During 2021 and into 2022, the surveys on whether it’s a good time to buy a house have simply collapsed. This did ring some alarm bells last year as many housing crash addicts used the results of Fannie Mae’s Home Purchase Sentiment Index to call for an epic crash in the second half of 2021. That didn’t end well, but let’s take a deeper look at what is happening here.

One thing is certain: potential buyers of all ages are not happy about the current market conditions. From Fannie Mae:

Recently, the percentage of people who said it was a good time to sell fell as well. So what is going on here? How can we drop buying and selling conditions in the same report?

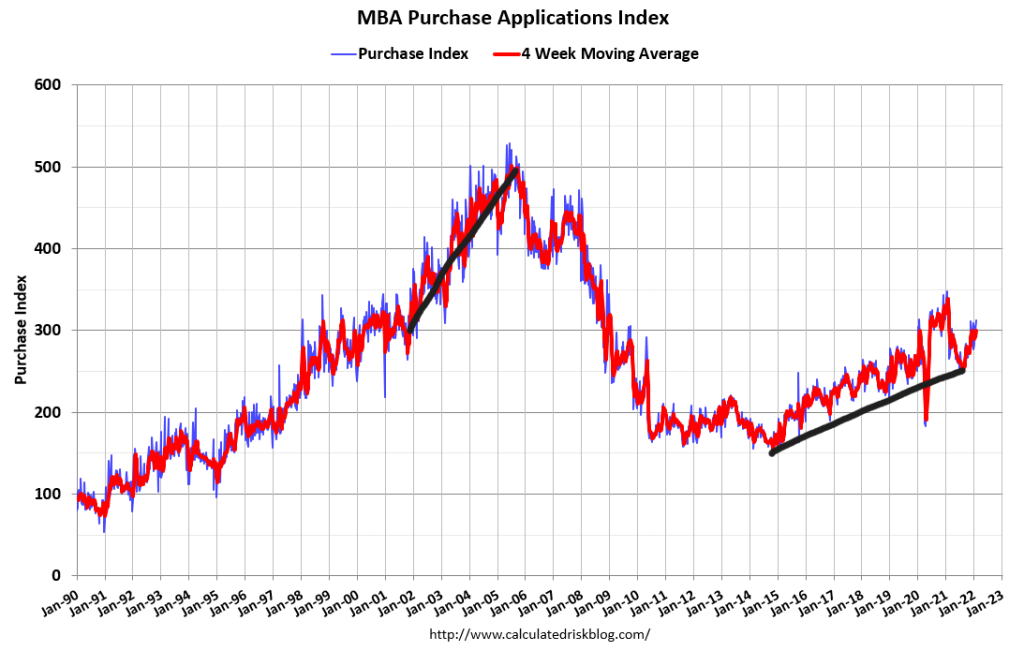

Last year, many of the second half 2021 housing crash bears were using the collapse of this index to say housing was done; nobody wants to buy a home. This was never the case, as purchase application data never once showed a noticeable decline in the data once you made COVID-19 adjustments.

Another interesting fact about 2021 was that certain people put a lot of weight on housing being held up by investors or iBuyers, reflecting that buying conditions had deteriorated so much in the survey in 2021. That same group of individuals was also shocked to see that mortgage demand picked up very noticeably toward the end of the year in 2021; even I labeled the existing home sales market as outperforming due to mortgage demand, which makes the survey look incorrect.

So what is the issue here? It’s simple: inventory levels were at all-time lows in 2021 and they just got worse in 2022, don’t make it any more complicated than that.

Nobody likes competition when buying a home. It can be stressful enough when the markets are regular, like they were from 2014-to 2019. Now we’re in years 2020-2024 and not only has inventory dropped to all-time lows, but we’re also dealing with the most significant housing demographic patch ever recorded in U.S. history: move-up buyers, move-down buyers with a lot of cash, investors and all-cash buyers. This survey was never about people saying they never want to buy a home; just that the conditions for buying a home are terrible — and I agree with them.

By the summer of 2020, I started to worry about inventory levels getting dangerously low. What happens when you have the best housing demographics ever, the lowest mortgage rates ever, and all-time lows in inventory? Unhealthy home-price growth, and it got worse and worse as the year went on.

As someone who never believed in the forbearance crash bros and their premise of collapsing demand, which would require a massive number of Americans walking away from their homes, the real fear was realized when total inventory levels never reached above my critical 1.52 million during the spring and summer of 2021. I knew the fall and winter fade of inventory was coming. To make matters worse, mortgage demand picked up in the second half of 2021. The entire housing crash 2021/FOMO premise fell flat on its face, and now we enter 2022 with fresh new all-time lows in inventory.

To make matters worse, home-price growth in 2020 and 2021 was so high that it surpassed the five-year price-growth model of 23% I had set for 2020-2024, and that was just to be in an OK position going into 2025. So, I agree with the consumer survey and keep saying this is the unhealthiest housing market post-2010. When prices are rising so quickly, you can understand why homebuyers are stressed.

Buying a home isn’t like buying an iPhone or an Xbox; you need somewhere to live every day, and with so much price inflation and meager inventory, you would be stressed too, especially if you keep losing bids. We always talk about the stress of home buying, but we should also include sellers in that discussion. Unless they choose to rent after the sale or sell their investment home, a seller becomes the next natural homebuyer. I know some people can get an extended lease and live in the house after the sale. However, with inventory so low and high competition, there is no guarantee they will get the home they want either.

On the surface, the survey looks correct; demand for housing is at pre-cycle highs, and total inventory is at all-time lows with unhealthy home-price growth in the last two years.

Also, unlike stocks, the chances of the home you want to buy falling 20% after a bad earnings report are zero. So, it’s a much different sector of our economy because housing is the cost of shelter to your capacity to own the debt; it’s not an investment.

Currently, the only solution to create more days on the market is for mortgage rates to rise high enough to facilitate that, and so far, this hasn’t been the case. However, if the 10-year yield can create a range between 1.94% – 2.42% with duration, this should do the trick. If 4% – 4.5% mortgage rates can’t generate more days on the market from this very meager level, then I don’t see anything else in 2022 that will do this.

Eventually, prices will get too high, and natural inflation demand destruction will occur; we are just not at that point currently.

To wrap it up, I believe the survey is an accurate reflection of the sentiment of homebuyers in America; it’s brutal out there. I disagree with people who said this survey was calling for a crash in demand in 2021 and 2022. We have accurate models to track when housing and the economy are getting weaker; we just don’t have flashing signs of that now.

I’m always amazed at how informative and clear your articles are. As a real estate professional in the trenches daily, I truly appreciate how you pull the market dynamics in and the relationship with rates, consumer sentiment and obviously, economic forces. As a professional that needs to anticipate and what will happen to our market in the future, your reads are especially helpful. I also love that you write so that folks outside of the lending and financial realm can understand and apply!