In those markets, and elsewhere, builders faced the unenviable task of selling new homes that were smaller and significantly more expensive than foreclosed homes they’d built as recently as the year before.

And all this was happening during the Great Recession – the worst U.S. economy since the Great Depression.

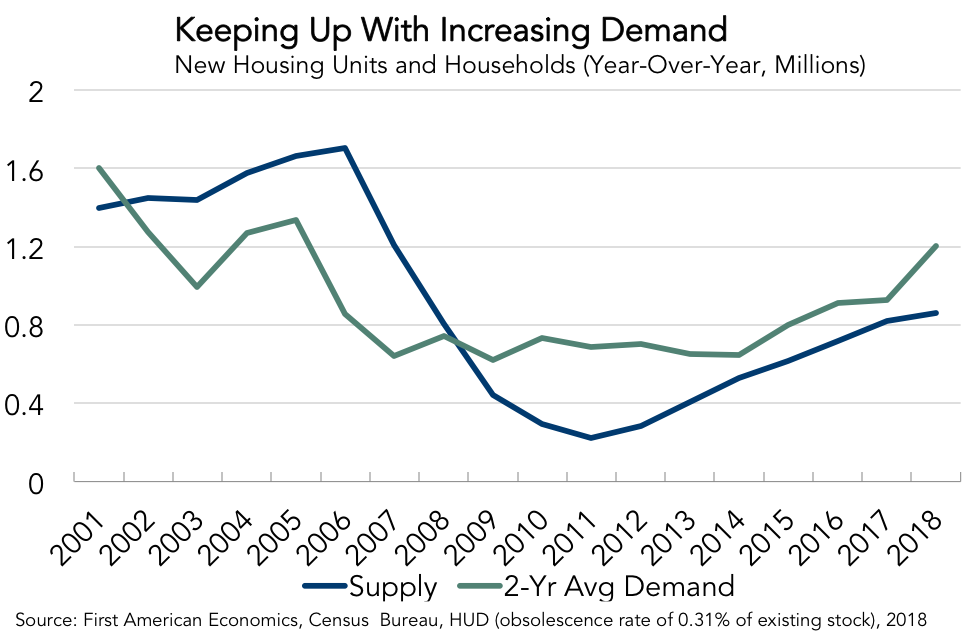

Unsurprisingly, homebuilders did the only logical thing they could do under the circumstances: they essentially stopped building new homes. Somewhat more surprisingly, ten years later – and after the longest sustained period of growth in the history of the U.S. economy – builders still aren’t building as many homes as they used to.

In fact, they’re not even building enough homes to meet demand, or enough to replace homes that are lost each year to demolition, disasters, or other causes.

Hope on the horizon?

There have been glimmers of hope on the new home front recently, however. Even though they’re down by almost 1% year-to-date, October housing starts were up 3.8% compared to September, and up by 8.5% compared to October of 2018. More importantly, starts of single-family homes were up 8.2% year-over-year.

And contrary to recent trends, builders seem more willing to construct entry-level homes today, at least on a selective basis. A new report from the American Enterprise Institute, using data from DataTree by First American, shows that newly-constructed homes account for a significant amount of the overall housing stock in cities where job growth has been strong – over 7% in Austin, Texas and 5% in Boise, Idaho for example.

So there are signs that new construction is heading in the right direction, and may gradually begin to ease some of the supply/demand imbalance that has been plaguing the market. But that’s only part of the solution to the problem.

Existing home inventory also missing

The lack of activity by new homebuilders since the end of the Great Recession has been an obvious, very visible cause of the low inventory of homes for sale. But even in a healthy, fully functional housing market, new home sales only account for 10-20% of all sales – the other 80-90% of sales are existing homes. And those existing homes have been largely missing from the sales inventory.

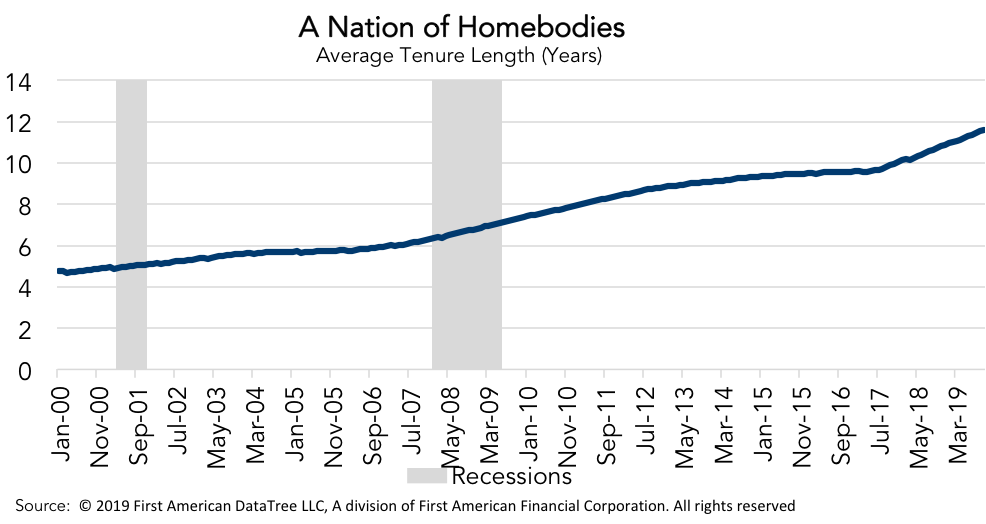

There are a number of reasons for this. The most obvious is that homeowners, by and large, are staying put much longer than they used to. In fact, the average length of time a homeowner has stayed in the same home has more than doubled over the past 20 years – from a little under 5 years in 2000 to almost 12 years in 2019, according to findings from DataTree.

There are numerous theories to explain this phenomenon: Baby Boomers opting to age in place rather than move into a retirement community; the formation of multi-generational households as elderly parents join their adult children (and their grandchildren); record levels of young adults moving home with their parents after college; and homeowners opting not to sell because they believe there’s nothing available to buy.

But whatever the reason, the impact on the number of homes for sale is powerful.

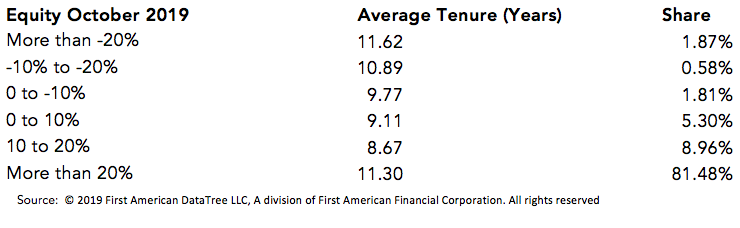

Another, less discussed factor might be that many homeowners who might otherwise be interested in selling may simply not have enough equity to do so.

While this may seem counter-intuitive at a time when homeowner equity is at an all-time high, and the number of underwater homes has fallen from historically high levels to percentages that look more or less normal, almost 19% of homeowners have less than 20% equity in their homes.

That makes it unlikely that they’d have enough money to comfortably handle the costs of selling their current home and putting a reasonable down payment on a more expensive property.

With roughly 50 million active mortgages, this means that nearly 10 million homeowners could potentially be keeping their homes off the market due to having negative equity (with virtually no short sale activity taking place), no equity, or not quite enough equity to orchestrate a move up purchase.

While it’s highly unlikely that all 10 million of these homeowners would be selling their properties if they had more equity, it’s very likely that at least some of them would, and even a relatively small percentage of these homes hitting the market would have a meaningful effect on inventory levels.

What’s the upshot?

Just as there isn’t one single reason for the lack of inventory, it’s unlikely that addressing any one aspect of the inventory shortage will solve the problem.

In fact, given that Millennials are entering the market in ever-larger numbers, and are now being joined by the older members of the Gen Z cohort, household formation is poised to expand more rapidly, creating even more demand for both owner and renter-occupied properties.

The most likely scenario is that inventory will return to normal levels gradually, as increasing home prices improve the financial outlook for equity-challenged homeowners, Baby Boomers ultimately downsize as their Millennial children move out, and builders continue to slowly ramp up their output.

In the meanwhile, assuming that the laws of supply and demand don’t suddenly change, it doesn’t seem likely that we’ll see home prices take a tumble anytime soon.