With unemployment claims rising weekly, the number of homeowners asking for respite on their mortgage payments has, predictably, increased by a sizable amount.

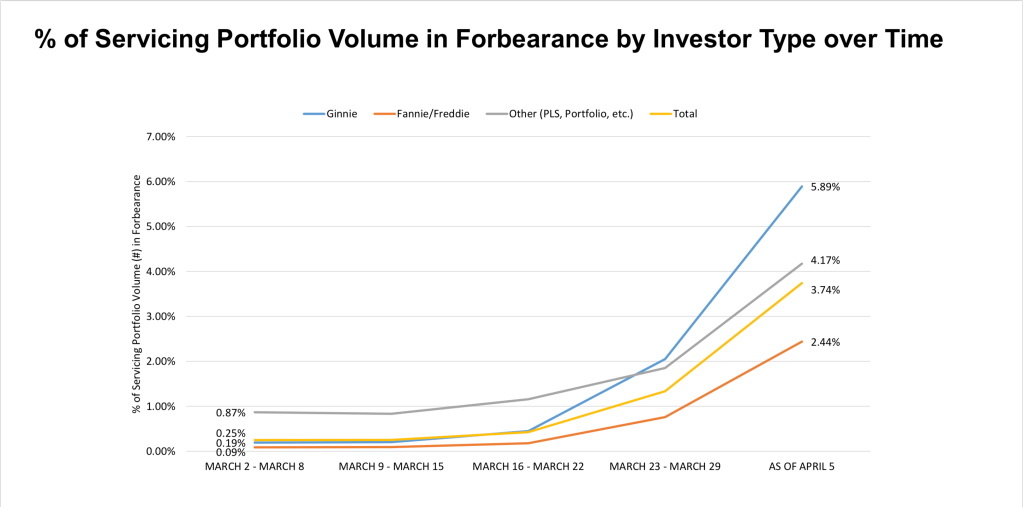

The total number of mortgages in forbearance rose to 3.74% in the week of March 30 to April 5, up from only 0.25% of all loans that were in forbearance for the week ending March 2.

That means the number of loans in forbearance increased by 1,396% in one month.

The data comes courtesy of survey data released Monday by the Mortgage Bankers Association. The survey noted that 2.73% of loans were in forbearance in the previous week, marking the sharp rise in forbearance requests as the coronavirus impacted the country.

According to the report, mortgages securitized by Ginnie Mae, the government agency that issues mortgage bonds backed by Federal Housing Administration and Department of Veterans Affairs loans, had the largest overall share in forbearance at 5.89% and grew by 1.58% versus the prior week.

Meanwhile, forbearance on loans backed by Fannie Mae and Freddie Mac increased to 2.44%, up from 1.69% the prior week.

“The nationwide shutdown of the economy to slow the spread of COVID-19 continues to create hardships for millions of households, and more are contacting their servicers for relief in accordance with the forbearance provisions under the CARES Act,” said Mike Fratantoni, MBA’s senior vice

president and chief economist, in a statement Monday.

“The share of loans in forbearance grew the first week of April, and forbearance requests and call center volume further increased,” Fratantoni added. “With mitigation efforts seemingly in place for at least several more weeks, job losses will continue and the number of borrowers asking for forbearance will likely to continue to rise at a rapid pace.”

Unemployment claims reached 6.61 million for the week ending April 4, according to last Thursday’s Department of Labor data. That brings the total number of jobless claims to about 16.8 million in recent weeks of the coronavirus pandemic.

To aid those who have financial hardship due to COVID-19, the CARES Act permits borrowers with federally backed mortgages to request and receive forbearance for up to 12 months.

Here are additional findings from MBA’s weekly survey, which represents 26.9 million loans or nearly 54% of the first-mortgage servicing market:

- Loans backed by independent mortgage banks rose to 4.17% of the servicing portfolio volume, up from 3.45% the prior week

- Banks saw a 3.63% forbearance share, up from 2.24% a week before