A bill introduced in the New Jersey Senate would require face-to-face counseling for the state’s reverse mortgage transactions and would void any loans executed without proof of such counseling having taken place. The bill is currently awaiting deliberation in the state Senate’s commerce committee.

The bill, S2520, would also offer a seven-day right of rescission on any reverse mortgage transaction, allowing a borrower to cancel the loan within that window without a penalty.

Bill proposal, lawmaker concerns

The current version of the bill was introduced earlier this month by state Sen. Shirley Turner (D), who represents New Jersey’s 15th district encompassing Hunterdon and Mercer counties. Turner originally introduced a similar bill in 2016, she told RMD in an interview.

Turner explained that her primary concern when initially introducing the bill came from a distressed constituent whose elderly mother lost her home after taking out a reverse mortgage without fully understanding the requirements of the loan, the senator said.

“His mother had taken out a reverse mortgage unbeknownst to him and he was very distraught because he didn’t learn of the reverse mortgage until it was too late for him to intervene,” Sen. Turner explained to RMD. “That was when he contacted me and he also contacted the state attorney general. We both investigated and found out that there was nothing that we could do because it was too late in the process.”

The constituent had hired his own lawyer, but his mother ended up having to leave the home after falling behind on associated taxes.

“She just fell further and further behind, and did not tell [her son] until it was too late, when she was getting the notices threatening to evict her from the house,” Turner said. “And she was then, of course, extremely upset because that was the house that she had lived in — and thought she would die in — because she had lived there for 60 years.”

The home, Turner added, had been built by the woman’s late husband in the mid-1950s. That made the senator concerned about the reverse mortgage industry’s marketing activities to borrowers, particularly those who might be dealing with the recent loss of a spouse.

Industry response

Turner’s bill would have a “chilling” effect on reverse mortgage business in the state of New Jersey, according to a letter submitted to the lawmaker’s office on Feb. 13 by the National Reverse Mortgage Lenders Association (NRMLA).

When asked if she had seen the letter, Turner said it had not yet arrived at her office as Friday.

NRMLA contends that the in-person requirement would dampen reverse mortgage availability in the state, primarily since most reverse mortgages originated in New Jersey are Federal Housing Administration (FHA)-sponsored Home Equity Conversion Mortgages (HECMs).

FHA’s HECM program already requires counseling prior to the closing of a reverse mortgage from agencies approved by the U.S. Department of Housing and Urban Development (HUD), and HUD requirements dictate that “clients may receive telephone counseling unless such counseling is prohibited in their state.”

“[W]e further note that, as of today, it appears that only […] six counseling agencies in New Jersey are approved by HUD to provide reverse mortgage counseling,” NRMLA wrote.

NRMLA also points out that an in-person counseling requirement is not imposed by FHA or HUD for HECM loans, and that such a requirement in New Jersey would “have the unintended consequence of decreasing the availability of reverse mortgage counseling while simultaneously imposing unnecessary hardships on New Jersey seniors seeking a reverse mortgage loan,” the letter stated.

Turner explained that she would be happy to meet with NRMLA or any other organization that either supports or opposes any legislation she introduces.

“I always meet with everybody,” she said. “Not just those who support my bill but also those that oppose it. And hopefully, we can find common ground and everybody wins.”

In-person hurdles

An in-person counseling requirement remains law in Massachusetts, which contributed to the halting of reverse mortgage business throughout the state at the onset of the COVID-19 pandemic due to stay-at-home orders handed down by then-Gov. Charlie Baker (R) in an effort to arrest the spread of the virus.

Soon afterward, an emergency bill passed by the Massachusetts Legislature relaxed the in-person counseling requirement, particularly due to the susceptibility of older people to the effects of illness caused by COVID-19. Since that point, the legislature has considered permanently rescinding the in-person counseling requirement, citing post-pandemic challenges and a limited supply of HUD-approved counselors who serve the full state.

A permanent solution has not yet materialized, however, with the legislature instead opting for temporary extensions of the relaxed rule. The current extension is scheduled to expire at the end of March 2024.

Comparisons to Massachusetts

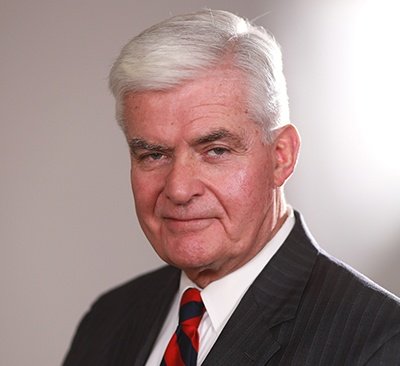

Reverse mortgage industry veteran George Downey of The Federal Savings Bank in Braintree, Massachusetts, has been a key figure in the industry’s efforts to change the law within that state. He offered his personal opinion on the New Jersey matter.

“Clearly, this is another well-intended but misguided initiative,” Downey said an interview, comparing the proposed New Jersey bill to the in-person provision in his state. “But in addition to the logistical reasons, attorneys I’ve spoken with agree with my opinion that the issue of disparate impact under the American Disabilities Act and Fair Credit Reporting Act (FCRA) could be a consideration.”

Disparate impact provisions in U.S. law refer to practices that may adversely affect one group of people within a protected class more than another, even though rules applied are ostensibly or formally neutral.

“As you bear down on this in-person counseling issue, it puts a protected class at a distinct disadvantage by requiring them to assume additional cost,” Downey said, primarily referring to transportation. Downey has had personal experience with disabled clients who had to shoulder high costs to reach an in-person counseling appointment.

“Just as easily, the counseling could have been accomplished with a phone call,” he said.