It looks like homeowners are beginning to see the true value of their homes.

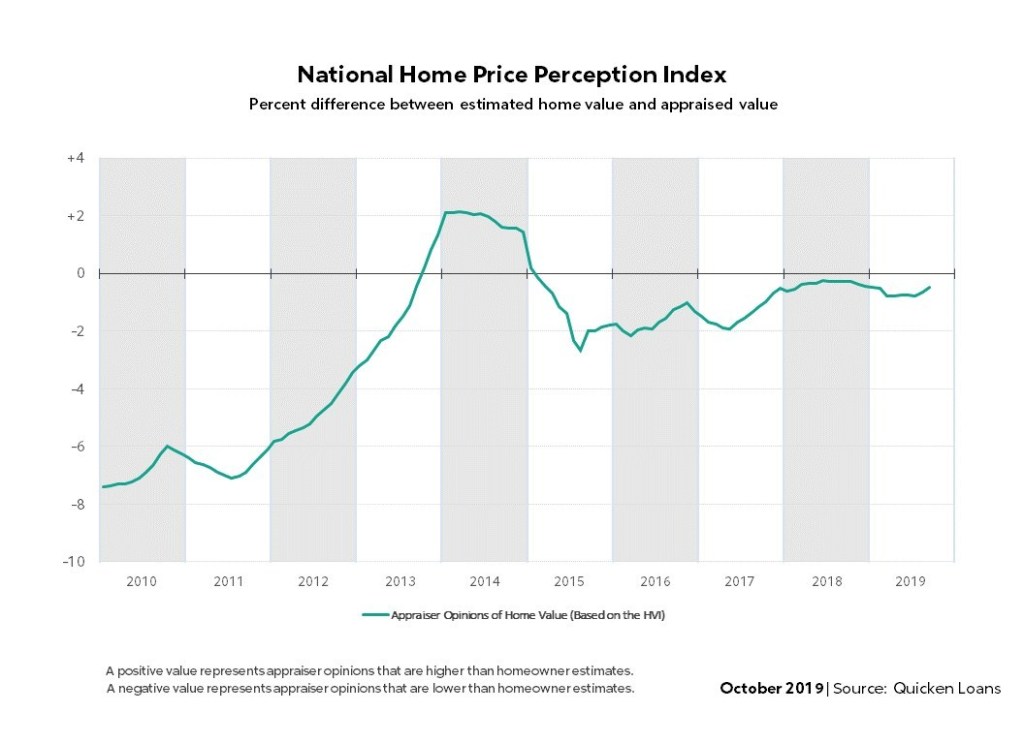

As home values made a jump this month, the average home appraisal in September was 0.49% lower than what homeowners expected it to be that month.

According to the Quicken Loans National Home Price Perception Index, this is a positive movement towards owners’ estimated and appraisers’ opinions, since appraisals in August were 0.64% less than expected.

“The HPPI is a reminder to have a good grasp on your area’s unique housing market before you start the mortgage process, for either a home purchase or a refinance,” Executive Vice President of Capital Markets for Quicken Loans, Bill Banfield said. “Underestimating your home value could, understandably, feel like a windfall. But if a homeowner overestimates their home value, the mortgage could need to be reworked when refinancing – possibly even requiring the owner to bring more cash to the closing table.”

(Image courtesy of Quicken Loans. Click to enlarge.)

In 55% of the metros in the study, the average appraisal was higher than expected.

The metros with average appraisals lower than its homeowners estimate had less than a 2% gap between its expectation and actual appraised value.

Boston and Charlotte’s homeowners showed they underestimated their value the most. Average appraisals at 1.71% and 1.61% higher than the owner estimated. Homeowners in Chicago overestimated home values the most, by 1.67%.

“The clear news from the HPPI data is that homebuyer interest is not falling with the leaves,” Banfield said. “Despite the start of the school year, and the introduction of cooler temperatures in parts of the country, home shoppers are still active. Buyer interest, combined with persistently low home inventory, continues to drag up home values. With August’s jump in homebuilding, at its highest level in 12 years there could be some hope on horizon for home shoppers who haven’t been able to find a home that is a perfect fit at the right price.”

The decrease in the gap between homeowners’ opinions and homes’ appraised values came at a time when home values experienced the largest monthly jump in five years.

According to the Quicken Loans Home Value Index, the average appraisal in September was 2.15% higher than in August.

That’s the largest monthly increase in more than five years. The annual growth in September also substantial, increasing 6.52% year-over-year. That’s nearly two percentage points higher than the annual growth reported in August.

States in the South saw the most modest home appraisal growth, monthly and annually, with a 0.26% monthly increase and 4.28% growth year over year. Meanwhile, the West had the largest jump; 2.93%. The Midwest reported the largest annual increase of 6.34%.