The question many in capital markets have been asking since the GSEs were put into conservatorship is this: Without Fannie, Freddie, or the Fed, who will buy the agency MBS? Today we are seeing this play out with a shortage of MBS buyers to the tune of about $2 billion in demand per day.

Supply and demand — when demand is low, MBS prices will drop at sale and the corresponding yields will rise.

Late last year, Laurie Goodman, the famed MBS expert and a leader at the Urban Institute in Washington, penned an article in Barrons to explain why rates were so high. She gives a very thorough explanation as to why the 30/10 spread is so high, stating, “Before and during the Great Financial Crisis, the Fannie Mae and Freddie Mac portfolios essentially served as shock absorbers, buying mortgage-backed securities, or MBS, when spreads were wide, selling when they narrowed.

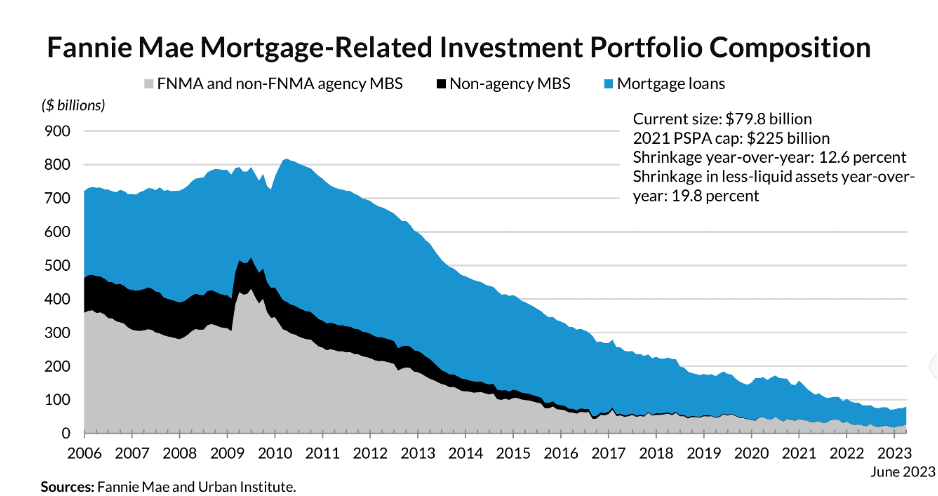

“In 2009-2010, the combined portfolios were over $1.5 trillion. In the wake of the Great Financial Crisis, Fannie and Freddie have been mandated to reduce their portfolio size. The two portfolios together are now under $200 billion. Meanwhile, the Federal Reserve was a fairly consistent buyer of MBS after the financial crisis, as part of its quantitative easing strategy. But as of June 2022, the Fed began to allow its portfolio to run off.”

Today, as Laurie points out, the GSEs are restricted in what they can buy. Per the 4th amendment to the PSPA (preferred stock purchase agreement), essentially the governing document for the two companies in conservatorship, it is stated clearly. Historically, the GSEs could make up for the short in demand if needed.

For example, if the current short was absorbed by GSE purchases, the spread between 30-year mortgages and and the 10-year treasury would likely collapse to it’s more normalized level, likely bringing mortgage rates down about 100bps +/-.

But the PSPA 4th amendment states the following: “Limit Future Increases to the Retained Mortgage Portfolio: The PSPA cap on the GSEs’ retained mortgage portfolios will be lowered from the current cap of $250 billion to $225 billion by the end of 2022, aligning with the FHFA conservatorship cap the GSEs are required to comply with today, while providing the GSEs with flexibility to manage through the current economic environment. As of November 2020, Fannie Mae’s mortgage portfolio was $163 billion, and Freddie Mac’s mortgage portfolio was $193 billion.”

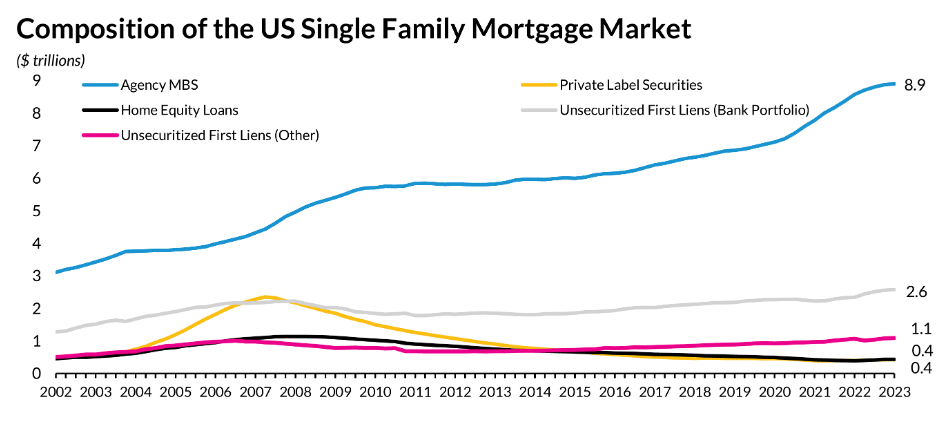

So why haven’t we seen spreads wider more often since conservatorship in 2008 until now? It’s simple really, the Federal Reserve engaged in three rounds of quantitative easing post-2008 during the Great Recession and then another massive round in the spring of 2020 due to COVID-19 recession fears. They created the short in supply that pushes prices up and yields down.

The problem now is that we have the greatest quandary in the markets. We are missing the two largest buyers of MBS on this planet. And to top it off, the FDIC is auctioning off the MBS and Treasury portfolios of the failed SVB, Signature, and First Republic Bank, which only increases supply into the market.

In a recent article in International Banking, Viral V. Acharya, C.V. Starr professor of economics, department of finance, New York University Stern School of Business (NYU-Stern), and Satish Mansukhani, managing director, investment strategy at Rithm Capital, state, “The Fed is thus caught between a rock and a hard place, with the demand- and supply-side effects of its tightening working in opposite directions. Which way will the pendulum swing? It is hard to know, but this may precisely be why interest-rate volatility has remained high.”

This is not a small market. Agency MBS is the dominant feature of the mortgage market with an approximate $9 trillion in outstanding volume. The hole being created here is enormous.

So what are the options?

First is to just leave this alone and let the markets function without interference. This would likely be the goal of fiscal conservatives who have argued that this excessive involvement by the Fed and the GSEs over decades has resulted in the market dysfunction we see today. Industry vet James Johnson penned a great piece for Rob Chrisman’s daily report in which he describes the current supply/demand conundrum and calls the period we are in as the “great reset,” a very appropriate reflection on the scenario today.

But there are other options to consider, and the reason to consider other options is because this excessive mortgage spread is hurting the people that this current administration is the most concerned with protecting.

High rates make affordability a significant barrier to homeownership. And with no end in sight, we as a nation are likely to only widen the opportunity gap between wealthier Americans and those with less means. First-time homebuyers and people of color who often have less inherited wealth and lower wages are the ones impacted the most in a time like this.

More importantly, this scenario is the unfortunate outcome of putting too much stimulus into the economy during COVID-19 combined with supply chain shortages that resulted in hyper inflation, leading us to todays scenario.

So option No. 2 is this: let the GSEs use their roughly $119bb available in remaining capacity within the limits of the PSPA to begin some purchase activity. And if there was a modification to the PSPA to allow a slightly higher balance, the GSEs could do what they have done all during the Great Recession and the COVID-19 pandemic and act as a “shock absorber” as Laurie Goodman describes. They could become tools to help stabilize a scenario, much of which was the result of the same set of agencies that produced the environment we are in today.

The unfortunate reality is that the FHFA would likely come under fire for using the permissible balance sheet to at least help temporarily. And those attacks would be something the administration would like to avoid in a heated election period. But this is an option and one that could help — particularly those who need the help the most and are now victims of hyper inflation that they did not participate in creating.

America is a great nation that has risen to beat back the Great Depression, two world wars, a variety of other conflicts, the oil patch crisis, and more leading up to the Great Recession and the COVID-19 crisis. But for the American dream, now threatened by this supply/demand imbalance, actions by federal agencies that played a partial role in the current scenario are also the ones that can help to balance out this dysfunction. And the ones who would be most impacted to the better would be those that need the help from our nation the most as they have been literally priced out of the housing market altogether.

And yes, there are other challenges, beginning with this terrible dearth in housing supply. But to use other variables as an excuse to not help here is a difficult argument to justify.

The bottom line is this, we have lost the biggest buyers of MBS in the world and this could keep rates artificially higher than would be the case in a more balanced supply versus demand environment. This is a project for the Biden administration to lead, which should include the NEC, Treasury, the Fed, HUD, and FHFA.

David Stevens has held various positions in real estate finance, including serving as senior vice president of single family at Freddie Mac, executive vice president at Wells Fargo Home Mortgage, assistant secretary of Housing and FHA Commissioner, and CEO of the Mortgage Bankers Association.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Dave Stevens at [email protected]

To contact the editor responsible for this story:

Sarah Wheeler at [email protected]

Well said, Mr. Stevens.

This timely article should be required reading for every member of Congress. As Dave cogently outlined the current economic focus by government seems to disregard the role of housing as a critical economic engine. There is simply insufficient capital in the banking system to support the US mortgage market today. The GSE’s ensure a viable housing market by providing mortgage market liquidity.

The Feds recognized the need for a mortgage investor of last resort by forming Fannie Mae in 1934 and Freddie Mac in 1970. While a lot of underwriting and risk management changes have evolved over time, the need to ensure mortgage market liquidity is still a critical strategic element of a viable housing market. Every person engaged in housing or mortgage banking should send this article to their congressperson and senator.