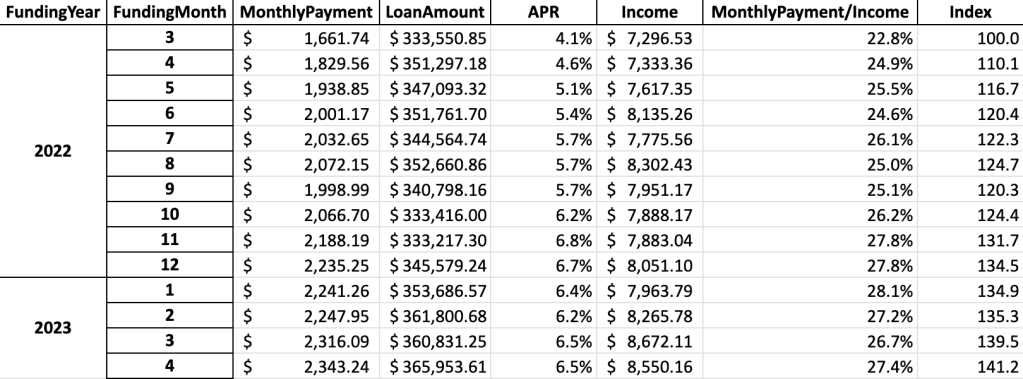

With mortgage rates still in the mid 6% range, borrowers who received mortgages in April 2023 paid an average of $2,343 a month, up 28% from a year prior.

That’s according to the latest origination data from mortgage tech firm Candor Technology.

Per data from Candor’s underwriting engine, the average buyer in April 2023 received a loan worth about $366,000 at an average APR of 6.5%.

A year ago, the average buyer would have paid $1,830 a month with a $351,297 mortgage at an interest rate of 4.6%.

The average income in April 2022 was $7,333 a month, according to Candor. In April 2023, the average borrower’s income had shot up to $8,550 a month. Still, the average monthly payment to income was 27.4% in April 2024, up from 24.9% a year ago.

“The recent interest rate hike from the Federal Reserve continues to keep the cost of home buying elevated when compared to the same period one year ago,” said Sara Knochel, CEO of data and analytics at Candor. “However, we are also seeing the homebuyer’s average income on the rise as well, which indicates more Americans may be picking up side income sources in order to finance their home purchase.”

Check out the last 12 months below: