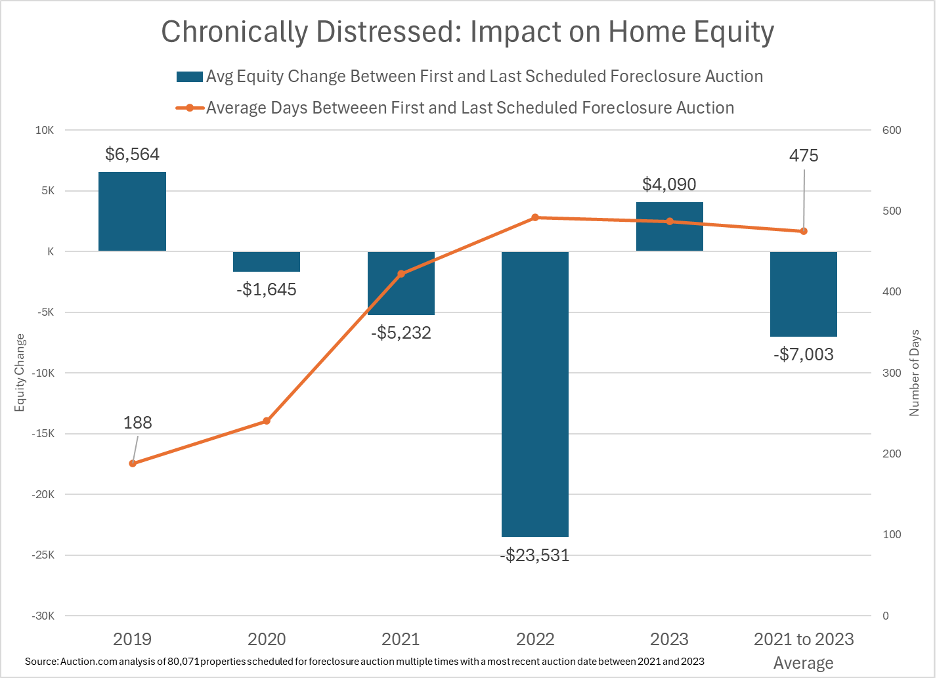

Chronically distressed properties lost more than $7,000 in total home equity on average while cycling in and out of foreclosure, according to an Auction.com analysis of more than 80,000 properties scheduled for foreclosure auction multiple times in the last three years.

The chronically distressed properties cycled in and out of foreclosure for an average of 475 days, resulting in a lost equity rate of more than $5,000 a year and nearly $450 a month. They were scheduled for foreclosure auction nearly four times (3.8) on average and represented 38% of all 210,000 properties scheduled for foreclosure auction in the last three years. The remaining 130,000 properties were scheduled for foreclosure auction only once.

Rapid home price appreciation can sometimes help slow the rate of lost equity as it did in 2021, when distressed homeowners lost an average of $377 a month. Accelerating home price appreciation can even sometimes help reverse the trend completely as it did in 2023, when distressed homeowners gained an average of $255 a month in equity. Conversely, slowing home price appreciation can help accelerate the rate of lost equity as it did in 2022, when distressed homeowners lost an average of $1,453 a month.

But increasing home prices, on their own, are often not enough to increase home equity for distressed homeowners. That’s because the unpaid loan balance continues to grow for delinquent mortgages due to unpaid interest, property taxes and insurance. While the average value of the 80,000 properties analyzed increased 3% between the first and last scheduled foreclosure auction date, the average unpaid loan balance increased by 6 percent.

When the mortgage balance is increasing at a faster pace than home prices, more time in foreclosure only digs a deeper home equity hole for distressed homeowners. And when home price appreciation slows or goes negative, as it did for a few months in 2022, the home equity hole is dug faster.

Trading equity for rent

Still, even the $1,500 a month in lost home equity experienced in 2022 may represent a beneficial tradeoff for many distressed homeowners facing a shorter-term disruption, allowing them to exchange that lost equity for some extra time to stay in the home until they can start making mortgage payments again.

“One of the examples I was researching for this month got a $58,000 partial claim granted,” said Houston-based real estate investor Francois Delille, referring to the partial claim program for mortgages insured by the Federal Housing Administration (FHA). The program allows delinquent borrowers to package up to 30 percent of the unpaid principal balance of their original loan into a non-interest bearing second loan that only needs to be paid off when the home securing the loan is sold or refinanced, or the first position mortgage is paid off sometime down the road.

“Assuming he put 3.5% down, he was able to get close to a 30% partial claim mortgage,” Delille continued. “Usually, rent is about 1 percent so effectively he paid at most for 3.5 months of rent equivalent and then got 30 months free rent equivalent.”

Effective foreclosure prevention

Partial claims — and the extra “free rent” time they give to distressed homeowners — have proven to be key part of an effective foreclosure prevention strategy that mortgage servicers and government agencies employed in the wake of the economic shock caused by the COVID-19 pandemic.

Most homeowners who missed mortgage payments because of that shock have returned to making mortgage payments on time thanks to a combination of widespread forbearance programs that gave homeowners time to get back on their feet, along with innovative loss mitigation tools like the partial claim, which protect homeowners from the burden of having to catch up with missed payments when they do get back on their feet.

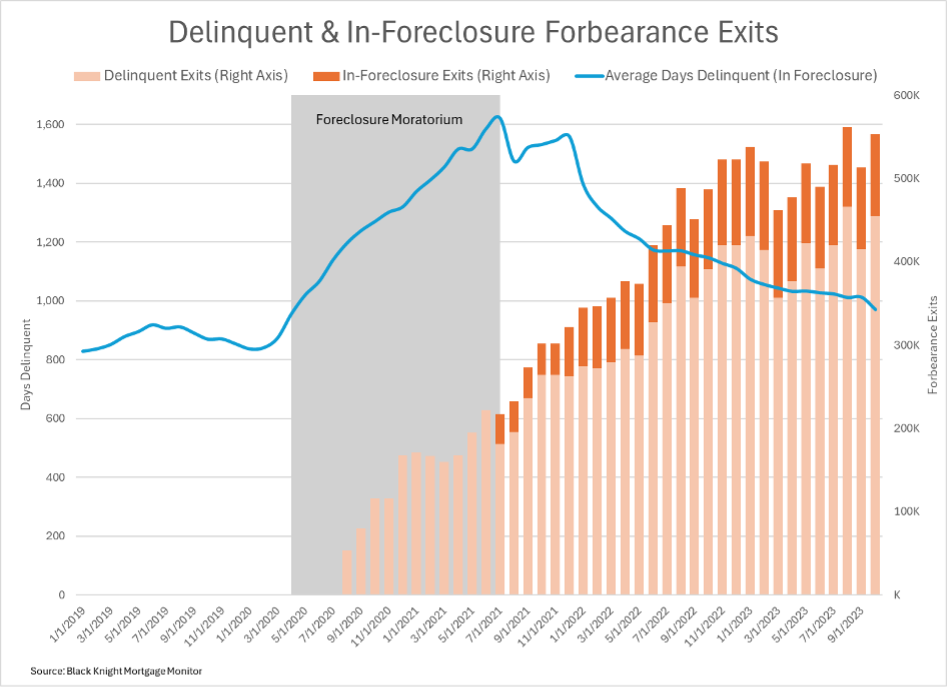

Of more than 8.7 million mortgages that entered COVID-19 forbearance, about 7.5 million (86 percent) are now back to performing or have been paid off, according to data from ICE as of November 2023. Only 93,000 (1%) of the forbearance exits have ended in a distressed disposition — in most cases a completed foreclosure auction.

Chronically distressed

Another 553,000 (6%) of the forbearance exits are still delinquent (455,000) or in foreclosure (98,000) after exiting forbearance, according to the ICE data. That number grew by 66,000 (14%) between November 2022 and November 2023, and is up by 331,000 (149%) since July 2021, when the pandemic-triggered nationwide foreclosure moratorium on government-backed mortgages expired.

For that smaller but growing subset of chronically distressed homeowners who may not be able to avoid foreclosure in the long run, staying in the home longer could be counterproductive, potentially eroding equity that could help them with more affordable replacement housing costs when they do eventually walk away from the home.

Providing a graceful exit

As a local community developer who has been buying distressed real estate in the Houston market for the last decade, Delille is passionate about providing distressed homeowners — whom he describes as “good people in a bad situation” — with a graceful exit that protects their equity while providing a path to replacement housing.

“As a company we always work with the occupants. … We always offer lease-back to people, and we have a few that have been tenants for several years,” he said. “I have a guy who has been leasing from us for six years. It’s a win-win.”

Protecting homeowner equity

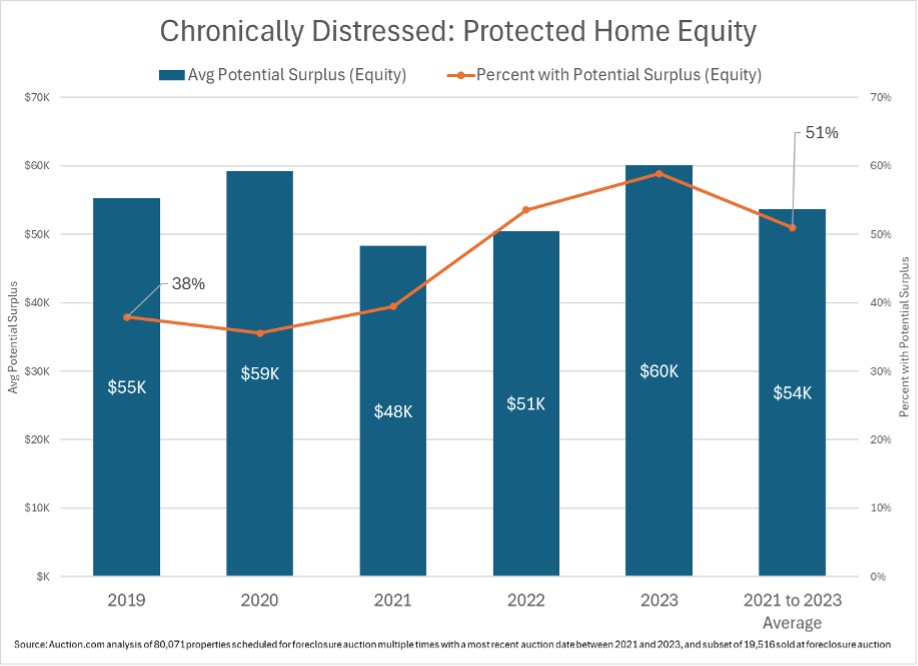

In addition to losing equity on paper, the actual home equity for properties cycling in and out of foreclosure may not be as high as the on-paper home equity given that many of these properties have deferred maintenance and are not in fully repaired condition.

The average on-paper equity for the 80,000 properties analyzed — based on the estimated after-repair value (ARV) of the property — was $141,188. But for a subset of about 20,000 properties that did eventually sell to a third-party buyer at foreclosure auction, the average actual equity — based on the winning bid in a competitive and transparent marketplace — was a negative $5,348. In other words, the chronically distressed properties were underwater by about $5,000 on average, based on an actual market-clearing value for the homes.

For chronically distressed homeowners with actual home equity — not just on-paper home equity — the last chance to protect that equity is at foreclosure auction. When a property is sold to a third-party buyer like Delille at foreclosure auction, any surplus above the total debt owed is distributed back to the distressed homeowner after junior liens have been paid.

Although the aforementioned 20,000 properties sold at foreclosure auction had an average negative equity of more than $5,000, slightly more than half (51%) of those third-party foreclosure auction sales generated some potential surplus for the distressed homeowner. And among those 51%, the average potential surplus was close to $54,000.

A review of properties purchased by Delille at foreclosure auction via the Auction.com platform over the past three years reveals that 58% of those sales have generated a potential surplus.

“On this property we bid $30,000 over the credit bid, the bank’s bid,” said Delille, recalling a foreclosure auction purchase he made in January 2023. “That means there’s surplus funds that, within about three weeks, he’s getting. So, he got a nice-sized check after the auction that allows him to fall on his feet.

“He had been struggling for many years and he just could not afford that home anymore,” Delille continued. “So, I think that surplus fund check allows him to find something that he can afford, has some reserve, land on his feet. In the end he was quite happy with the result. We didn’t have to file an eviction; we were able to work out an agreement with him. He needed a month to move. We helped him move. And he was very relieved with the process.”