Months of high mortgage rates and low existing inventory led to another annual increase in new home purchases in June. Mortgage applications for new home purchases jumped 26.1% in June from the same period last year, according to the Mortgage Bankers Association builder application survey. Compared with the prior month, applications dropped by 5%.

MBA estimates that about 687,000 new single-family homes were sold in June at a seasonally adjusted annual rate. It’s a decline of 9% from the May pace of 755,000 units. On an unadjusted basis, MBA estimates that there were 60,000 new home sales in June 2023, a 6.3% decrease from 64,000 new home sales in May.

“New home purchase activity continues to be a bright spot, as both new home applications and home sales were up on an annual basis,” said Joel Kan, MBA’s vice president and deputy chief economist. “With existing inventory still held back by homeowners, prospective buyers have turned to newly built homes instead. Rising mortgage rates in June likely caused some pullback in purchases over the month, as the 30-year fixed rate averaged close to 6.8%. However, applications for new home purchases have now shown annual increases for five consecutive months.”

Purchase mortgage rates this week averaged 6.78%, the biggest weekly decline since mid-March, according to the latest Freddie Mac PMMS.

Homebuilders constructed an annualized rate of 1.434 million houses in June, down 8% from May and 8.1% from June 2022, according to the U.S. Census Bureau. Single-family home constructions saw a 7% month-over-month decrease to rate of 935,000 in June.

The average loan size decreased from $403,581 in May to $400,281 in June. Conventional loans accounted for 65.5% of loan applications. Federal Housing Administration (FHA) loans composed 24.1%, Veterans Affairs (VA) loans took up 10% of total applications and Rural Housing Service (RHS) and United States Department of Agriculture (USDA) loans consisted of 0.3%.

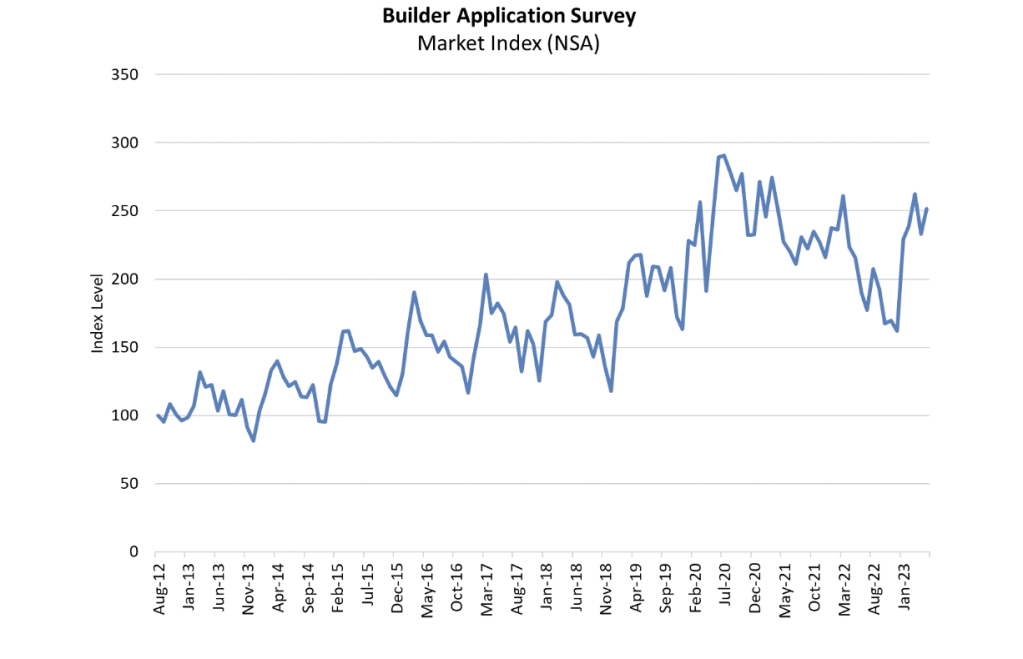

The survey tracks application volume from mortgage subsidiaries of homebuilders across the country. Using this data, MBA provides an early estimate of new home sales volumes at the national, state and metro level.