At its Annual event Wednesday, Mortgage Bankers Association Chief Economist Mike Fratantoni forecast that mortgage rates could rise in the year to come, but that they will remain near all-time lows.

Fratantoni pointed out that the job losses seen in 2020 have been unprecedented, even when compared to the Great Recession.

“Yes, it’s come down to 10 million, but look at how that compares again to the peak in 2009 of 6.6 million,” he said. “This has just been a tremendous negative shock for the economy as a whole.”

However, due to the narrow industry focus of the job losses, this downturn has proved much different than what the economy saw in 2009. And the recovery will likely depend on how long the pandemic lasts.

“This distress is not going away soon,” Fratantoni said. “Many of these folks who thought they were on a temporary furlough are now reporting they have a permanent job loss. Many of the employers they thought they were returning to have gone bankrupt, and the longer this crisis lasts, the longer the restrictions are in place, and again, the public health demands that some of these restrictions remain in place, but the economic cost is real.

“And because you have so many people who are going to be displaced from what was the job they had chosen, that search for a new job in a new sector of the economy, even if it’s going to eventually be successful, is going to take more time, so we think the recovery from here is going to be a little slower than that what we have seen thus far in 2020,” he continued.

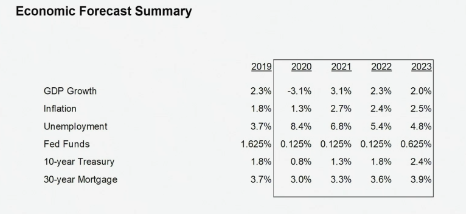

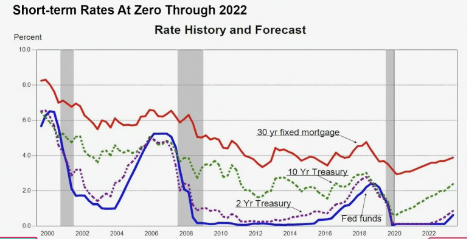

Earlier this year, the Federal Reserve ended its June two-day policy meeting leaving rates unchanged and gave a strong indication that it will not raise interest rates for a long time. Fratantoni brought up this point, saying that short-term rates will stay at 0% at least until 2022 and said that we will see a very cautious Fed when it comes to raising rates from here.

However, he forecasted that mortgage rates will steadily rise over the next year. The chart below shows interest rates for the 30-year fixed-rate mortgage will end this year at about 3% and could hit around 3.3% in 2021.

Housing inventory and prices

Given the low interest rates that are driving demand, housing inventory has become a rising concern. MBA Associate Vice President of Industry Analysis Joel Kan explained that current inventory rests at just a three-month supply. He said as builders work to replenish the supply with new homes, the most recent census data shows a 1.1 million annualized pace for new construction — the highest level since 2007.

But while inventory is increasing, it is not happening fast enough, putting upward pressure on home prices. Kan explained estimates show an annual increase of about 4% to 5%, a trend that will continue in the year ahead.

Profitability

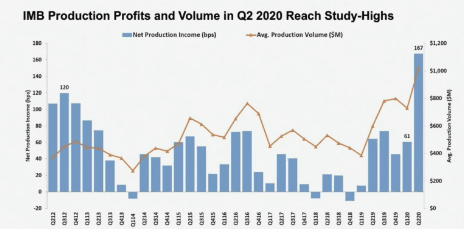

Before this year, 2003 was the last time a record was set for profitability on the origination side, and 2012 was the last record year for refinances. However, MBA Vice President of Industry Analysis Marina Walsh predicted 2020 could possibly set new records for profits for independent mortgage bankers.

MBA forecasts mortgage originations to total $3.18 trillion in 2020 – the closest we’ve gotten to 2003’s high of $3.81 trillion. In 2021, mortgage originations are expected to fall to around $2.49 trillion, which would still be the second-highest total in the past 15 years. At $1.54 trillion, next year’s purchase originations would eclipse the previous all-time high of $1.51 trillion in 2005.

“What’s interesting too, is look at that orange line, that’s the average production volume,” Walsh said. “Usually in our quarterly performance report, you would think that that’s an annualized number three, for 350 IMB at 1 billion. But 1 billion is the average for that particular quarter. So exceptionally high volume and exceptionally high profits as well.”

Servicing

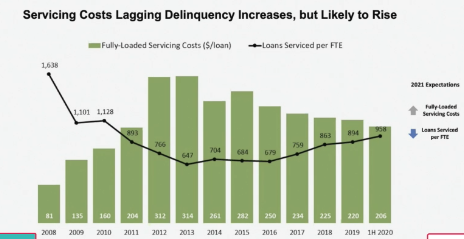

On the servicing side of the business, elevated borrower delinquency rates – particularly for FHA borrowers – remain a concern. Top of mind for servicers will be pursuing the most appropriate loss mitigation strategies for post-forbearance borrowers and investors.

“Servicers will remain busy in 2021 helping borrowers exit mortgage forbearance and into longer-term solutions,” Walsh said. “This will likely result in the operational need for additional loss mitigation personnel and increased servicing costs.”

And while delinquencies hit all-time highs over 2020, Walsh explained the forbearance options kept foreclosures low and could continue to help borrowers into 2021.

Walsh said that as more loans fall into the seriously delinquent bucket, servicer costs could rise.

“Based on the data that we have now, productivity is actually continuing to increase, but that’s only for through the first half of 2020,” she said. “Same thing happened for those of you that were around in 2009, whereby we had very high delinquencies and our costs hadn’t quite caught up yet and as loans get more delinquent and are seriously delinquent, that’s when the real costs start to really come into play.

“We do expect in 2021 that as these loans are in the seriously delinquent stage, especially for servicers with large FHA pool — FHA loans as a percentage of their overall volume — we would expect to see the servicing costs go up and productivity drop and continued hiring of loss mitigation specialists,” Walsh said.

The pandemic effect

However, the MBA’s 2021 forecast assumes an effective vaccine will bring the COVID-19 pandemic under control, leading to a gradual economic recovery that is aided by further fiscal stimulus.

“The economy, labor market, and housing market have all seen meaningful rebounds since the onset of the pandemic, but there is still profound uncertainty,” Fratantoni said. “Additional waves of the virus could lead to further lockdowns and more job market instability.

“On the other hand, another pandemic-related stimulus package would result in faster economic growth and additional support for the housing market, albeit with slightly more upward pressure on mortgage rates,” Fratantoni added. “2021, particularly the second half, should be a year of continued purchase growth and slowing refinance activity.

“As long as the spread of the pandemic is brought under control, the economy should expand around 3% next year, allowing the job market to improve, incomes to rise, and home sales to meaningfully increase,” Fratantoni said.