Exponentially increase your loan officers’ origination potential without incurring additional expense? Sounds too good to be true, doesn’t it? However, today more than ever before, this ambitious goal is within reach thanks to the marketing power of the internet via social media.

The single biggest challenge to success with social media is managing regulatory compliance. Examiners such as the CFPB and FDIC provide stringent oversight of digital activity, and mistakes can cost you and your loan officers dearly. That’s why a growing number of lenders are investing time and resources into developing and implementing robust social media compliance policies.

Arming your origination team with the right technology and training to manage consistency, compliance and brand recognition on social media is worth the investment – not to mention the peace of mind. Overlooking the importance of taking a strong, offensive position with effective social media training can force your business into a less favorable defensive position down the road – one filled with exam issues, fines, possible enforcement action and more. Don’t let poor training on acceptable social media practices prevent your company from realizing the full potential these digital channels have to offer.

Effectively implementing a social media program and training loan officers on the numerous regulations and policies pertinent to mortgage lending is no small task. As with any successful training program, it’s important to engage your team, create a clear understanding of the obstacles and opportunities, monitor activities and provide ongoing education and reinforcement.

Make no mistake, though – you should encourage your loan officers to be active on social media to capitalize on the vast lead generation opportunity. The percentage of loan officers currently using social media to generate leads is behind the curve. According to information presented at the Mortgage Bankers Association conference, only 20–30% of loan officers are considered “highly active” on social media nationwide, underscoring the opportunity to increase borrower prospecting on these digital platforms.

Start by acknowledging your loan officers’ ability to impact prospects in a positive manner and help them develop content that is strategic and hooks potential leads. Show your loan officers firsthand that they can leverage the strength of your company while promoting their personal attributes.

Defining Social Media Policies

Creating and defining workable social media compliance policies should be the backbone of your corporate social media strategic plan. Make certain that policies reflect your corporate culture and executive strategy, as well as the needs of your front-line loan officers. Your policies should encompass a broad spectrum of activities, including all marketing channels, from web content to online networking. The key to success in this area is to have a policy that covers your institution from a regulatory examination perspective and is flexible enough to evolve as new social media platforms are introduced.

Management’s involvement is critical to your institution’s success. Leaders need to understand key compliance concerns, perform regular risk assessments and show their support of policies that prevent compliance violations, fines and reputational damage. A compliance manager or team should be assigned to oversee policy administration, implement training, and handle monitoring and reporting of social media activities.

Discussing Privacy Concerns

Privacy concerns are one of the primary challenges lenders face in managing social media compliance. It’s understandable that loan officers may feel apprehensive about your monitoring efforts, so it’s important to clearly explain that these activities are a regulatory requirement, and only posts related to the company need to be reviewed. Employees may feel uncomfortable at first, so it’s important to discuss the circumstances openly and honestly. Presenting a clear picture of the benefits and importance of monitoring – for both the organization and employee – can go a long way in supporting policy compliance.

As your loan officers expand on their use of social media to generate leads and attract business, they will become subject to numerous compliance regulations. Compliance policies and monitoring procedures are put in place to protect all parties, including your loan officers, from inadvertently committing violations and incurring fines.

Training Loan Officers on Compliance Issues

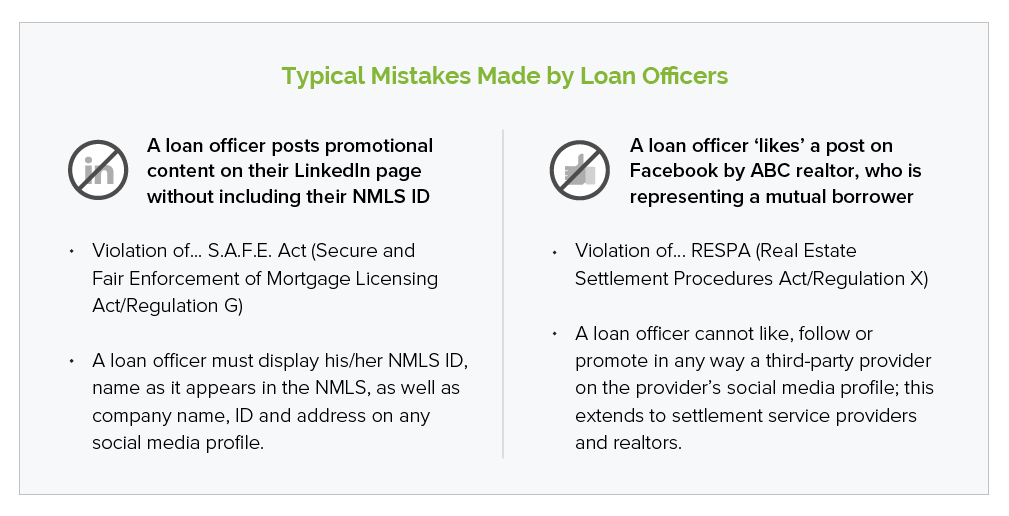

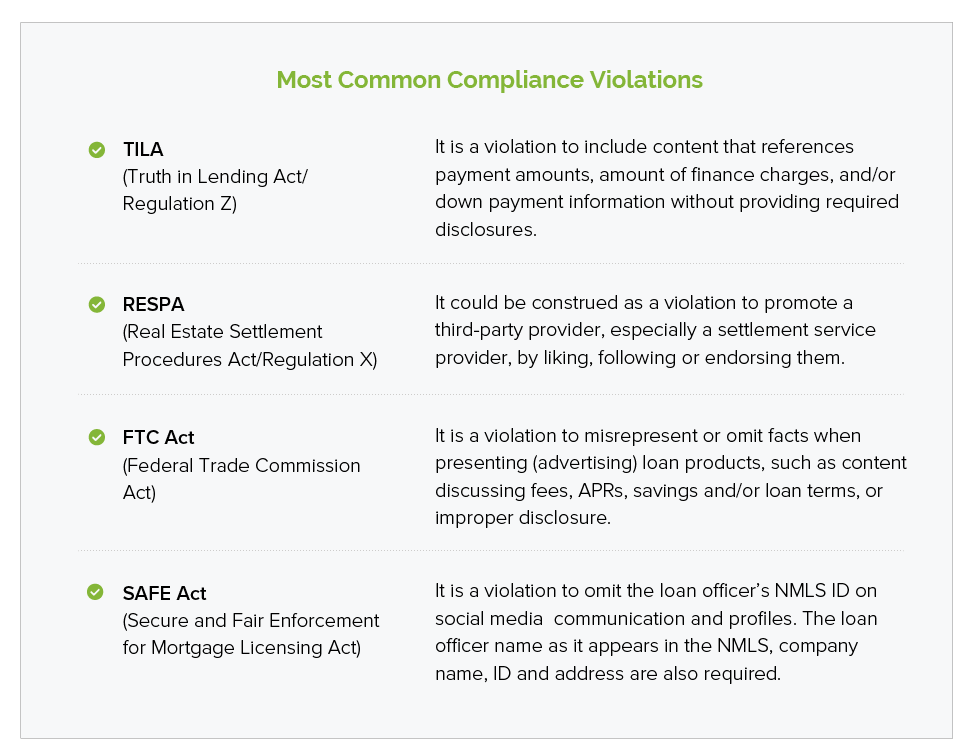

Compliance is complex, especially since the time of the financial crisis. Social media platforms and activities are expanding at an exponential rate, and most policies that regulate social media must be dissected out of broader regulations, demanding a great deal of interpretation. The various federal, state and investor regulations that directly affect your company, employees and corporate policies must be organized and presented in a manner that is both meaningful and digestible.

Your social media compliance policy will help dictate the training your loan officers need, making it critical to have a complete policy that encompasses applicable regulations and current social media activities. Loan officers must have a clear understanding of what they can and cannot say in their online posts, as well as the consequences if violations occur.

Consider providing examples of posts that may be flagged by regulators and content templates that will help generate leads without creating potential violations. Solicit feedback from your loan officers on content development and lead strategies, as well as successes and challenges they’ve experienced.

Ongoing Training and Monitoring

Social media compliance training is not a one-time event. Even after a strong policy is established, it will require reinforcement, regular updates and continuous monitoring. Training programs must also be re-evaluated regularly. As regulations and guidelines change, and new social media platforms and functionalities emerge, policies must evolve.

The ability to successfully monitor your loan officers’ social media usage requires sophisticated technology that benefits both your organization and the loan officer. For example, Black Knight’s social media platform delivers features specifically designed to help protect an organization from compliance risk. The automated monitoring features within the platform enable 24/7, real-time oversight of social media activities involving your company, as well as comprehensive audit reviews to maintain oversight of targeted social media activities and venues. By staying alert to problematic content, you’re in the best position to remediate the published material if necessary. Additionally, tools such as Black Knight’s platform can help you identify areas of opportunity within your training program so you can take a proactive approach to mitigating future events.

Black Knight Simplifies Compliance

If you’re ready to advance your social media compliance efforts, Black Knight can help. The Black Knight social media platform is the industry’s only comprehensive solution to efficiently manage all compliance obligations in addition to marketing objectives. Developed specifically for mortgage lenders, the platform offers key features such as automated monitoring and flexible audits, access to pre-approved content for quick broadcasting, borrower reviews and on-demand reports.

Learn more about engaging your loan officers, improving regulatory compliance and enhancing lead generation via social media in Black Knight’s complimentary white paper.