For years, Zillow’s Zestimate, the property value estimation tool that appears on nearly every listing on its website, has been a source of contention for real estate professionals and consumers.

The issue? While Zillow describes the Zestimate as a “great starting point” for determining the value of a home, homebuyers and sellers often believe the Zestimate listed is the true market value of the home.

Now, one of Zillow’s chief competitors is rolling out its own home value estimate tool, but the site is taking steps to avoid the consternation created by the Zestimate.

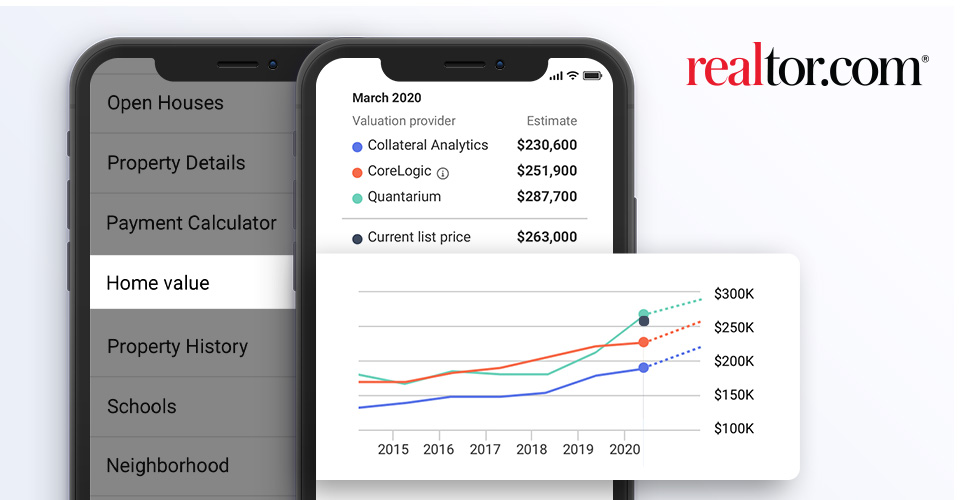

Realtor.com announced Thursday that it is unveiling its own home value estimate tool, which will appear on for-sale and off-market listings on the site.

The company previously displayed an estimated home value on off-market listings, but for the first time, realtor.com is now displaying an estimated home value on for-sale listings as well.

But unlike the Zestimate, which is based solely on Zillow’s proprietary algorithm, realtor.com is using multiple outside sources to power its home value estimate.

Going forward, nearly all of its listings will now feature three separate home valuation estimates, each powered by an automated valuation model from three of the biggest names in real estate valuations and data.

According to realtor.com, the companies providing the home valuation estimates for its listings are CoreLogic; Collateral Analytics, which was recently acquired by Black Knight; and Quantarium, which was acquired by Xome in 2015.

As for why the site is using outside data providers to power the home value estimates instead of developing its own AVM like Zillow, Todd Callow, vice president of product management for realtor.com, told HousingWire the company wants to provide homebuyers and sellers with choices.

“We’ve thought about this a lot of different times,” Callow told HousingWire. “We’ve thought about building something ourselves. This is a very well-considered decision. This is about empowering the consumer. We wanted to provide them with objective third-party data. We want to offer that consumer choice.”

The choice Callow is referring to is the different property valuations that each AVM will provide.

As the company noted in a press release, numerous factors go into the estimates that each company’s AVM will provide, and there will likely be some discrepancies on listings.

Callow acknowledged the issues that have come from single-source valuation models, like the Zestimate, and said that the company felt it was important to provide those multiple perspectives on the value of a particular home.

“The distinction we were trying to draw is that by using three data sources, we’re providing customers with a more robust view,” he said. “Our view is that no one AVM is right for every property. There’s a range of opinions. We hope it sparks a conversation between all parties involved.”

But, Callow cautioned that not every single listing will have property value estimates from all three sources. That’s due to the differences in size and scope of each provider’s coverage area. Put simply, each of the three AVM providers datasets are different and may not match up on 100% of the listings.

According to Callow, collectively, the providers will be able to provide valuations for approximately 90% of the listings on the site.

Additionally, Callow said that the valuation estimates are available on the web and mobile realtor.com sites, but not yet available in the company’s app. Callow said the company is working to migrate the valuation estimates to the realtor.com app and hopes to have them available shortly.

“A home is often a person’s largest asset, so it’s natural to wonder what it is worth,” Callow said in a release. “By providing consumers with multiple estimates from the same sources that financial institutions rely on to estimate a home’s value, we are able to offer a broader set of data to help our users make informed decisions about buying and selling homes.”

HousingWire also attempted to contact each of the AVM providers, but as of publication time, none of the companies had responded. This article will be updated if any of them respond.