The results from the November general election in the United States could have notable impacts on key issues relevant to the reverse mortgage industry including the selection of a new servicing contract for the Federal Housing Administration (FHA), the legislative priorities of the White House and Congress as it relates to matters of housing, the likelihood of policy movement on issues related to reverse mortgages and the general receptivity that politicians will have to reverse mortgage-relevant issues in 2021.

This is according to a panel of political professionals with experience working in Washington, D.C. on behalf of the reverse mortgage industry, who shared perspectives on the current political landscape in the nation’s capital at the National Reverse Mortgage Lenders Association (NRMLA) Virtual Annual Meeting & Expo which took place this month.

Congress, House Financial Services

The general shake-up in both houses of Congress will help to set the stage for the kind of government which will be prevalent in the United States in 2021, considering that Democrats lost ground on their majority in the House of Representatives while the fate of control in the Senate is based entirely on the results of two run-off elections taking place in Georgia this coming January.

“[These House races have] a lot of significance, because Democrats’ running room has been narrowed, they will have less ability to cram things through,” says Scott Olson with Olson Advocacy based in Arlington, Va. “And then in the Senate, things are also very much up in the air in a sense that there are two Senate runoffs on January 5, both in Georgia. However, I’ll go out on a limb as a Democrat and say that I think that the Democrats have a pretty uphill climb to win those two seats. So, I think a bet is probably in order that the Republicans will retain control of the Senate. All of this has implications [for the reverse mortgage industry].”

While the Senate situation is currently in flux, the situation in the House appears to be stable, according to Olson. This is largely because of the fact that though slimmer, Democrats will be maintaining a House majority which will keep control of the House Financial Services Committee in the control of Chairwoman Maxine Waters (D-Calif.).

“With regard to what has been happening the last year, I would say that the committee did not produce that much in the way of legislation, and certainly very little or nothing that was agreed to by the Senate,” Olson explains, echoing even a pre-pandemic prediction made at last year’s NRMLA Annual Meeting about the possibility of Home Equity Conversion Mortgage (HECM) program legislation in 2020. “For our part, NRMLA had [been] working with the Financial Services Committee on draft HECM legislation to make sure that the direction it was going did not run afield.”

The fact that the situation will remain at a relative status quo in the House means that both the industry and the association feel that there is not a “runaway freight train” on the hands of the industry in 2021, Olson says, and smaller margins in the House for Democrats will likely translate to a necessity for conciliation between the two parties.

“In the House, we expect Ms. Waters to remain the chairperson of the Financial Services Committee,” Olson says. “We expect them to continue to pay attention to HECM issues. But I don’t think there’s anything that we’re scared about, and with diligence, I think that things should be okay.”

The White House

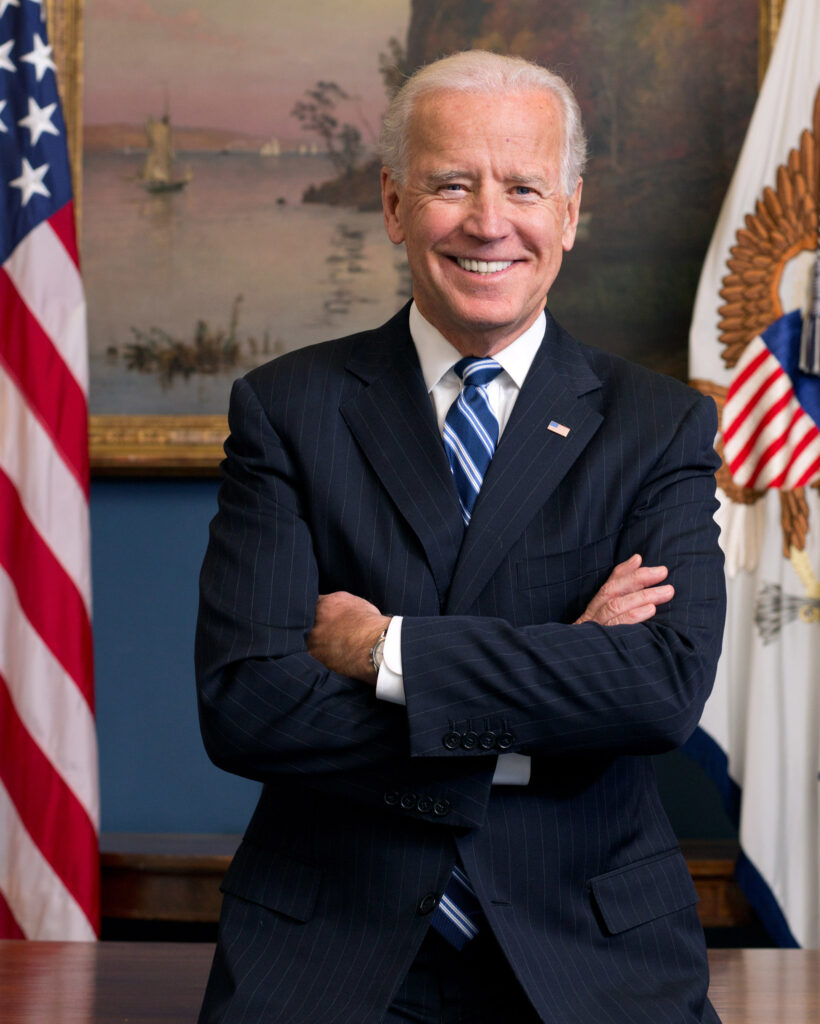

Less clear at this point for the panel was the situation regarding the presidency, a situation which has remained largely unchanged as incumbent President Donald Trump has yet to concede the race even though a majority of media outlets have called the contest for Former Vice President Joe Biden.

As the president continues to seek legal remedies in an effort to overturn projected results in key battleground states, the panel found it most productive to focus on the likeliest outcome of the final results. This is according to David Horne, a government relations expert and former chief of staff for the U.S. Department of Housing and Urban Development (HUD) under Secretary Steve Preston in the final months of the George W. Bush administration.

“I’m going to start with Biden being president and the Senate staying Republican, because I think that’s probably the most likely result if there’s a split government,” Horne explained. “There are some people who believe that that is actually the best opportunity for Biden to ultimately govern. […] As many of us may recall, during the Obama years, whenever there was a challenge in legislating, the man who went up to meet with Mitch McConnell was Joe Biden.”

That translates into a hope for Horne that there will “actually be some governing” in a divided government scenario, which would see Biden in the White House and the Senate remaining under Republican control, he said.

“From a split government perspective, assuming that the presidency goes to Biden, I think you’re going to potentially see very constructive legislation and engagement on appropriations bills that we haven’t had before, which obviously can have great effect on the HECM program if provisions are in there,” he explained. “I’m not sure how much there’ll be in terms of FHA or housing legislation. I think the focus will remain on the GSEs, Freddie and Fannie to the extent that they’re starting to move out of conservatorship.”

If there are opportunities to address volatility or inconsistencies in the HECM program where a legislative action would be more necessary, such opportunities will “be much greater” for positive change in a divided government scenario, Horne said.

HUD and FHA

As an association, NRMLA is involved in regular dialogues with various state and federal government agencies which oversee the administration of the HECM program. In the majority of cases, it is very likely that all of the current administrative priorities for the reverse mortgage business will continue uninterrupted, while the industry will have to adjust to a new reality when it comes to decisions which require the input of political appointees, said Horne.

“Some of those policy issues that were pending in front of Ginnie Mae might slow up a little bit, particularly if they require a political person to work on [them],” Horne explained. “We’re still very involved in what goes on at the Office of Management and Budget (OMB), and some of the issues regarding the policies that drive the HECM program.”

Considering the result of the election and the place that the reverse mortgage industry occupies on the broader political landscape, most of the issues that the industry and the association projects that it will have to contend with will still be the same issues in 2021, since it is unlikely that even a turbulent election season like 2020’s will upend the proverbial table regarding the majority of reverse mortgage issues that are sensitive to political changes, Horne explained.

“I would suggest that probably, roughly 80-85% of our advocacy issues on the management of the program [will go] forward as if there’s been no election,” he said. “And on the margins, 10 or 15% that rely on policy/political appointees may slow up a little bit.”

The path the industry’s interests are currently on is encouraging, according to Melody Fennel with Fennel Consulting in Arlington, Va. However, there are other elements that could be at play.

“Well, we’ve been going in the right direction, we have every expectation that we’re going to continue to go in the same right direction,” she said. “We’ll see what happens behind the scenes.”