[Editor’s note: As of November 2022, we no longer use Slack, and we’re happy to share that we’ve moved to Circle for our new community platform. We will be continuing Q&As, live discussions and more in this new community platform. If you’re a member and not a part of our Circle community yet, you can click the link at the end of the article to join.]

In this HW+ Slack Q&A, Lead Analyst Logan Mohtashami gives the inside scoop on where rates are headed, whether or not he has updates to his 2022 forecast and more.

As a member of HW+, you can us join for regular 30-minute Slack Q&As, where we invite the HW Media newsroom to break down the hottest topics in the industry. Tune in for our next event with Mohtashami happening April 6th at 12 CT in the #articlediscussion channel.

The Q&A was hosted in the HW+ Slack channel, which is exclusively available to members. To get access to the next Q&A, you can join HW+ here.

The following Q&A has been lightly edited for length and clarity. This Q&A was originally hosted on March 23rd.

HousingWire: To begin, how has your 2022 forecast changed so far? What has remained the same?

Logan Mohtashami: One of the things about my work is that I never revise my forecast every month like some economists do because I tend to forecast ranges in data rather than adjust the estimates based on an event. For example, my home price growth forecast for 2022 was between 5.2% – 6.7%; at first, that looked like it was too small.

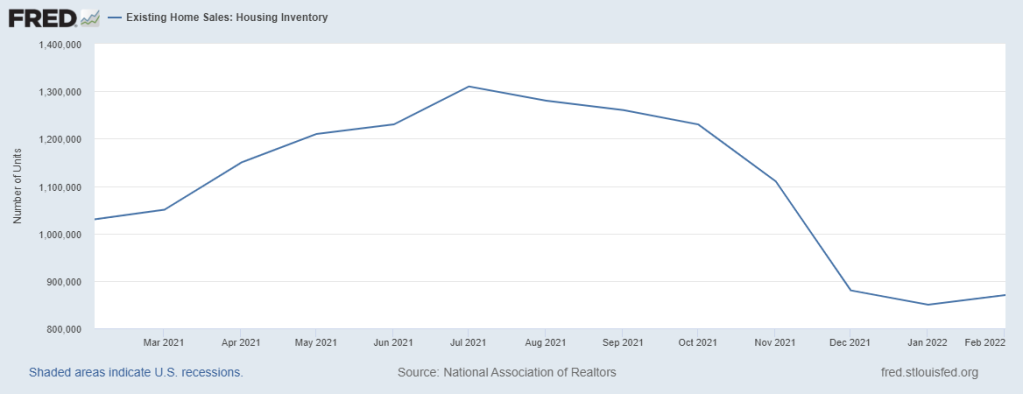

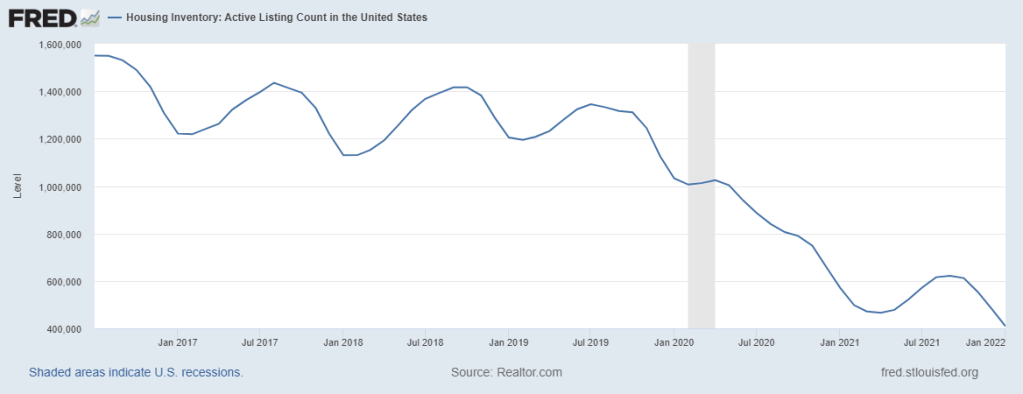

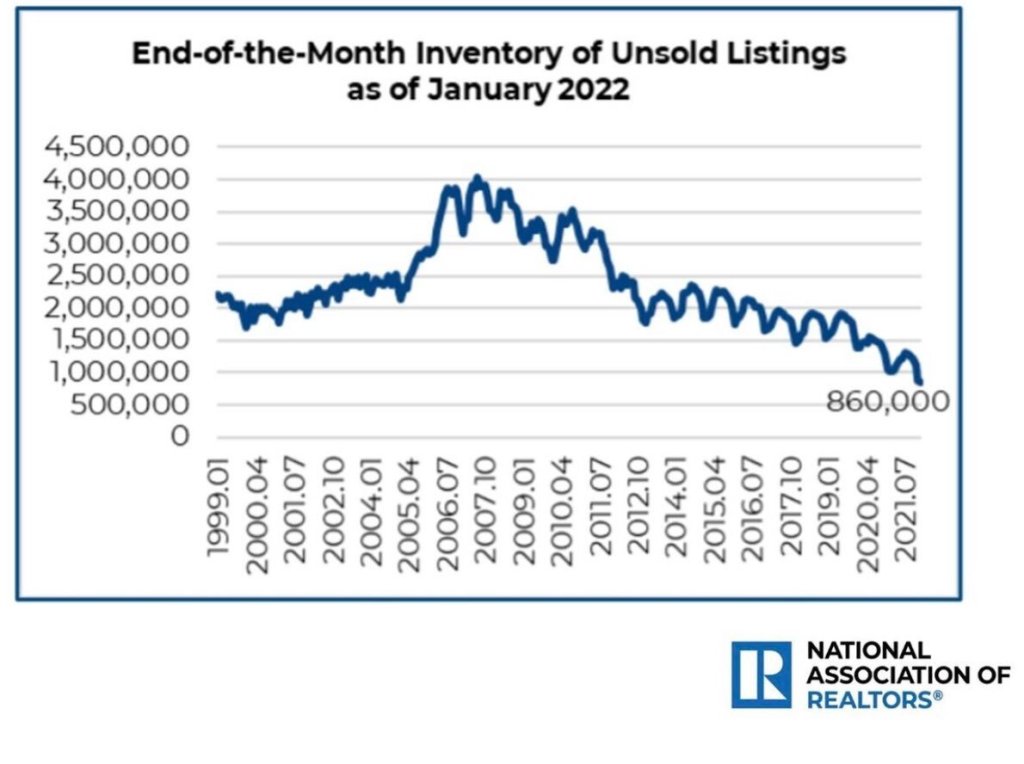

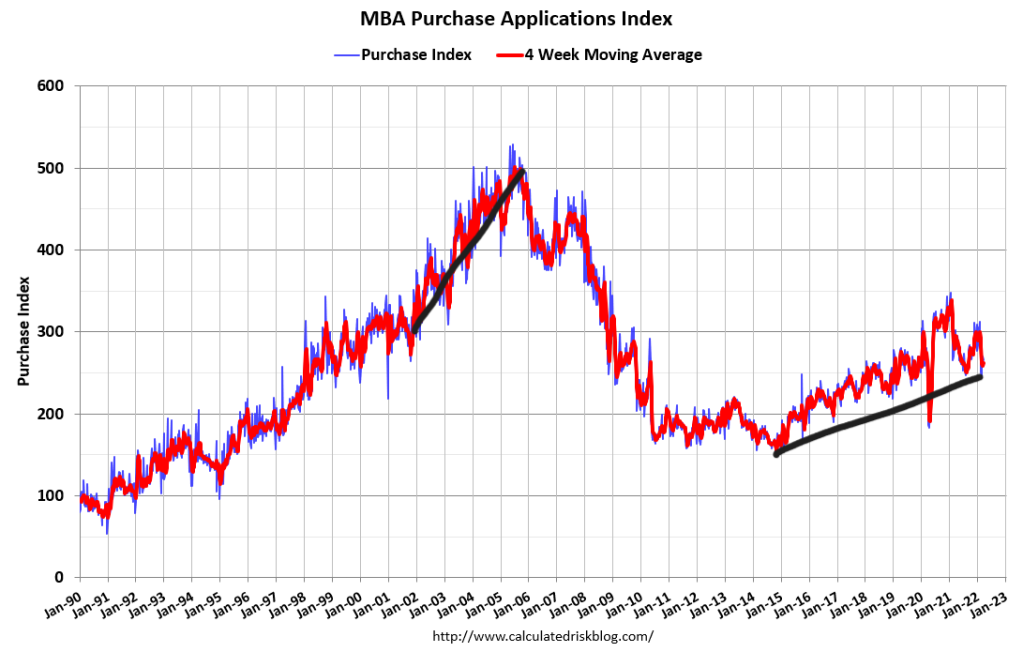

However, since I had the possibility of the 10-year yield getting to 2.42% and 4% plus mortgage rates, I accounted for that in the range. The one thing that has happened in 2022 that has been worse is that national inventory levels have worsened in 2022 to start the year. Due to this reality, I have downgraded the housing market from unhealthy housing to a savagely unhealthy housing market.

Inventory has been falling for years. It got worse in 2020 and 2021, dropping down to levels that are so bad for the national housing market that it warrants me to start discussing possible credit controls in 2023 if we begin another year at fresh new all-time lows.

HousingWire: How will rising rates affect new home construction? What does this mean for first-time homebuyers?

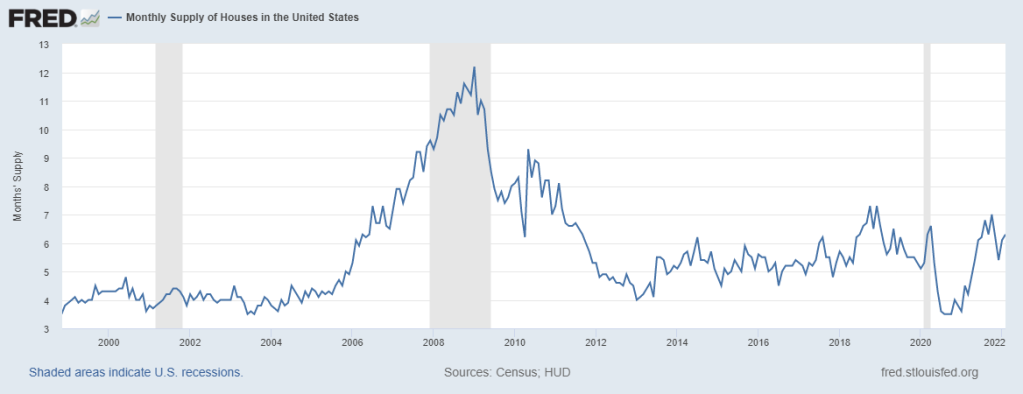

Logan Mohtashami: Rising rates make housing less affordable, so for a first-time home buyer that doesn’t have the benefit of selling their home with that nested equity, it makes it harder for them. Housing construction will be impacted if the monthly supply for new homes breaks above 6.5 months on a 3-month average. Today’s new home sales report was satisfactory. However, we need to be mindful of this going out. My article today on HousingWire will be going over that in more detail.

The monthly supply rose to 6.3 months today, and the 3-month average is at 5.93 months. For now, it’s ok, but this is one sector that people need to keep their eye out on because it’s tied to mortgage buyers more than the existing home sales market.

HousingWire: Switching gears really quickly, have you received any feedback on your savagely unhealthy housing market piece?

Logan Mohtashami: People know that I haven’t been a big fan of this housing market since inventory levels broke under 1.52 million, and we are seeing massive forced bidding on homes. To downgrade it to a savagely unhealthy housing market caught some people by surprise. However, they understand why and why I am rooting for mortgage rates to rise and stay high.

I have set specific markers for myself during this unique housing period in 2020-2024, and we have crashed through some of the markers. For example, I would be okay with home price growth being 23% and under in five years but not in 2 years. The days on the market to sell a home is too low. The only thing that I believe creates balance in the housing market is higher rates because the sellers and builders have too much pricing power in this low inventory environment.

HousingWire: What are some of the red flags for a recession that are currently occurring and what are future ones that you’re watching for?

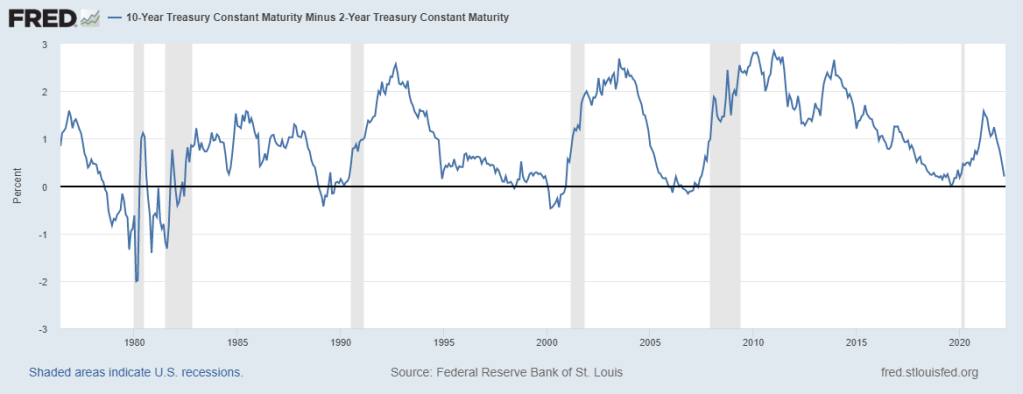

Logan Mohtashami: Right now, 2 of my six red flags are up, The unemployment rate getting to 4%, and the first Fed rate hike are flags 1 and 2. The next one I am looking for is the inverted yield curve, which I have been watching since Thanksgiving of 2021. When the 2-year yield and the 10-year yield slap hands and say hello, the market tells us a recession isn’t too far away. I have a much more complicated take on the inverted yield curve, so I will discuss it more when that happens.

HousingWire: To wrap up, what are some final thoughts you want to share about the current housing market?

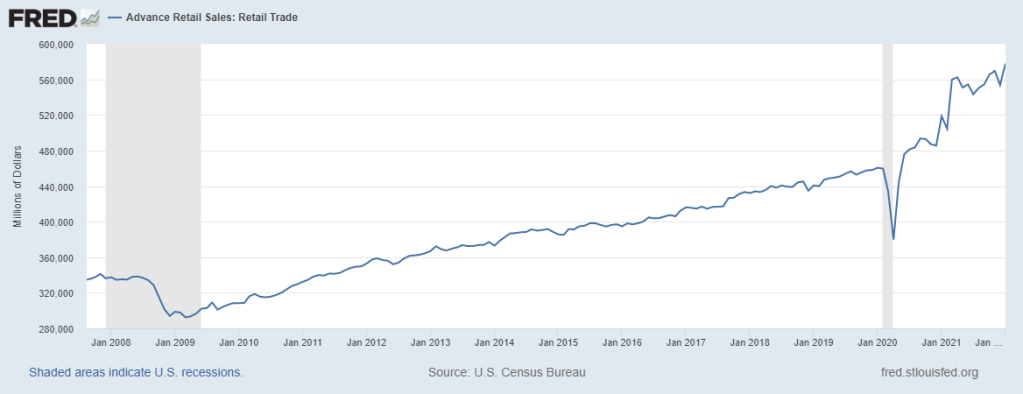

Logan Mohtashami: The recent economic data has been solid such as retail sales. The one thing I am looking for toward the 2nd half of 2022 is can this data stay firm with the Russian Invasion creating havoc all over the world.

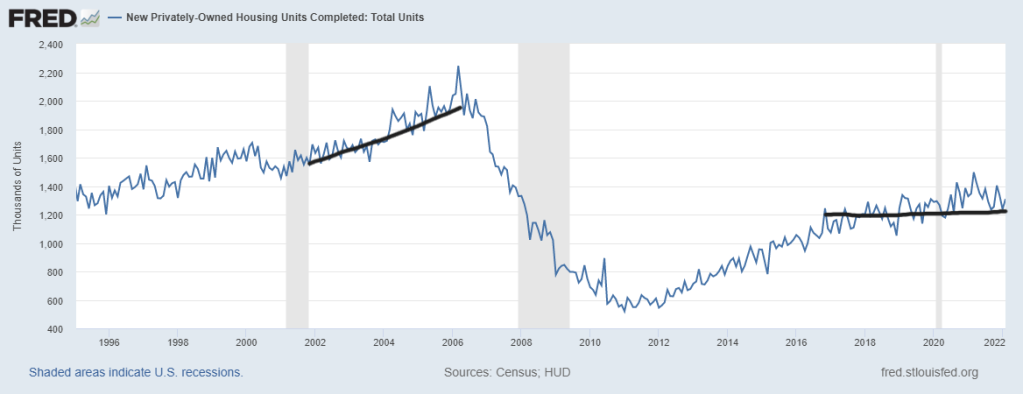

Everything that I thought could go wrong with the housing market has happened, and the supply chain mess has made things worse. This is much different from the marketplace we saw from 2002-2005, a massive credit bubble.

Housing starts completions shows the kind of stress the housing construction market is under now. We have solid housing permits and starts data, but it’s simply taking too long to build a home.

Take full advantage of your HW+ membership and join our exclusive Circle platform dedicated only to HW+ Members! To join the community, go here.