High-volume home sellers are in a bit of a pickle in today’s market thanks to rapidly rising mortgage rates last year.

“We’re just trying to move inventory quickly,” said Lee Kearney, a Tampa, Florida-based real estate investor who has an inventory of between 15 and 20 homes for sale at any given time. “If it’s not moving, change the pricing so it does move. These are market-based decisions.”

Kearney’s simple strategy for surviving as a high-volume seller in an environment where demand has dried up: listen to the market and do what it says.

“As a seller if something is sitting out there a couple weeks and it’s not selling, the price is too high,” said Kearney, who has been investing through multiple real estate cycles and believes housing will not be rebounding substantially in the near term. “There’s no good news around the corner. If you believe that statement, then the action item is to lower the price.”

Although there have been some recent positive signs in the housing and jobs markets, those signs point to stubbornly high inflation and a corresponding stubbornness on the part of the Federal Reserve to continue raising interest rates over the longer term to fight inflation. A longer-term fight against inflation lowers the likelihood of sustainable good news in the housing market and raises the risk of a coming recession.

iBuyers pull back in this housing market

Although he is being much more selective in his acquisitions, Kearney has not stopped acquiring properties altogether, a strategy that some larger institutional investors adopted in certain Tampa neighborhoods in late 2022. Those neighborhoods are now feeling the most pain in terms of value loss, according to Kearney.

“The $500,000 house is now $450,000. It’s an interest rate calculation,” he said. “Especially cookie cutter neighborhoods where the iBuyers pulled out.”

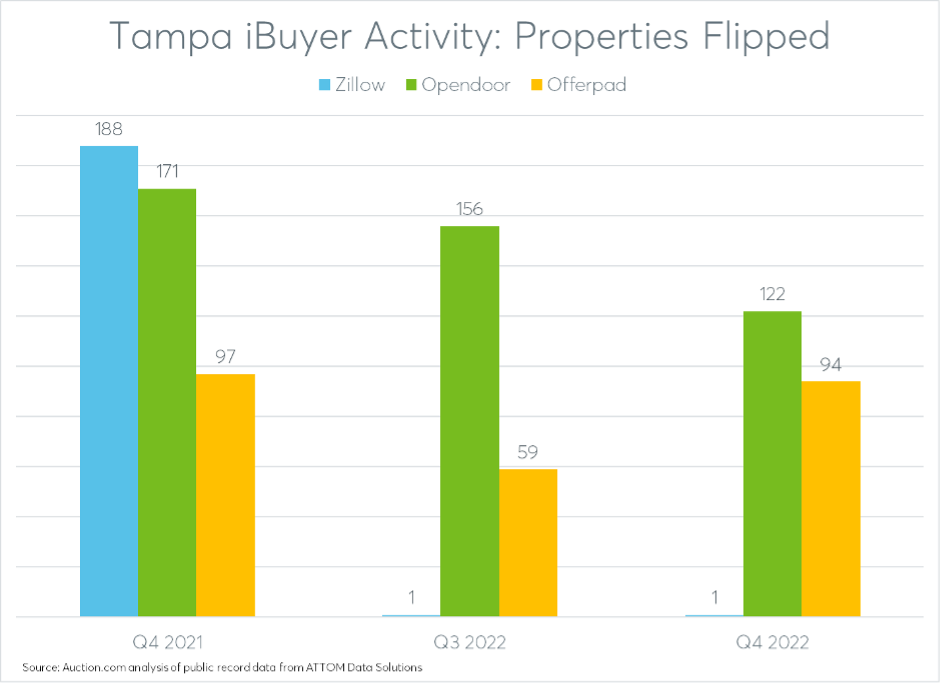

An Auction analysis of public record data from ATTOM Data Solutions shows iBuyer activity home flipping activity in the Tampa Bay metro area dropping 52% in Q4 2022 compared to the year before. The drop was driven primarily by a 99% decrease in homes flipped by Zillow, but Opendoor home flipping activity was also down 29% over the same period and Offerpad home flipping activity was down 3 percent.

Opendoor lost an average of $6,000 on Q4 2022 flips, down from an average gain of nearly $16,000 per property for homes flipped in Q4 2021. Offerpad’s Q4 2022 flips still produced an average gross gain of nearly $12,000 per property (not including holding, rehab or selling costs), but that was down 69% from the average gain of more than $38,000 per property a year before. The one property that Zillow flipped in Tampa in Q4 2022 sold for a whopping $173,000 less than its purchase price. In Q4 2021, Zillow’s 188 home flips in the Tampa metro area averaged a gross gain of about $7,000 per property.

Distressed property pricing strategies

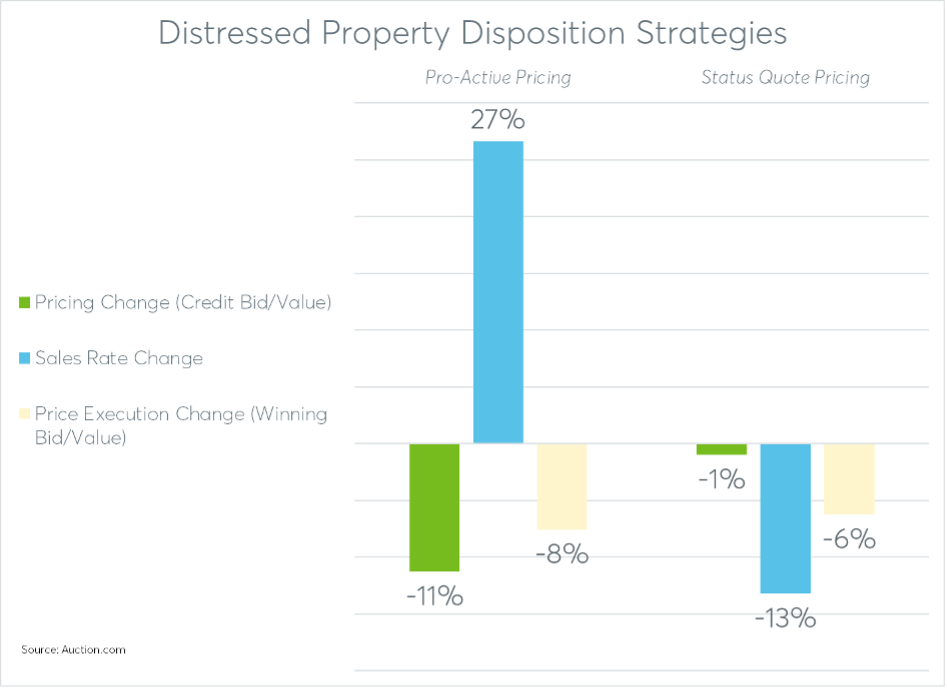

Data from the Auction.com 2023 Distressed Market Outlook report shows how another type of institutional seller — lenders who are selling at foreclosure or bank-owned auction — are adjusting their disposition strategies in response to downshifting demand.

In the fourth quarter of 2022, the most proactive of these lenders began adjusting their credit bids at foreclosure auction lower, thereby maintaining a sales rate of 50% or more at the foreclosure auction. By maintaining that optimal foreclosure auction sales rate, these proactive lenders are able to minimize disposition losses while also mitigating the risk of holding properties as real estate owned (REO) in a market where home prices are flat or falling.

The fourth quarter adjustment by proactive lenders lowered the average price-to-value ratio for all foreclosure auctions on the Auction.com platform by three percentage points, from 73% in the third quarter to 70% in the fourth quarter. This was the overall average, with the most proactive lenders lowering credit bids by more than five points.

Those most proactive lenders saw the sales rate at foreclosure auction rise well above 50% by the end of the year while the sales rate for all lenders continued to fall, albeit at a slower pace, bottoming out at close to 45% in December.

Optimal disposition outcomes

Keeping the foreclosure sales rate above 50% helps distressed property sellers to best leverage the disposition channel that has been proven to yield the highest net proceeds in a variety of housing market conditions.

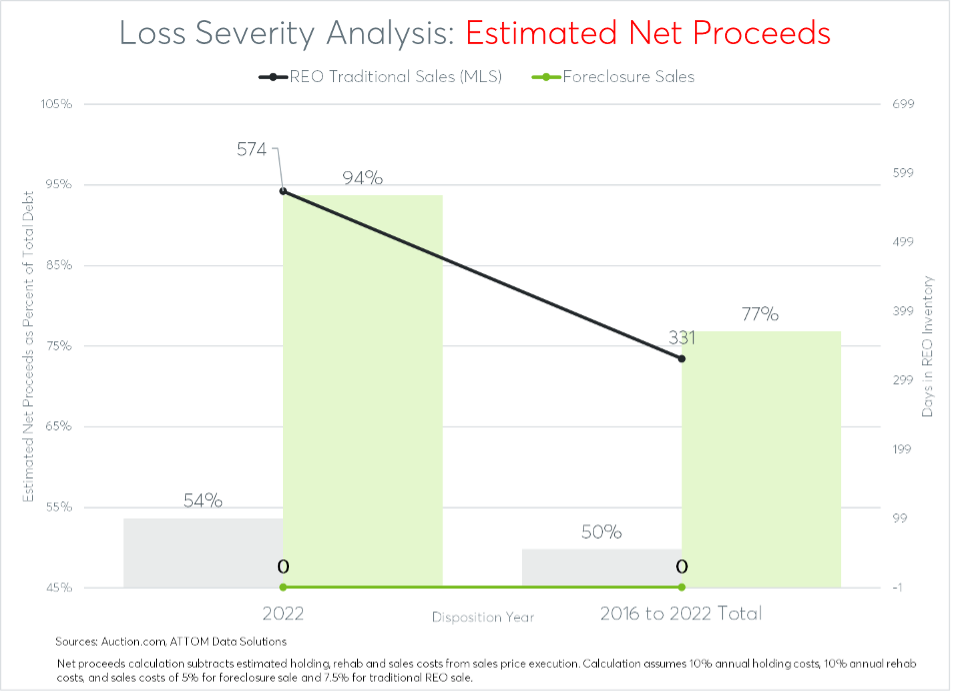

An analysis of more than 435,000 distressed property dispositions since 2016 in the 2023 Distressed Market Outlook report shows that distressed properties sold at foreclosure auction yield an estimated net proceeds of 77% of the total debt owed to the foreclosing lender. That’s 27 percentage points higher than the estimated net proceeds (50% of total debt) for properties that reverted to REO and then were subsequently sold on the retail market, typically through the Multiple Listing Service.

Holding properties as REO becomes even more risky in a slowing real estate environment. The performance gap between foreclosure sale dispositions and retail REO sale dispositions widened to 40 points in the downshifting 2022 market.

Optimal neighborhood outcomes

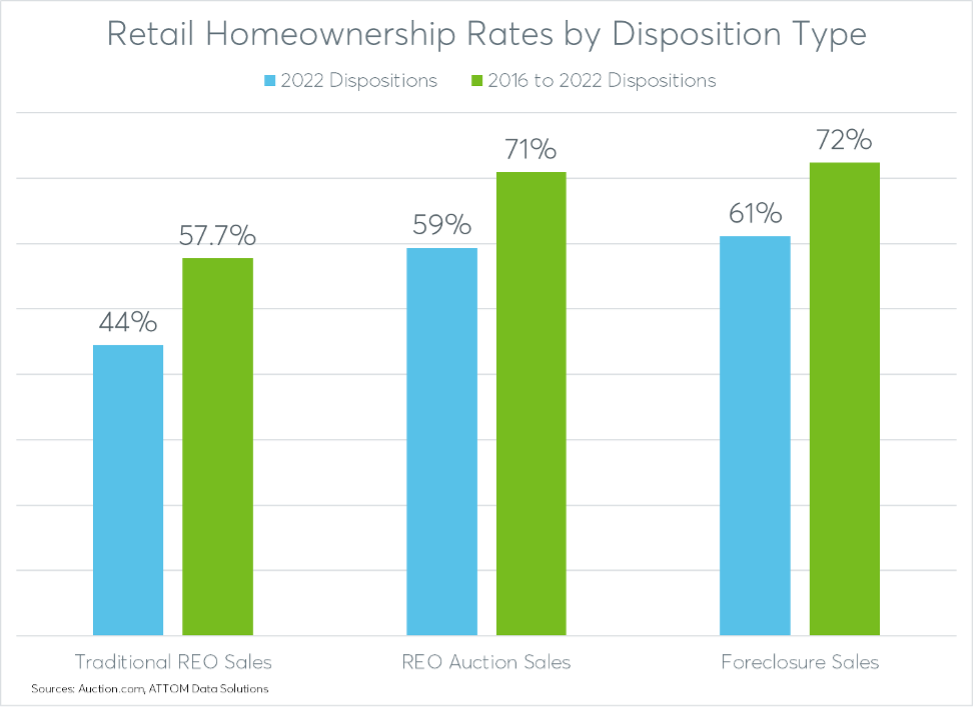

It also turns out that selling more property at foreclosure auction lifts homeownership rates and improves property values. The same analysis of 435,000 distressed property dispositions shows that 72% of properties that were renovated and resold after being purchased at foreclosure auction ended up in the hands of owner-occupants. That was 14 percentage points higher than the 58% homeownership rate for retail REO sales.

The renovated foreclosure sale properties were sold for 99% of estimated “after-repair” value, indicating significant renovation and helping provide favorable comparable sales for other properties in the surrounding neighborhood. By comparison, the retail REO sales sold for 73% of estimated “after-repair” market value.

Despite selling for close to full “after-repair” market value, the renovated foreclosure properties still represented relatively affordable housing, particularly for families in underserved neighborhoods.

Renovated foreclosures in low-income Census tracts sold for an average price of $211,963 in 2022, with the monthly mortgage payment on those homes — including property taxes, insurance and assuming a 5% down payment and the average 30-year fixed mortgage rate in the month of the sale — requiring 22% of the monthly median income for families in the surrounding tract. Renovated foreclosures in minority Census tracts sold for an average price of $223,227 in 2022, requiring 24% of the median family income in the surrounding neighborhood.

To learn more about pricing properties in today’s market, visit Auction.com.