Don Layton, the former CEO of Freddie Mac recently penned what can only be described as an attack piece on mortgage originators from his seat as a fellow at the JCHS, Harvard’s Joint Center For Housing Studies. But what Mr. Layton has done is simple: perpetuate his ongoing disdain for the participants in the manufacturing of mortgage loans in the U.S. and, in the process, made some inaccurate assumptions as to causality.

The piece is titled, “The Policymaking Implications Of Record-High Mortgage Origination Profits During The Pandemic.” In it he describes mortgage originators as “middlemen” in the transaction between a consumer and the secondary market. His thesis seems to lean on his long-standing belief that the GSEs and the Ginnie Mae programs are all that matter in creating access to mortgage finance and that lenders are, essentially, greedy institutions that leveraged the actions of the Federal Reserve during the pandemic to maximize profits as opposed to passing through the full value of rate reductions to consumers. His disdain for mortgage originators clearly oozes through his words but skew his sensibilities in his published paper.

A bit of history

First, let’s be clear. It is true that margins widened enormously as a result of the actions of the Federal Reserve. In the peak of the pandemic, 30-year mortgage rates tumbled, bottoming out at around 2.25% for a well-qualified borrower. Volumes skyrocketed and overwhelmed an unprepared mortgage finance system that, just months earlier in 2019, thought it might be heading into higher rates and slower volumes.

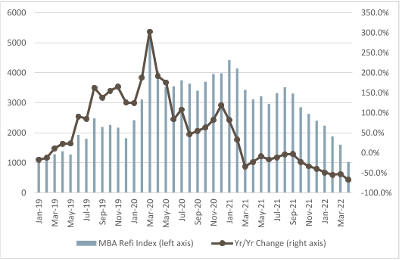

In fact, if you look at the period just prior to the Fed’s COVID-19 reaction, refinance volume was far lower and then suddenly spiked upwards by more than 250% on a year-over-year basis. Lenders and the GSEs both bore the brunt of this impact.

In the beginning phase in early April 2020, the interest rate moves were so swift that many were worried that mortgage originators hedged pipelines might cause institutional failures as a result of margin calls. I would note that this liquidity concern could have been alleviated by actions from the GSEs themselves, including the very company with which Mr. Layton was once CEO. But they didn’t, and lenders quickly were forced to drain their liquidity to support these margin calls, something policymakers remain very concerned about on a go-forward basis.

This surge in volume left mortgage originators with limited options to manage consumer demand. Since denying applications in order to slow volume to a manageable level would have drawn outcries from housing activists and more and would be deemed illegal as well, they had to go to the only two options available.

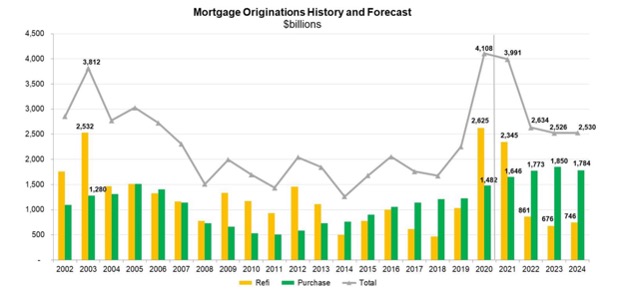

First, mortgage lenders tried to hire as rapidly as possible. The total capacity for the U.S. mortgage market pre-COVID-19 would allow for $1.5 to $2 trillion in volume. With the Fed’s extraordinary round of intervention, called Quantitative Easing (QE), the market volume doubled. 2020 and 2021 were back to back the two largest mortgage origination years in U.S. history. With 2003 being the only year previously to come close to that level.

A zero sum game

Hiring enough skilled capacity to manage the volume was a challenge. Since all lenders were trying to hire, it became a zero sum game that ultimately required lenders to both hire and train unskilled workers to become processors, closers, underwriters, quality control staff, and more. This was an impossibility to accomplish quickly amidst the rapid onslaught of volume.

The only other option to slow volume — pricing

The only other option lenders had, therefore, was to try to slow volume another way. And the one remaining valve to which they could turn was pricing. So, amidst the pandemic recession, with the historic levels of mortgage production and capacity limitations, lenders began raising rates or slowing the full recognition of the declines in order to keep service levels and customer expectations at bay.

Mr. Layton argues that these “middlemen” — the mortgage originators — somehow took advantage of Fed actions intentionally to manufacture excess profits. While it’s true that margins widened as pricing was used to tether volume levels, anyone in the mortgage business knows that this industry has no ability to collude in a joint effort to produce better returns.

If one wants evidence of that, just look at the inability to control mortgage origination pay scales. The mortgage industry is notoriously uncoordinated when it comes to market management. That usually serves as a benefit in a normal market as the competition among the multitude of mortgage bankers and mortgage brokers will typically drive rates to the lowest common denominator, often bringing margins to near break-even levels.

Clear distain for mortgage originators

What’s perhaps most concerning in this Layton treatise is his “middleman” language and clear disdain for mortgage originators, seeming to almost describe them as an impediment versus a critical access channel. Mr. Layton seems to fail to realize that as CEO of Freddie Mac, he and his successors had every opportunity to ease the process burdens on lenders that might have reduced some of the operational inefficiencies that established these timelines for the processing of a mortgage.

But most importantly, I think that Mr. Layton has missed the critical element. Far from being “middlemen,” without mortgage originators, the products of Freddie Mac, Fannie Mae, and the Ginnie Mae programs would be nothing more than a set of dusty books on shelves.

Freddie Mac greatly benefits by three things

The reality is that the company he once ran — while critical — benefits greatly by three things. First, the GSEs do not bear the general and administration burden of having to manage the mortgage origination infrastructure of America’s mortgage market, which thus allows them to operate with just a few thousand employees.

Second, the GSEs are members of an exclusive club with only two members that consist of Fannie and Freddie. Legislation currently bars any new entrants to the model, thus essentially eliminating any real competition.

Third, all of the GSEs’ debt is guaranteed by the U.S. Government. The triple A status on agency MBS that results from this guaranty assures that agency (and GNMA) securities will trade ahead of almost all others in a global market, thus providing the GSEs a level of market advantage that does not exist in any form similar on the earth.

The crushing aftermath

One final point, just as mortgage lenders saw wider margins in these back-to-back historic $4 trillion years, the industry today is facing the crushing aftermath of that with a market facing an approximate $1.5 trillion decline in 2022.

Layoffs, margin compression, mergers and acquisitions, and more are beginning. When this cycle is over, the breadth of the industry will look vastly different than it does today. Freddie and Fannie; however, will look relatively the same, because they do not compete and are not saddled with all the expenses of manufacturing the mortgage. Mr. Layton’s former company can benefit from watching on the sidelines, concerned only with some counter-party risk that might come from some weakened companies.

Oh yes, by the way, Mr. Layton defends the 50 basis-point refi fee as warranted because of the pandemic, and one that was removed following a realization that impact would be less. That is a complete distortion of fact. Director Calabria imposed a fee on refinances simply because he also knew that he could widen GSE margins in this high-demand cycle. It had nothing to do with risk.

In fact, refinances lower risk to a mortgage portfolio. The fee only was removed following the termination of Calabria’s tenure. The incoming Director Sandra Thompson eliminated the fee.

A little knowledge is a dangerous thing

My father always taught me, “a little knowledge is a dangerous thing.” His love for Shakespeare showing through, but a lesson for Mr. Layton, who over his tenure at Freddie Mac, openly showed disdain for mortgage insurance companies and now mortgage originators while failing to realize the privilege his company held and holds in the marketplace.

His assumptions about margin shifts amid market cycles; however, is the most concerning as this seat he holds at JCHS may have influence on others looking to take a bite out of a critical part of the mortgage finance system. And for that reason, it’s important to speak openly against his perspective.

David Stevens has held various positions in real estate finance, including serving as senior vice president of single family at Freddie Mac, executive vice president at Wells Fargo Home Mortgage, assistant secretary of Housing and FHA Commissioner, and CEO of the Mortgage Bankers Association.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Dave Stevens at [email protected]

To contact the editor responsible for this story:

Sarah Wheeler at [email protected]

Excellent commentary as always. Loved the truth in the statement that “their ideas would be books on a shelf” without us to execute. Thanks for sticking up for us, David. I am proud of the service I provide to my community and I work hard to earn a living. Don Layton, like most executives of big companies or sitting in lofty positions in academia, is so far removed from the realities of borrowers’ lives that he is in no position to judge what hard working people like myself do everyday. His disdain shows his ignorance and arrogance both, and I suspect a does of humility is long overdue.

David Stevens has long been a champion of those on the front lines doing the heavy lifting. Why not pay those who originate the mortgage loan what they are worth. Manufacturing a mortgage loan has always been the hardest part of the transaction. Buying a loan already originated is the easiest part and what Mr. Layton might not understand is all the hard work in getting that loan to market. I applaud all the efforts or all originators and also felt there needed to be a contrasting voice to Mr. Layton’s comments. Glad to be on the side of originators!