Mortgage demand ticked up last week as interest rates decreased following the news of a slowing job market. Applications increased by 2.6% on a seasonally adjusted basis during the week ending May 3, according to the Mortgage Bankers Association’s (MBA) weekly mortgage applications survey.

“Treasury rates and mortgage rates fell last week on the news of a slowing job market, with wage growth at the slowest pace since 2021, and the Federal Reserve’s announced plans to ease quantitative tightening in June and to maintain its view that another rate hike is unlikely,” Mike Fratantoni, MBA’s senior vice president and chief economist, said in a statement.

According to the MBA, the average 30-year conventional rate dropped to 7.18% as of May 3 while the average rate for Federal Housing Administration (FHA) loans fell 17 basis points to 6.92%, the first time in three weeks it has been below 7%.

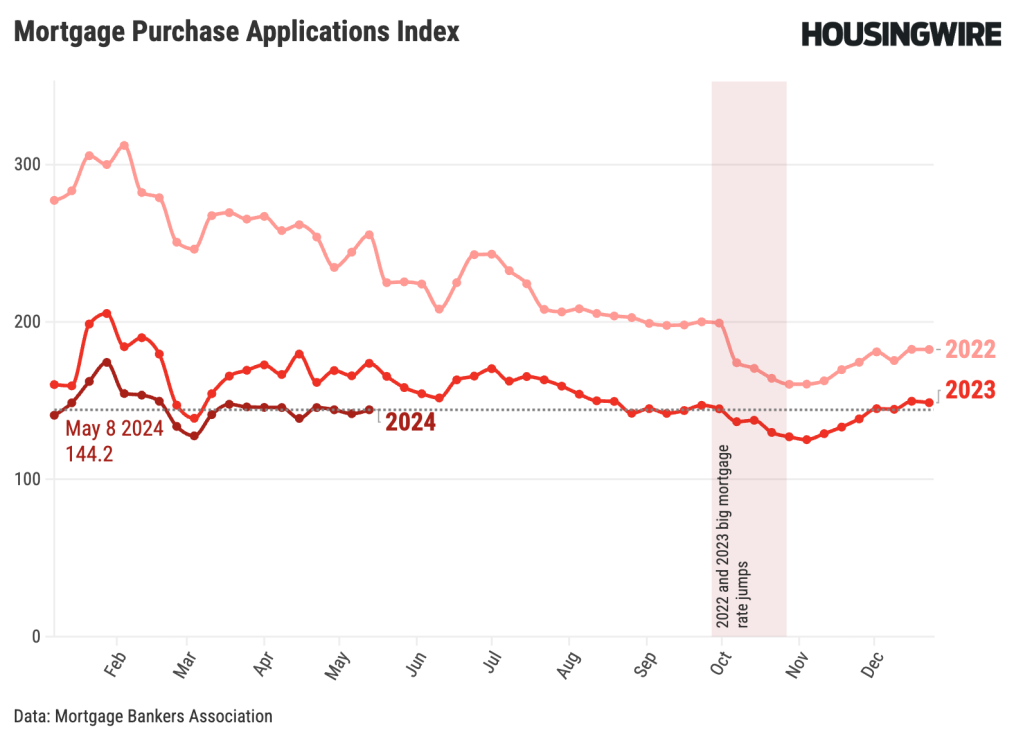

Purchase loan application volume ticked up by 2% from one week earlier, driven by a 5% gain in FHA applications.

“First-time homebuyers account for roughly half of purchase loans, and the government lending programs are an important source of financing for these homebuyers,” Fratantoni added. “The gain in FHA activity is a sign that this segment of the market is active.”

Meanwhile, refinance volume rose by 5% from the prior week. The refinance share of mortgage activity increased to 30.6% of all applications.

“Even with the increase, which included a 29% jump in VA refinances, refinance volume remains about 6% below last year’s already low levels,” Fratantoni said.

The MBA survey showed that the average mortgage rate for 30-year fixed loans with conforming balances ($766,550 or less) decreased to 7.18%, down from 7.29% last week.

Meanwhile, rates on jumbo loans (balances greater than $766,550) also decreased week over week to 7.31%, down from 7.39%.

On Wednesday, HousingWire’s Mortgage Rates Center showed the average 30-year fixed rate for conventional loans at 7.48%, down from 7.58% one week earlier.