The largest U.S. nonbank mortgage lenders continue to gain market share as the industry consolidates and a number of smaller players exit the space due to a lack of strong franchises to retain sufficient volume, Fitch Ratings reported Tuesday.

Fitch expects additional consolidation in the industry as profitability remains constrained by a challenging origination environment.

Meanwhile, the largest originators will benefit from continued consolidation as they will be able to take advantage of their competitive positions once origination volumes start to increase.

“While many originators suffered operating losses amid rapidly rising rates, scaled lenders were better equipped to navigate rate hikes and maintain operational flexibility, as cost saving initiatives were implemented and large servicing books continued to provide cash flow streams,” Fitch stated.

Fairway Independent Mortgage Corp. exited the wholesale channel last month, following the departures of Citizens Bank and loanDepot from the channel in 2023 and 2022, respectively. Last year, Homepoint shut down operations, while Wells Fargo closed its correspondent lending business.

Fitch projected that lenders with leading market positions within their respective channels should be able to continue to gain share. They are typically buoyed by scalable technology platforms, diversification from servicing cash flows, relatively low corporate leverage, and access to liquidity that affords them the flexibility to withstand market cycles.

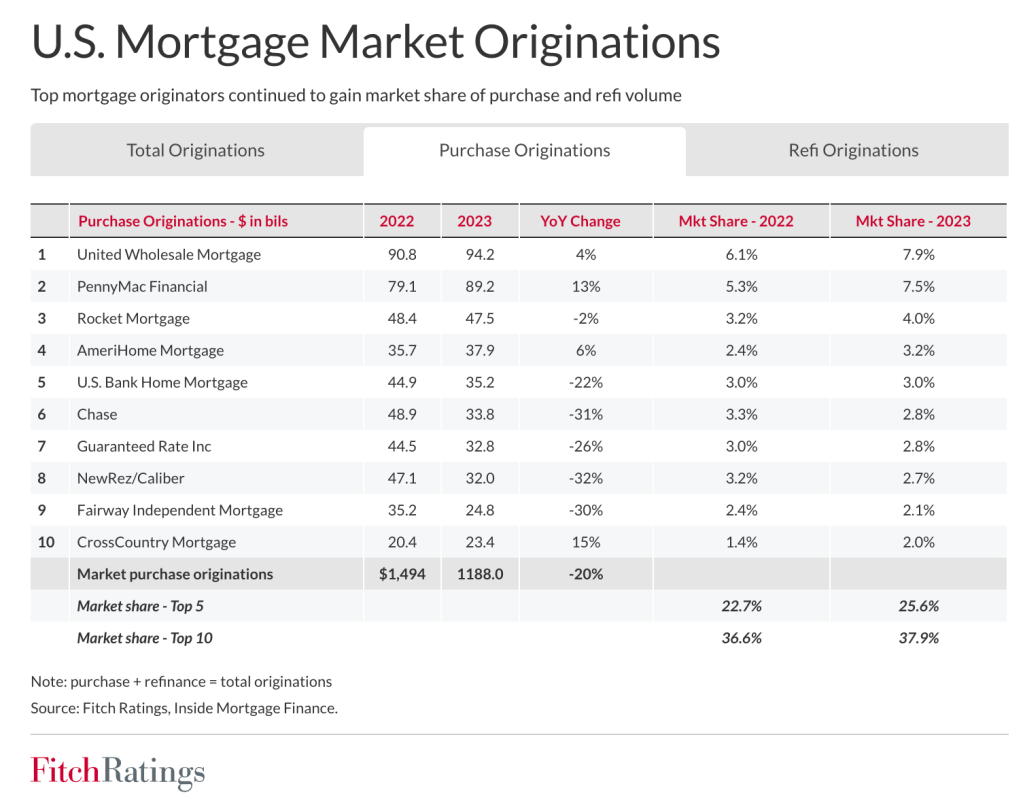

United Wholesale Mortgage (UWM) came in as the top mortgage originator in 2023, followed by PennyMac Financial and Rocket Mortgage, according to data from Fitch Ratings and Inside Mortgage Finance.

“The correspondent and broker channels are more focused on purchase origination volumes and are less fragmented than the retail channel, which has seen volumes drop more quickly amid lower refinancing activity,” Fitch said.

UWM originated $94.2 billion in purchase originations in 2023, up 4% from 2022 and good for a market share of nearly 8%.

PennyMac posted purchase origination volume of $89.2 billion, an increase of 13% from 2022. Rocket Mortgage had purchase origination volume of $47.5 billion, down 2% from 2022.

The operating environment will remain challenging through 2024, Fitch said, given interest rate expectations of only modest declines from current levels.

The 30-year fixed mortgage rate is projected to remain between 6.5% and 7.5% in 2024 before declining to between 6% and 7% the following year, according to Fitch forecasts.

But lenders with rightsized cost structures will benefit once incremental improvement in volume occurs, Fitch noted.