Whether it’s the side of the road we drive on, our preferred system of measurement or how we define “football,” America always seems to distinguish itself from Britain.

Guest Author

Despite this, American lenders unanimously adopted the London Inter-bank Offered Rate (LIBOR) index for U.S. adjustable-rate mortgages (ARMs). And after nearly 40 years, LIBOR has become the most commonly used benchmark rate in the world, covering an estimated $300 trillion in assets across the globe.

Effective January 3, 2022, the mortgage industry will cease using the long-standing LIBOR and, instead, adopt the new Secured Overnight Funding Rate (SOFR). With billions of dollars in ARM assets tied to the LIBOR index, this will have huge implications for the mortgage industry – and the consumers it serves.

LIBOR, explained

Each weekday, at approximately 11 a.m. Greenwich Mean Time, about 11 to 16 large banks (known as panel banks), report the rate at which they believe they can borrow a “reasonable” amount of dollars from each other in the London Inter-bank market. Then, by 11:45 a.m., the average rate is calculated and published.

This methodology underscores the unreliability of the approach, as it’s based largely on estimates – versus data – made by a small, elite group of banks. Concerns about LIBOR intensified following the 2008 financial crisis. Reports began surfacing that some banks were falsely inflating or deflating their interbank rates to manipulate the market to their benefit and increase profit. This became known as the LIBOR scandal.

News of the scandal, paired with the exponential growth in financial markets, created an immediate need to update the methodology. And in 2014, the Federal Reserve commissioned the Alternative Reference Rate Committee (ARRC) to recommend a benchmark interest rate to replace LIBOR.

SOFR, identified

In June 2017, the ARRC selected SOFR as the preferred alternative to LIBOR, noting the stability of the repurchase market (on which SOFR is based) as the main benefit.

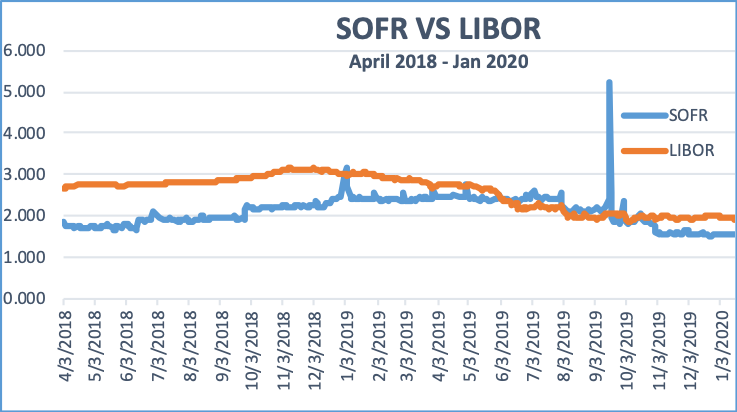

SOFR is a “near risk-free” rate because the underlying repurchase transactions are secured by U.S. Treasuries, whereas LIBOR is based on unsecured transactions. Additionally, SOFR is not calculated based on sample size or future forecast by a small, elite group of banks. Instead, the calculation considers underlying daily transactions, which currently cover over $800 billion. This reduces the chances of potential manipulation, as no panel banks or judges are required.

In April 2018, the Federal Reserve Bank of New York began publication of SOFR and by August 2018, Barclays became the first bank to issue commercial paper tied to the rate, selling approximately $525 million of short-term debt.

Making the change

The switch from LIBOR to SOFR isn’t as simple as swapping one methodology for the other. In the mortgage sector, legacy, non-agency residential mortgage-backed securities are the most susceptible to manipulation, since most reference LIBOR.

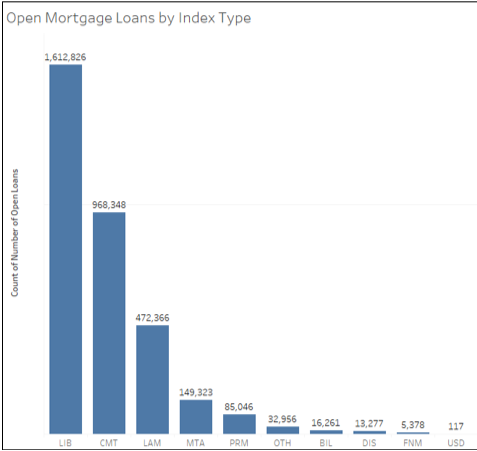

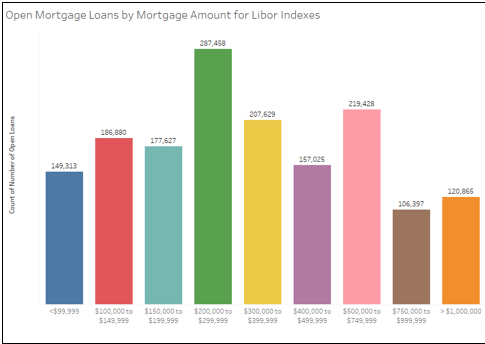

Residential mortgage-backed securities is a shrinking market, particularly as ARM originations are at all-time lows after subprime mortgage clampdowns. Still, about $1.2 trillion of U.S. mortgage debt is linked to the LIBOR rate, making it the largest segment of consumer debt impacted by the transition.

Why does this matter? For starters, an ARM note contains provisions that allow changes to the interest rate and monthly payments, based on the index or benchmark rate. It also has specifications surrounding when and how much the rates can change over the life of the mortgage.

Thus, the first step is to change the index listed in the ARM note from LIBOR to SOFR.

While the newly issued securitized products and most outstanding agency mortgage-backed securities have a fallback clause detailing the process of handling the transition from LIBOR to SOFR, most old notes will go through a manual review. For legal and compliance experts, there are many pending questions surrounding logistics. For instance:

- How do we update the index in preexisting contracts with no fallback language? Most of these were private or portfolio loans, and many have custom provisions in the ARM note and riders.

- Will a notice to the borrower regarding the index change suffice, or is an amendment needed?

- Will new contracts require borrower acknowledgment to avoid complaints that they’ve not been notified of the change?

To help with the transition, the Federal Housing Finance Agency has provided specific actions and their due dates to Fannie Mae and Freddie Mac. For instance:

- New language will be required for single-family uniform ARM instruments closed on or after June 1, 2020

- To be eligible for acquisition, all LIBOR-based, single-family and multifamily ARMs must have loan application dates on or before September 30, 2020

Acquisitions of single-family and multifamily LIBOR ARMs will cease on or before December 31, 2020

Tips for implementation

Like any big change, the transition from LIBOR to SOFR will require a well-thought-out strategy. Here are some tips to help ensure a smooth process:

- Organize a planning phase for servicers to conduct a full audit of existing ARM loans, including detailed data and document analysis.

- Discuss your strategy with legal and compliance (and get it approved).

- Decide how you’ll notify clients, e.g., a borrower notice of index change or legally binding amendment.

- Partner with a vendor who provides software systems that can help with the transition process. Look for system capabilities such as optical character recognition (to help automate document reviews), data extraction and audit features, electronic signature capabilities and print and secure shipments to borrowers. Monitor loans at each change cycle to confirm the index changes in the servicing system are accurate.

- Train customer service teams on the new system, as well as how to respond to borrower queries regarding the transition. Organizations can also send notifications to borrowers via mail or set up temporary call support functions to help with the change.

The big picture

As January 3, 2022, inches closer, it’s more important than ever for the mortgage world to prepare for the transition from LIBOR to SOFR.

The time to plan and implement transition processes is now. By moving to an actual traded rate such as SOFR, mortgage servicers can effectively ensure that rates are no longer susceptible to falsification – and usher in a new era for the financial world.