Despite mortgage rates briefly falling below the 6% threshold, both housing inventory and mortgage demand fell last week. Let’s dive into the trend lines of the housing market.

First, here is a quick housing market rundown from last week:

- Purchase application data was negative 10% week to week — but still positive for the year

- Housing inventory decreased by 8,664 units, a more extensive inventory decline than we saw in the prior week

- The 10-year yield had a wild week, and mortgage rates did break under 6% for a day and then rose after the more substantial than-expected jobs number

Purchase Application Data

We took a step backward last week with a 10% decline in purchase apps from the prior week. That’s after positive growth of 25% and 3% over the prior two weeks, respectively. It’s disappointing but I ask you to remember a key date – Nov. 9, 2022. Once you make seasonal adjustments with purchase application data, that’s where the data line begins to show improvement.

We are well into the seasonal demand increase for purchase applications if demand grows; this means the heavy volume period on this data line is between the second week of January and the first week of May. After May, total volumes traditionally fall. We are working from a shallow bar in this index – seven years of growth were taken away in one year in 2022. The bar is so low we can trip over it! However, with that said, purchase apps have started to improve from the waterfall dive on Nov. 9, 2022. I put more weight on the year-over-year data, and not only has the bleeding stopped in this data trend line, but even with the 10% weekly decline last week, we have also been able to bounce from the lows created recently.

The show-me part of the housing market starts with this bounce from an extreme bottom. Purchase application data is forward looking for 30-90 days; the bleeding stopping from a low base is a good start. However, we are going to see if 6% mortgage rates are good enough to create some growth in the future or if the housing market needs rates near 5%. Last year, when rates dropped to 5%, we saw some demand pick back up. But that 5% level didn’t last long, and then rates spiked back up to 7.37%. We might see volatility in this data line until it stabilizes, so I cautioned people to read big positive or negative moves with some grain of salt on the weekly data until things settle down. However, one thing is for sure, the housing market found a working bottom, and the weekly tracker is more critical than ever.

Weekly Housing Inventory

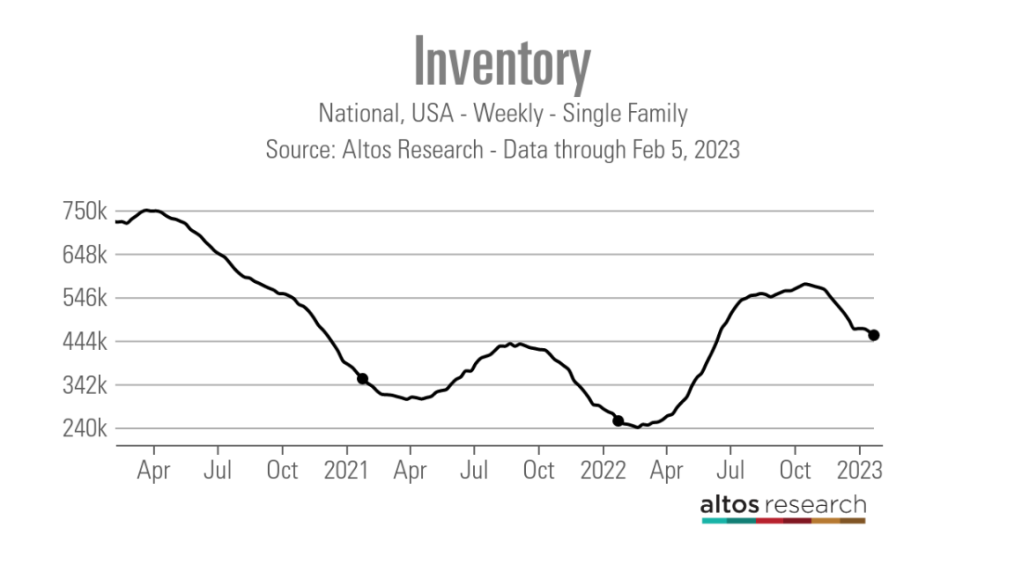

A few weeks ago, I was encouraged that we had a slight increase in inventory and a small decline the following week. We have had back-to-back weeks of noticeable decline in the Altos weekly inventory data. This week inventory fell 8,664 units from the previous week.

Altos Research Weekly Chart

Hopefully, we will get the seasonal inventory push sooner in 2023 than we did in the last two years. It’s a small grace that inventory is still higher this year than last year. Last year we saw a decline in inventory during this period; mortgage rates were still much lower last year.

Since purchase application data started to improve from Nov. 9, 2022, it fits into the 30-90 day forward-looking sales data line. We could be getting some lower inventory now because of the slightly better demand. We recently saw the pending home sales data turn positive for the first time in many months.

- Weekly inventory change (Jan. 27 – Feb 3, 2023): Fell From 465,654 to 456,990

- Same week last year (Jan. 28 – Feb 4 ): Fell from 271,954 to 255, 662

One of the concerns I have had with the housing market is the post-2020 inventory channel, which took us to all-time lows. When rates were below 4%, this created massive housing inflation. Now that rates are above 6%, we don’t see the same type of housing inflation data we had from 2020 up until rates broke over 5.875% in 2022. However, as you can see below, we don’t have much breathing room to get back below all-time lows if demand picks up and inventory levels don’t grow. We don’t have a high price growth problem now and shouldn’t be with rates over 6%, as we saw in 2020, 2021, and the early part of 2022 when mortgage rates were lower. As you can see below, we don’t have a lot of housing products available for a country of 330,000,000 people.

NAR Inventory Levels: 970,000

We should be getting the seasonal inventory push higher in inventory soon; I hope we do. The question is, right now, how much is demand hitting the inventory levels? And should we be concerned if new listing data doesn’t grow much this year? I would be concerned if I were you. A great chart from Freddie Mac shows the trouble with having rates too high as new listing data declines. When I am rooting for more inventory, I am rooting for more sellers who are buyers of homes once they sell; this brings us back to a regular housing market.

One thing we have seen post COVID-19 that when new listing data does decline, we can have a waterfall dive in demand. The first time was a global pandemic, and once people got back to standard, new listing data grew, as did sales. In 2022, rates were simply too high for people to want to sell and buy another home after the sale.

10-year yield and mortgage rates

Last week we had a lot of action but didn’t end up anywhere again. The Fed meeting sent bond yields lower only to regain some of that move by the end of the day, and then on Friday bond yields shot up higher after the better-than-expected jobs report.

I have long stressed that breaking below 3.42% on the 10-year was going to be tough, so much so that I joke that I brought out Gandalf from “Lord of the Rings,” who says you shall not pass. Well we haven’t been able to do so for some time now. Mortgage rates did break below 6% last week for the first time in a while but rose from 5.99% to 6.19% after the stronger-than-anticipated jobs data.

Part of my 2023 forecast for the 10-year yield is that if the economy stays firm, the 10-year yield range should be between 3.21%-4.25%, meaning mortgage rates between 5.75%-7.25%. With economic weakness, bond yields could quickly drop to 2.72%, taking mortgage rates near 5%. So far, the economic data has stayed firm, with some recent positive data from the housing market as the builder’s confidence and pending home sales data have shown some growth from epic dives lower.

The week ahead

Last week we had a bunch of labor data that was very positive, with over 11 million job openings, jobless claims under 200,000, and an unemployment rate of 3.4%. We had all this with the growth rate of inflation still falling and falling wage growth data—so much for us needing a job loss recession for the growth rate of inflation to fall.

This week will be a very light economic data week; we have Tuesday’s trade balance data, the critical jobless claims data on Thursday, and the Michigan consumer index on Friday. We always want to keep a close eye on jobless claims because my entire Fed pivot is only based on the labor market breaking, and that would require jobless claims getting to 323,000 on the four-week moving average, which we are far from as we are at 191,750. The Fed is more focused on inflation and wage growth, so we can have positive economic data without worrying about the Fed’s need to be more aggressive.

I find it hilarious that the people who said we were in a recession last year are now screaming for the Fed to hike more aggressively because the economy is too strong and inflation can grow. I have been on Recession Watch since Aug. 5, 2022, but the two things I need to see to create a softer landing or a lighter recession are the same things I wrote back on Aug. 5.

With that in mind, how might this reverse? Well, the two easy answers are this:

1. Rates fall to get the housing sector back in line

2. Growth rate of inflation falls, and the Fed stops hiking rates and reverses course, as they did in 2018

The inflation growth rate has cooled, and mortgage rates have fallen from recent highs, but the Fed is still hiking. They’re almost done but are not close to cutting rates. We don’t have everything I want, but it’s a start. For housing and going forward, it’s all about mortgage rates, and the growth of inflation and economic data will be critical to monitor each week.