The loan repurchase trend that began to sting many mortgage originators in 2022 appears to finally be winding down, according to a recent report by Sterling Point Advisors and Augment Analytics.

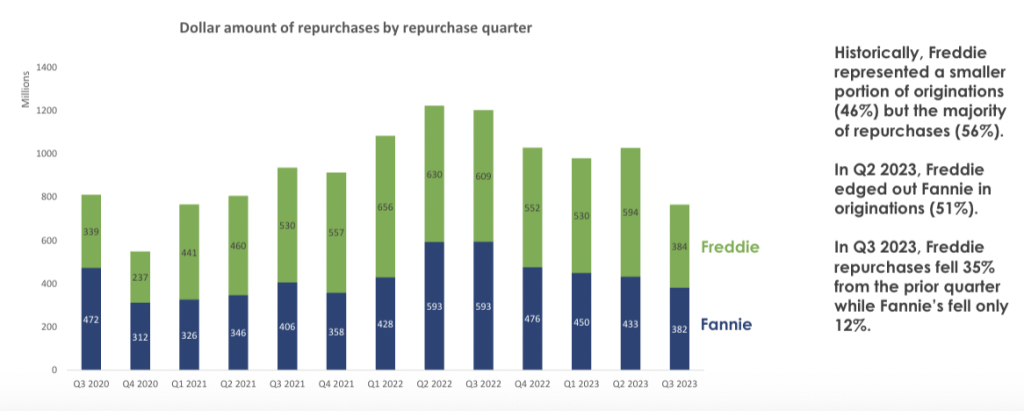

The report, based on loan-level data from Fannie Mae and Freddie Mac, shows that the dollar amount of loan repurchases peaked in the second quarter of 2022, at $630 million for Freddie Mac and $593 million for Fannie Mae.

A large portion of those loans, once repurchased from the government-sponsored enterprises (GSEs) at par, were later resold for much less in the so-called “scratch and dent market.“ This created balance-sheet havoc for a number of lenders, particularly for small and midsized originators.

But the volume of repurchases has trended downward since the peak, according to the Sterling Point/Augment report.

As of third-quarter 2023, the most recent data available, Freddie Mac’s repurchase volume was $384 million, with Fannie Mae’s volume at $382 million. The report notes, however, that “in Q3 2023, Freddie repurchases fell 35% from the prior quarter while Fannie’s fell only 12%.”

Brett Ludden is managing director and co-head of the financial services team at Sterling Point Advisors, a merger and acquisitions advisory firm. He is also the co-founder and managing partner of Augment Analytics.

“We’re seeing a downward trend in total [loans] repurchased [on a dollar basis], and that’s true for both Fannie and Freddie,” Ludden said. “I anticipate that trend continues for both.

“… But the data [for Q3 2023] indicate that Freddie’s repurchase rates are going down at a much faster pace [than Fannie’s]. … We’ll get more definitive data when we get the fourth-quarter results to see if the trends continue at that point.”

A report from the Urban Institute focused on Fannie and Freddie loan repurchase rates shows that the GSEs in recent years “have become more aggressive, forcing more repurchases earlier in the life of the loan than was the case in earlier vintages.”

The Urban Institute report, published in November 2023, shows that the average number of months from origination to repurchase between 2005 to 2008 (prior to and during the early stages of the global financial crisis) was 46 months for Freddie Mac and 52 months for Fannie Mae. From 2018 through Q1 2023, however, that same figure was 11 months for Freddie and 13 months for Fannie.

Policing loans

Even as the agencies have become more aggressive in loan repurchases in the past several years, particularly in the wake of record origination volumes in 2020 and 2021, data seems to indicate that lenders have also become more vigilant in policing loan originations to ensure quality control (QC).

ACES Quality Management, a fintech that provides quality-control software for the financial services industry, issued a Mortgage QC Industry Trends report with data through Q3 2023. The report provides a quarter-by-quarter critical-defect rate for mortgages (primarily Fannie, Freddie and Federal Housing Administration loans) that were analyzed via its software.

According to the ACES report, the critical-defect rate declined from 2.47% in third-quarter 2022 to 1.67% in Q3 2023, the most recent data available. The report defines a critical defect as one that “would result in the loan being uninsurable or ineligible for sale.”

One of the QC efforts now underway to stem agency loan repurchase demands was launched by Fannie Mae this past September. It mandates, among other measures, that companies that sell loans to the agency must complete monthly prefunding reviews on either 10% of its prior month’s loan originations or 750 loans, whichever is less.

Because loan repurchase data from the GSEs is only current through the third quarter of 2023, it’s still too early to tell if Fannie Mae’s program will have a material impact on its repurchase demands.

“Repurchases have been a hot topic for lenders, and to some degree, the agencies and investors have gotten a bad rap in these discussions,” said Nick Volpe, executive vice president of ACES Quality Management. “It makes sense that the investors are asking lenders to ward off as many problems as possible [via QC efforts] before a loan is made.

“The overarching goal of prefunding QC is to ward off problems before they become issues on closed loans. The problem obviously is bad loans that lead to repurchase and indemnification.”

Non-QM vigilance

Pamela Hamrick, president of Incenter Diligence Solutions, which provides due-diligence reviews and document management services for the mortgage industry, said that prefunding reviews are also gaining more traction in the nonqualified mortgage (non-QM) space.

Non-QM loans are those that cannot be purchased by the GSEs. The pool of non-QM borrowers includes real estate investors, foreign nationals, business owners, gig workers and the self-employed, as well as a smaller group of homebuyers who face credit challenges, such as past bankruptcies.

“There are a lot more of the non-QM and DSCR (debt-service-coverage ratio) loans than there have been in the past,” Hamrick said. “And those loans are historically riskier than a typical conventional loan.”

She added that a growing share of non-QM lenders are starting to “embrace more QC prefunding eligibility reviews … because they have major concerns about liquidity in the secondary market for their non-QM and DSCR loans.”

“If a lender closes a loan and a mistake is discovered, it’s likely that their loan won’t get purchased,” Hamrick explained. “So, having a prefunding eligibility review better ensures that the loan transaction can be problem free.”

John Levonick is a senior partner with the law firm Garris Horn LLP, which serves mortgage companies, secondary market investors, quality control firms, third-party review firms and others in the financial services space. He also previously served as CEO of Canopy, a third-party review firm.

Levonick said that in today’s market, the economics have shifted toward encouraging more quality control reviews at the originator level.

“The presumption is that the investors give better pricing for the loans if they have been [run through a quality control review] by the originator,” he added. “And when that happens, the investor will purchase the loans and also purchase the rights to the due diligence through what’s called a reliance letter, which permits the investor to rely on the work done for the lender as if it was done for the investor [satisfying regulator and rating agency requirements].

“So, the lender, regardless of size, has to come out of pocket and pay for the due diligence, but then they allegedly recapture that cost through better execution [of the loan sale to the end investor].”

A&D Mortgage is one example of an originator that is committed to prefunding quality control reviews. Alexander Suslov, the company’s head of capital markets, said that originators perform prefunding reviews on 100% of A&D’s overall loan production, including its non-QM originations.

“Because we do 100% of the prefunding review, we didn’t have that many loan repurchases for it to be super alerting,” Suslov said. “With the little increase that we had, it simply alerted us that we need to be more careful [in certain areas].”

Future technology

Alan Qureshi, managing partner of Blue Water Financial Technologies — a technology solutions provider for the secondary mortgage market that also offers risk management services — said he holds out great hope for the future of tools such as artificial intelligence (AI) and digital quality control reviews in helping to level the playing field in the mortgage market, including on the loan repurchase front.

“Because of the nature of buybacks and because of the non-standardization of loan delivery, I have a fundamental problem around counterparty selection in a market where the big get bigger and the small, well, they get cast aside, but that’s not good for the consumer,” Qureshi said.

“The flip side is if I instead have a platform that leverages technology (such as AI and optical character recognition software, or OCR) to essentially level the playing field. That’s a much better outcome and solution for the industry.”

Verus Mortgage Capital is an aggregator and affiliate of asset manager and investment adviser Invictus Capital Partners, which sponsors a nonagency securitization platform. Verus has acquired more than $30 billion in residential loans and completed 58 securitizations since its inception, according to Dane Smith, Verus’ senior managing director and president.

“There’s a lot of stakeholders throughout the mortgage ecosystem, and due diligence is kind of the common thread that allows … [loan] documents [assembled in a PDF file] to be turned into an institutional-quality asset,” Smith said.

In a business that is inherently high volume and high stakes, Smith also said advances in technology — including on the AI and OCR front — promise to create even greater efficiencies and accuracy in the system at all levels. He stresses, however, that the industry is still a long way from removing all human touch and judgment from the quality control process, which is essentially the bond of trust holding the system together.

“We buy loans from over 100 different mortgage banks in a given month,” Smith said, “… and we’ve been working with and training a [generative AI] system on our [non-QM] guidelines.”

He stressed that the AI system is still in development and not in general use at this point.

“We’ve been training it just so you can ask a question, and it can give you the various guidelines in response,” Smith explained. “So, we’re much closer [to AI underwriting in the non-QM space], but I still think there’s still a pretty decent ways to go before you could upload all the mortgage docs, and it can understand what type of loan it is, or it could understand and underwrite the loan, and it could bump it up against guidelines.

“ …There’s lots of ways we can use AI to increase productivity. Unfortunately, we’re still a ways from decisioning and underwriting and QC.“