A Comparative Market Analysis (CMA) is a detailed report that helps real estate agents evaluate and determine the market value of a property. It is an essential tool that allows agents to clearly communicate a pricing benchmark for a property. Successful agents create effective and accurate CMA reports that help their clients make informed decisions.

A CMA report includes information on similar, comparable properties in the area, including recent sales, active listings and current market trends. Like you, as a real estate agent, I have prepared many reports analyzing pricing trends to help provide guidance to buyers, sellers and investors alike. In this article, I’ll share the steps, what to include, what not to includes, and how to assemble a CMA report that’ll impress your clients.

Key takeaways

— A comparative market analysis report can provide valuable insights for both buyers and sellers, as well as real estate agents.

— For buyers, it can help them determine if the property they’re interested in is priced correctly and if it is a sound purchase. This may affect their life savings since buying a home is one of the largest purchases one can make!

— For sellers, it can help them determine the best price at which to list their property and ensure they get the best return on it. Sellers would be able to carefully review comparable properties on the market as well as those that have successfully closed.

How to prepare a CMA report for your clients

The most important factor in any CMA is the quality and accuracy of the information that goes into it. Proper research, and a thorough understanding of the data you’re including is required to get the best information out of the analysis.

If your CMA is put together in haste with irrelevant information, it will not be a helpful tool for anyone and may reflect poorly on you as the agent presenting it. It’s imperative that agents invest their time to properly prepare comps!

To create an effective and accurate CMA report, you need to consider several factors, including:

- What is included in a CMA report

- What doesn’t belong in a CMA report

- How to choose or determine which comps to include

- How to evaluate each potential comp

- Market and neighborhood trends

Information your CMA report must include

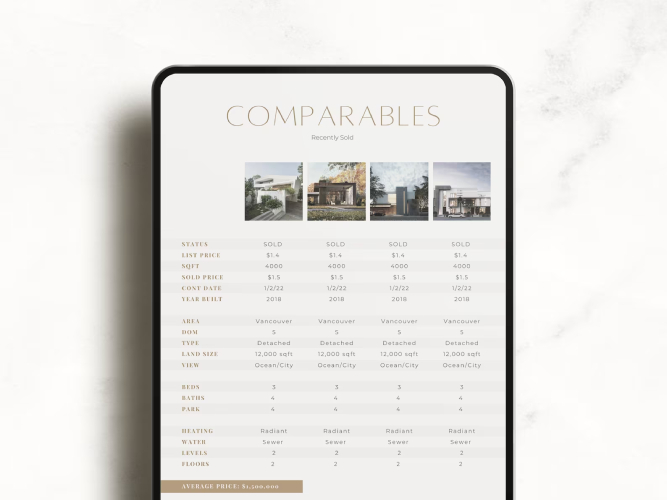

You should include both active listings and closed listings in your CMA report. Your comparative marketing analysis should include the following data points:

- Location of relevant listings that are comparable

- Pricing of active listings

- Selling price of recently closed sales in the same building or area

- For recently closed listings, length of time property was on the market

- Size and number of bedrooms and bathrooms in all comparable properties (known as comps)

Information to exclude from your CMA report

- Personal owner information: Do NOT include names or details of any owners in the comps. The ideal comparison is an “apples-to-apples” analysis without the unnecessary distractions of irrelevant data.

- Property appraisal information

- Detailed outline or description of each property. CMA reports are simple and effective tools. These details are more relevant and appropriate in an appraisal. However, you’ll want to consider all of these details when choosing your comps. More on that later.

- Unlike Properties: Omit any properties in completely different locations or those in a different size or price range.

Assembling your comparative market analysis

I usually develop a report that is broken out into five sections, outlined below. Here are the steps you should take to develop your CMA report

Step 1. Gather subject property details

Whether you’re evaluating a listing for a seller client or potential property for purchase for a buyer, you’ll want to include details about the subject property, to include the home’s size, lot size (if applicable), age of the property, any renovations or upgrades, the condition of the property, its construction or design style, as well as its physical address and location.

Step 2. Select active listings comps

Choose active listings near to the subject property. The distance will really depend on your market and your knowledge of the surrounding neighborhoods. Choose properties of like kind. If your subject property is a single-family home, focus on single-family homes in the same school district.

Ensure that active comps are ones that have similar lot size, square footage, number of bedrooms and bathrooms, and number of parking spots included with the property (if it’s an apartment or condo). If active listings are abundant, you’ll want to limit your chosen comps to those that hit the market most recently.

Pro Tip

Five to eight properties are the sweet spot. Floorplans are a bonus, but many agents don’t include them.

3. Recently sold comps

You’ll want to include recently sold properties of the same type and size, noting the same factors as with active listings comps. Choose properties that have sold in the past six months or in a period of rapid market movement, in the past three months. Focus on properties that closed with reasonable terms and within a reasonable number of days on market.

Pro Tip

You don’t need to include all the property details in your Comparative Market Analysis. They are more appropriate for an appraisal. However, it may be helpful to add short descriptions like “renovated” or “XL terrace” to show unique features of the properties you’ve included in a “Notes” section at the end of your CMA report.

4. Detail market and neighborhood trends

Here’s where your hyper-local market knowledge can really shine! It is essential to consider the micro-market or neighborhood trends when creating a CMA report. For example, in New York City where I live and work, many different neighborhoods border each other and are very close together – but property values vary significantly from one to the next.

It behooves you to confirm where any property sits when including it in the list of comparables as it may greatly affect the pricing. Including these details can show your client that you are a highly knowledgeable agent in your hyper-local area!

5. Develop your analysis or executive summary

For an apples-to-apples comparison, you’ll want to adjust for the differences between your chosen comps (both active and sold) and your subject property. For example, if one of the sold comps had an additional parking space, you’ll want to adjust its sold price down based on the local market value of a parking space. In a densely populated urban area, parking is at a premium, whereas in the suburbs, a parking space might not hold as high a value.

If an active listing has two bedrooms and your subject property has three bedrooms, you’ll want to adjust your price recommendation accordingly. Again, this is where your local market expertise is highly valuable to your client. Understanding the features and their value in your market is crucial to creating an accurate comparative market analysis for your client.

The full picture

Once you’ve gathered all the necessary data, it is time to put it all together. It is crucial to structure the report in a way that is easy to view and understand for your clients. What good is a report that you can’t read? You can use digital tools or print out the report, depending on your clients’ preference.

You’ll likely see a trend emerge from the comps you’ve chosen and can give your buyer or seller an estimated value or market price for the subject property in question. If they are a seller, you can suggest a conservative, moderate and aggressive selling price for their listing. If they’re a buyer, you can suggest a conservative, moderate or aggressive offer price for the subject property they’re interested in. You get the picture!

A note on timing

Now that you’ve done all the market research and analysis, it’s time to present your findings to your client. I find it helpful to send my comparative market analysis via email a few hours prior to an in-person or virtual meeting, where details can be discussed. This gives your clients an option to review or scan the document and prepare questions if needed.

On the other hand, sending it days in advance may result in clients canceling the meeting as they may feel as if they have your analysis and no longer need your expertise and services. I like to point out to clients that we will review the minutiae in our meeting. Presentation is key here!

Where to find good CMA report templates online

There are numerous templates available online that can help you create an effective and accurate CMA report. You can find free templates or purchase more advanced ones to provide your clients with a more detailed report. Your brokerage may also have a branded template available for use. You may also want to find a few and take the best formatting of each to create your own using tools like Canva.

| Providers | KeyFeatures | Starting Price | Learn More |

|---|---|---|---|

| Etsy | Choose your level of design customization. Options for every budget. Professionally designed templates. | CMA Report templates startign at $2 | |

| Canva | Wide variety of free, customizable templates and fonts. Download to multiple formats. Premium stock images. | Free, with paid plans from $12 per month | |

| HouseCanary | Tools to help you select comps. Property value insights. | $10 per report | |

| Cloud CMA | Interactive, cloud-based tool. Premium, printed CMA reports. | $49 per month | |

| ShowingTime | A suite of productivity tools for agents, including appointment setting. Branded, visual reports. | $45 per user, per month |

Frequently asked questions: CMA reports

What’s the difference between a comparative market analysis and an appraisal?

A comparative market analysis is an evaluation of a property’s value based on comparable properties in the area. It allows agents and their clients to compare similar properties relevant to their analysis.

An appraisal is a more detailed professional report that provides a property’s appraised value based on a thorough inspection and analysis of the property’s condition and features. It is used by lenders and third parties to ascertain a specific price point of a home.

How many comps should be included in a comparative market analysis?

There is no set number of comps that should be included in a CMA report. The number of comps you include will depend on the availability of comparable properties in the area and the quality of the data. I like to focus on having three to five ACTIVE listings and three to five recently closed properties, for a total of five to eight properties, for a complete picture.

What data sources should I use in a comparative market analysis?

When creating a CMA report, it is essential to use reliable data sources. These may include local real estate listings, county property records, and MLS databases. The information should be recent and relevant to the current market. If there are no data points, older items may be included but there should be a footnote disclosing this.