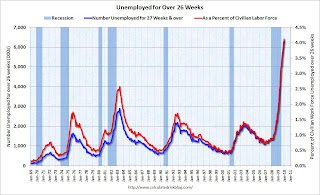

I’m going to spend today focusing in on one of the most classic drivers of residential mortgage defaults: job loss. It’s clearly an issue for most of us in the United States, with unemployment hovering around 10 percent for the past few months now. Like most things in the world of statistics, however, numbers aren’t always what they seem — and this is especially true of our nation’s unemployment statistics. In case you missed the memo, last Friday the Bureau of Labor Statistics released job estimates for January 2009 that found the nation’s unemployment rate falling from 10.0% to 9.7%, while non-farm payroll employment essentially sat on its hands (losing 20,000 jobs) — a number of media outlets were quick to focus on the alleged turnaround, too. But this is January, for one thing — the most volatile of all months for employment data. And it’s also a month that saw some massive statistical revisions worth paying attention to. Just how volatile were January’s numbers? One single statistical adjustment by itself managed to subtract 427,000 jobs from January’s job total, while also pulling down the previously-estimated employment level for March 2009 by another 930,000 jobs. It’s called the “birth/death model,” and it’s a complex modeling technique used by economists at the BLS to estimate how many new businesses (not individuals) are formed or die over time — an extremely tough thing to do. The model is updated each January for the previous March-to-March fiscal year, and is based on employer tax records. And while such benchmark revisions often even out over time, even the BLS was forced to admit last week that the annual revisions were much, much harsher than even they had expected. “These errors started to grow in the fourth quarter of 2008 and got significantly larger in the first quarter of 2009,” the Labor Department said in a statement, which admitted to “a breakdown” in the stability of its job estimates. And while BLS economists are looking at ways to smooth out much of the statistical volatility of its estimates going forward, the fact remains that the “birth/death model” is likely to affect plenty of estimates going forward until a solution is implemented. In particular, I’d expect the current methodology to effectively underestimate job losses while on the downswing — which we’ve already seen — but to also underestimate job creation when the economy is eventually improving. Nonetheless, the benchmark revisions put into place now mean that the total number of jobs lost since the Great Recession began are officially much larger than originally estimated, numbering more than 8.4 million jobs lost since December 2007. I’ll let the politicians argue over whether red or blue states are to blame. Much more mundane is this: that’s a lot of people that won’t be paying a mortgage any time soon. Why? Because other data from the BLS show that anyone losing a job faces a massive uphill battle to find other employment. 41% of those unemployed have been out of work for at least 6 months. A record 6.31 million workers in January were unemployed for more than 26 weeks (among those still looking for work) — that’s a whopping 4.1% of the entire civilian work force, as the graph below shows (hat tip to Bill over at Calculated Risk, and used with permission).  Interesting, as well, is the measure that I tend to view as the real measure of employment distress — the so-called U-6, which measures both un- and under-employment. That number finally fell on a seasonally-adjusted basis, from 17.3% percent of the labor force in December 2009 to 16.5% in January. Much of that came about as the number of people working part-time for economic reasons plummeted in the household survey. Which is heartening, on some level — even if the January figure is still, by far, the worst such seasonally-adjusted U-6 reading since the BLS started calculating alternative measures of employment in 1994 (Jan. 1994 saw a seasonally-adjusted U-6 of 11.8 percent, by way of comparison). It’s worth noting, however, that the non-seasonally adjusted figure represents some sort of ignominious record, reaching 18 percent. All of which is to say that it’s probably foolish to expect a quick turnaround in the nation’s employment picture. A colleague, John Mauldin, pointed to recent comments from economist David Rosenberg:

Interesting, as well, is the measure that I tend to view as the real measure of employment distress — the so-called U-6, which measures both un- and under-employment. That number finally fell on a seasonally-adjusted basis, from 17.3% percent of the labor force in December 2009 to 16.5% in January. Much of that came about as the number of people working part-time for economic reasons plummeted in the household survey. Which is heartening, on some level — even if the January figure is still, by far, the worst such seasonally-adjusted U-6 reading since the BLS started calculating alternative measures of employment in 1994 (Jan. 1994 saw a seasonally-adjusted U-6 of 11.8 percent, by way of comparison). It’s worth noting, however, that the non-seasonally adjusted figure represents some sort of ignominious record, reaching 18 percent. All of which is to say that it’s probably foolish to expect a quick turnaround in the nation’s employment picture. A colleague, John Mauldin, pointed to recent comments from economist David Rosenberg:

“… the level of employment today, at 129.5 million, is the exact same level it was in 1999. And, during this 11-year span of Japanese-like labour market stagnation, the working-age population has risen 29 million. Contemplate that for a moment; fully 29 million people competing for the same number of jobs that existed more than a decade ago. That sounds like pretty deflationary stuff from our standpoint. “Not only that, but consideration must be taken that in 2009, we had a zero policy rate, a $2.2 trillion Fed balance sheet and an epic 10% deficit-to-GDP ratio. You could not have asked for more government stimulus. Yet employment tumbled nearly 5 million in 2009.”

Depending on whom you ask, the economy will need to generate 100,000 to 150,000 jobs per month just to hold the unemployment level steady. We’re pretty far away from seeing that sort of pace of job growth — especially since credit remains so tightly wound, and most employer surveys I’ve seen suggest no robust plans for businesses to hire any time this year. All of which means that we’re likely to see continued pressure in the mortgage space throughout most of 2010, and well into 2011 as well — pressure that will both limit origination activity, and more directly continue to squeeze servicer capacity. Paul Jackson is the publisher of HousingWire.com and HousingWire Magazine.