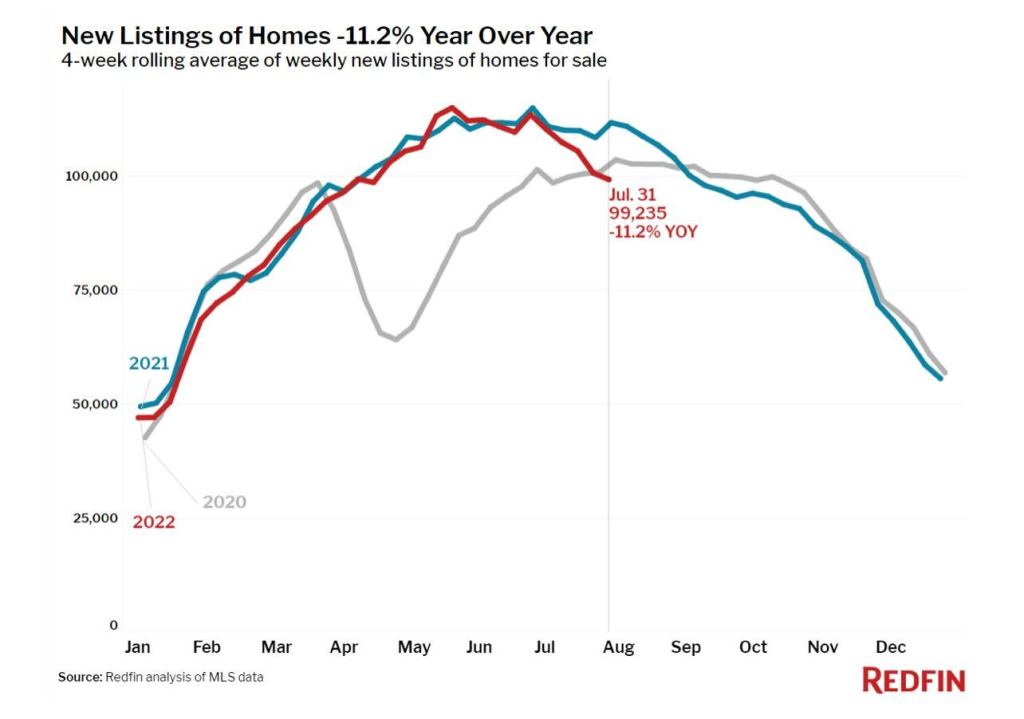

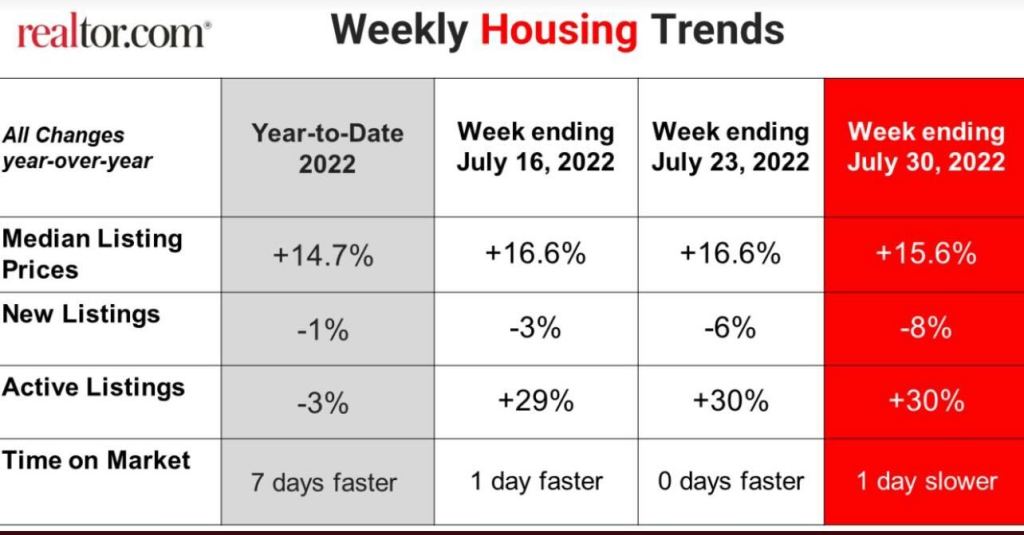

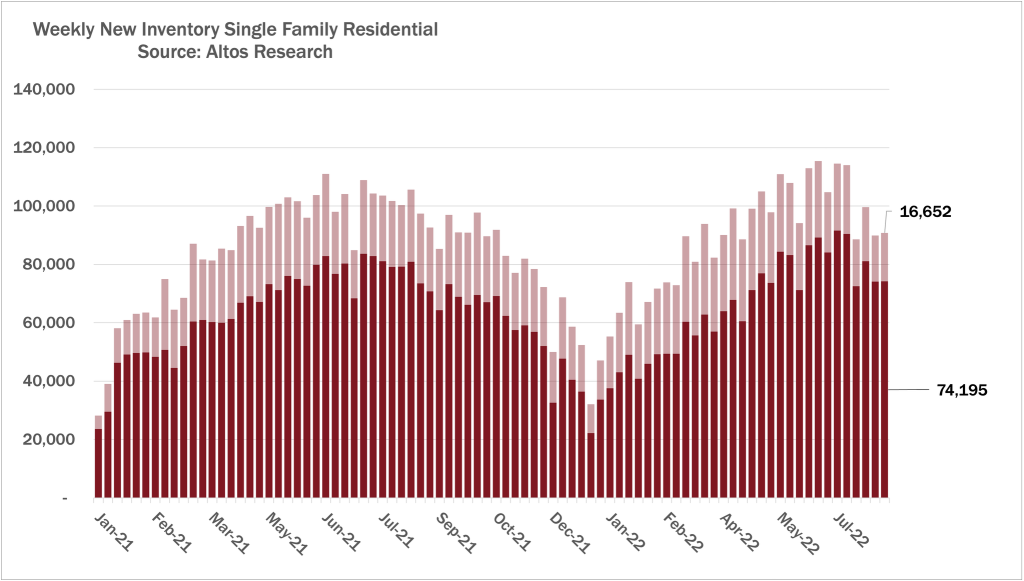

One of the most important housing market stories in recent weeks has been the decline in new listings, which has slowed the growth rate of total inventory. What does this mean? Some have said this is evidence of a soft landing for housing since we are in August and it doesn’t look like we are going to even get to the peak inventory levels we saw in 2019 this year, or even breach the lower levels of 2019 on the national data.

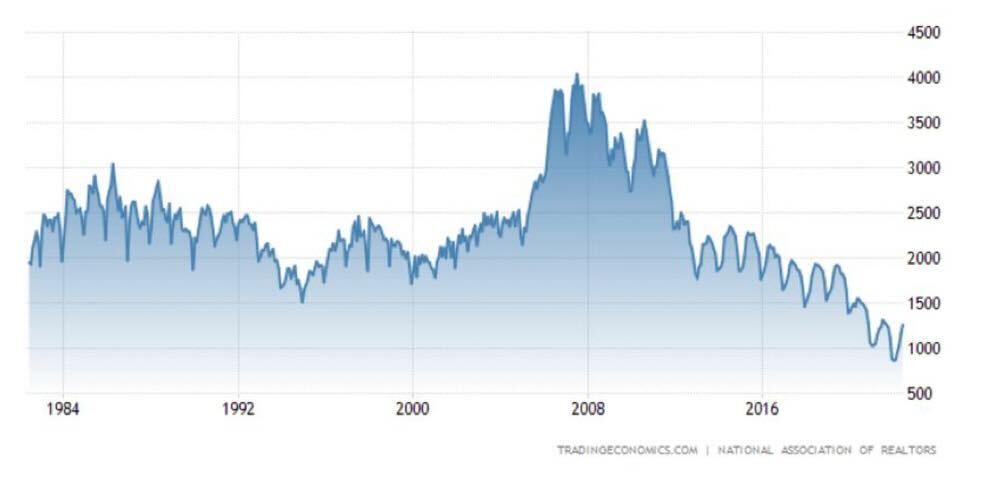

From the National Association of Realtors:

What I want to talk about is the concern I’ve had throughout this post-COVID-19 housing market: When will we get total inventory back into a range of 1.52 million to 1.93 million? Once that happens, I can finally take the savagely unhealthy housing market theme off my talking points.

First let’s take a look at the data.

Clearly, we are seeing a slowdown in new listings as the data has been negative now for weeks. One thing that I have stressed is that higher mortgage rates can create a slowdown in demand and thus allow more inventory to accumulate through a weakness in demand. After March of this year when rates were rising, this was the case, especially when rates ranged between 5% to 6%. Inventory growth is happening much like we saw in 2014 — the last time total inventory grew — which was also the last time mortgage purchase application data went negative year over year.

However, inventory accumulation due to weakness in demand is only one of many ways to see inventory increase. If you really want to see inventory grow to 2019, 2016, 2014 or even 2012 levels, you need a healthy amount of new listing growth each year. We aren’t talking forced sellers, foreclosures or even short sellers. With just traditional new listings and with higher rates and time, we should be able to hit peak 2019 inventory levels.

The problem with new listings declining now is what will happen if mortgage rates make a solid push lower. At that point housing inventory could slow even more, pause, and in some cases fall again due to demand. If mortgage rates peaked at 6.25% or 6.50%, that means that the next big move should be lower and that is a risk to getting balance back into the system.

How low do rates need to go?

Mortgage rates have made a move of 1.25% in recent weeks and I have talked about how low they need to go to make a material shift in the markets. Looking at the most recent mortgage purchase application data, I haven’t seen anything yet to show that demand is coming back in the meaningful way. In fact the recent data shows that even though we saw a positive 1% move week to week, the year-over-year data is still down 19%.

So as of now, the growth rate of inventory slowing down is a supply issue more than demand picking up in a meaningful way. This is why if rates do fall, we will have more supply and more choices for borrowers, who in some areas won’t have to get into a bidding war for a home. This is something I will be keeping an eye on for the rest of the year, since I do have all six of my recession red flags up, which historically means that rates and bond yields fall.

Two things that I believe are key for a soft landing are rates falling to get housing back in line and inflation growth falling so the Fed can stop with the rate hikes and start cutting rates if the economic data gets even worse.

Inflation!

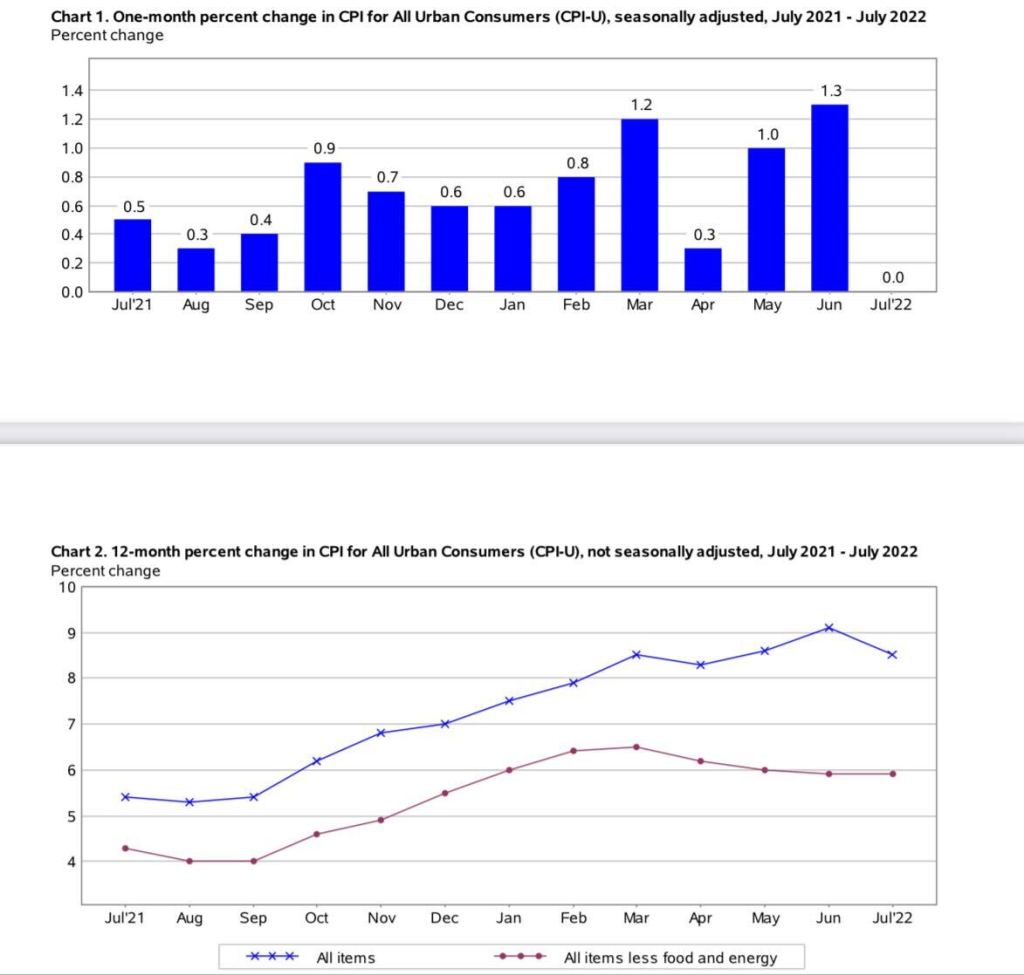

The recent inflation data did surprise the downside a bit, sending the bond market rallying, stocks higher and mortgage rates falling.

However, we are far from calling it a victory as inflation growth rate is still very high and we do have some variables that can create supply shortages, such as war and aggression by other countries.

For today, people cheered the growth rate of inflation falling as they know this is the biggest driver of the Federal Reserve’s hawkish tone and more aggressive rate hikes. Also, in general, the mood of Americans is much better when gasoline prices are falling and not rising. However, we need much more aggressive monthly prints heading lower for the Fed to be convinced that inflation is no longer a concern.

All in all, the decline in new listings does warrant a conversation on how much more growth we will see for the rest of the year. Inventory data is very seasonal and traditionally we see inventory start to fall in October as people start getting ready for the holidays and the New Year, and then in the spring and summer inventory pops up again.

I would remind everyone that the growth rate of inventory, working from all-time lows, was aggressive in the last few months, so some context is needed if we do see some weekly declines in inventory during the summer months. For now, this is due to a lack of new sellers rather than demand picking up. If demand starts to pick up due to falling rates, that is an entirely different conversation we will have, but we haven’t crossed that bridge yet.

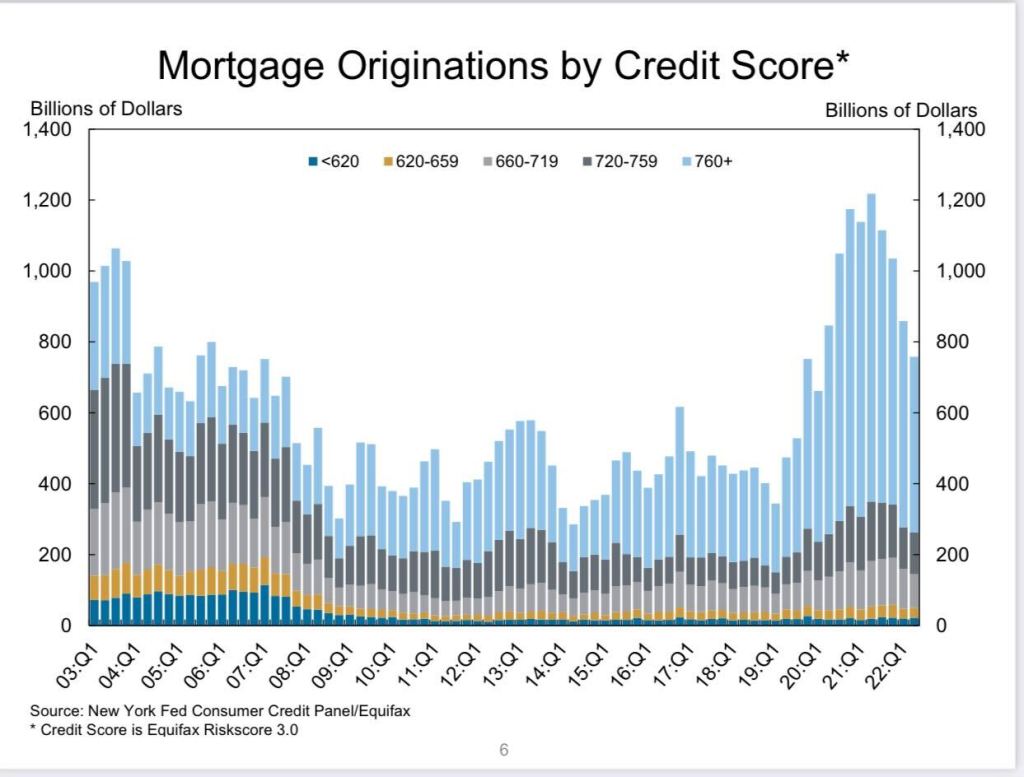

Just remember that American homeowners are just in much better shape these days.

I know the professional grift online since October of 2021 was that a massive wave of millions of people were going to list their homes to sell at any cost to get out before the housing market crashed.

However, homeowners don’t operate this way. A traditional home seller is a natural homebuyer, buying another property when they sell. They don’t sell their house to be homeless or purposely sell to rent at a higher cost for no good reason. If we get a job loss recession we can have a further discussion of credit risk profiles, but for now, it shouldn’t be too shocking that new listings are declining, except for the fact it’s happening sooner than later in the year.

We’re covering this important topic at our HousingWire Annual event Oct. 3-5., where Logan will be a featured speaker. Register here to join us in Scottsdale, Arizona.