As housing inventory remains low, home shoppers may find themselves with fewer options.

Throw in the latest rise in home prices, and potential buyers on a budget are even more pressed for choices. With that in mind, the latest study from SmartAsset factors in budgeting costs and location to find the salary required to make home payments across the country.

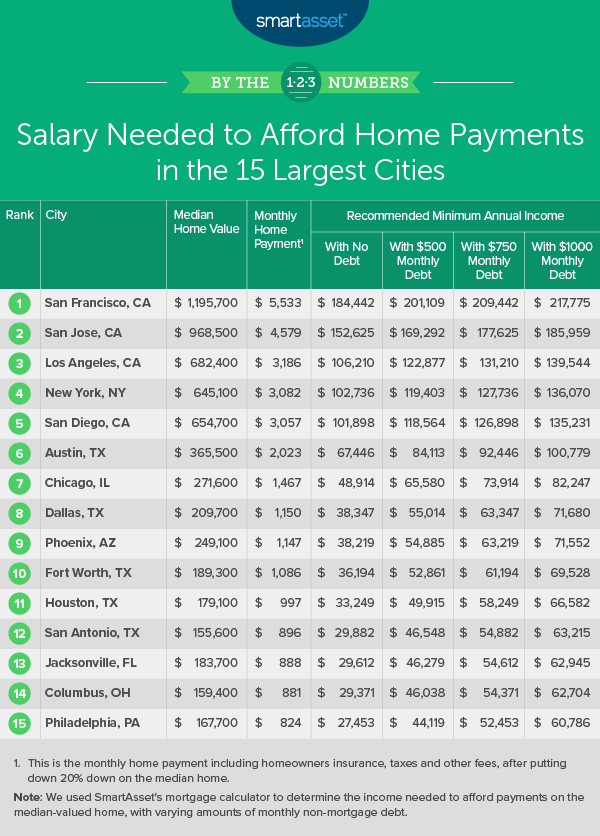

It’s worth noting, the report arrived at its figures while assuming a homebuyer would get a 30-year mortgage with a 4% interest rate for 80% of the home value (after paying a 20% down payment). The study also assumed the person would have an annual homeowners insurance of 0.35%.

SmartAsset found the most expensive locations are on the east and west coasts. On average, the median home value across the 15 largest cities in the country is roughly $418,500. But, median home value ranges from about $1.2 million in San Francisco to about $170,000 in Philadelphia.

If a homeowner lived in one of the 15 largest cities, they would have to make $68,440 on average, to cover home payments, only assuming the person doesn’t owe additional non-mortgage debt.

Homeowners with additional debt need to make between $17,000 and $34,000 more.

If the homeowner’s debt payments are at $500 a month, they would need a salary of more than $85,000. If their other debt payments are more, maybe around $1,000 a month, they would need a salary of at least $101,800 to cover this expense.

No. 1 on the list is San Francisco, where the median home value is $1,195,700. Here, SmartAsset says that homeowners need a salary of $184,442, and no additional non-mortgage debt in order to afford a home.

With a monthly debt of $750, the homeowner would need a salary of $209,442, and with a monthly debt of $1,000, they would need to be making almost $218,000.

Fellow tech hub San Jose, California and Los Angeles, the least affordable housing market, follow behind San Francisco, respectively.

At the bottom of the list, Philadelphia sits at No. 15. Here, the median home value is $167,700 and median real estate taxes are $1,602, according to SmartAsset.

With $1,000 in additional non-mortgage debt, the average Philadelphia homeowner would need to make $60,786 to afford a home.

If the person had $750 in debt, they would need to make $52,453, and if the homeowner had $500 in monthly debt, they would need a salary of $44,119 to afford home payments.

With no additional non-mortgage debt, this homeowner would need to make at least $27,453 a year to cover monthly home payments of $824.