As the number of unemployed Americans surges, the number of borrowers with mortgages that are going into forbearance is escalating as well.

The most recent data from the Labor Department shows 4.43 million people filed for unemployment last week. Meanwhile, the number of people whose mortgages went into forbearance increased by nearly 500,000 in the seven days ended on Thursday.

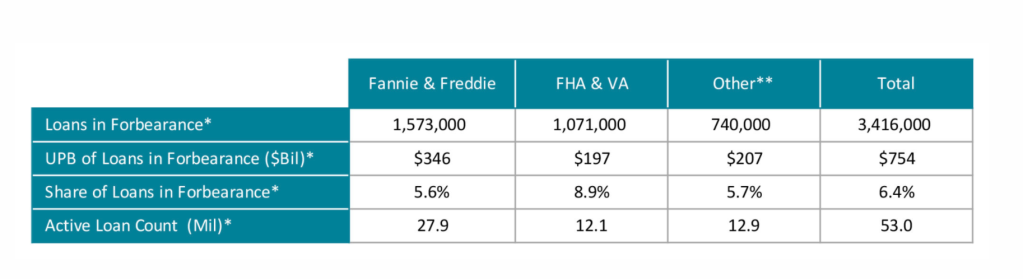

New data from Black Knight shows that there are approximately 3.416 million mortgages in forbearance now, an increase of 477,000 from last week’s total of 2.939 million.

According to Black Knight, approximately 6.4% of all mortgages are currently in forbearance. Last week, approximately 5.5% of all mortgages were in forbearance.

Broken down by loan type, Black Knight’s report shows that there are approximately 1.573 million loans backed by Fannie Mae and Freddie Mac in forbearance, an increase of nearly 200,000 loans over last week’s total of 1.374 million.

That figure means that 5.6% of the GSE’s total portfolio of 27.9 million loans is currently forbearance, representing $346 million in unpaid principal balance.

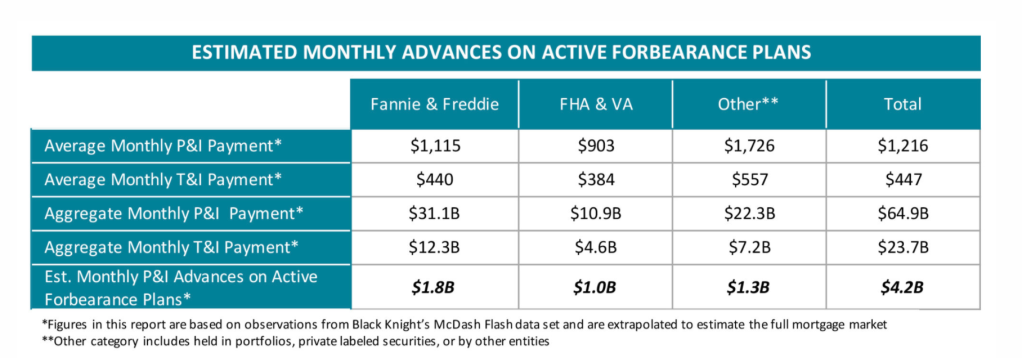

The data also shows how much GSE mortgage servicers will have to advance to cover the four months of mortgage payments they’re required to front after the GSEs announced new policies this week.

According to the report, servicers will need advance an estimated $1.8 billion in principal and interest payments each month for the GSE loans in forbearance.

“Having a four-month end date on the period in which servicers need to advance principal and interest payments on behalf of homeowners in forbearance is extremely helpful to our servicing clients,” Black Knight CEO Anthony Jabbour said.

“Still, even knowing that time limit, with today’s number of forbearance plans, servicers are still looking at more than $7 billion dollars in advances over those four months,” Jabbour continued. “And the forbearance numbers are climbing steadily, day by day. Clearly, this remains a challenging situation all around.”

The report also shows that nearly 9% of all loans backed by the Federal Housing Administration or Department of Veterans Affairs are now in forbearance, an increase of nearly 150,000 loans in one week.

According to the report, 1.071 million FHA or VA loans are in forbearance.

About 5.7% of loans held either in portfolio or privately securitized are also in forbearance, an increase from 4.8% last week, according to the report.

And with unemployment continuing to rise, it’s unlikely that the number of borrowers with mortgages in forbearance will slow down any time soon.