The reverse mortgage industry has expressed overwhelmingly positive feelings about business prospects for 2021, and is taking notice of an influx of new interest in the reverse mortgage product category as caused by the ongoing COVID-19 coronavirus pandemic. This is according to a recent 2021 Industry Outlook survey conducted by RMD by polling out industry readership about how they’re feeling about the business, and what they plan to focus on over the course of the next year.

While many industries suffered significantly in 2020 as a result of the global pandemic, the reverse mortgage industry actually saw one of its best years in recent history. That growth can’t be attributed totally to the pandemic, though the financial uncertainty stemming from the economic downturn certainly played a key role.

We will present the results of our Outlook survey in two parts, with the second part arriving soon.

Industry outlook is overwhelmingly positive

The RMD Outlook survey was conducted online between November 11 and December 2, 2020, and asked reverse mortgage industry participants to share their insights on issues such as the anticipated impact of the COVID-19 pandemic on business operations into 2021; what the general business outlook for the upcoming year is for them; growth strategies they plan on observing in the new year; and the biggest potential opportunities and challenges are that they foresee for 2021.

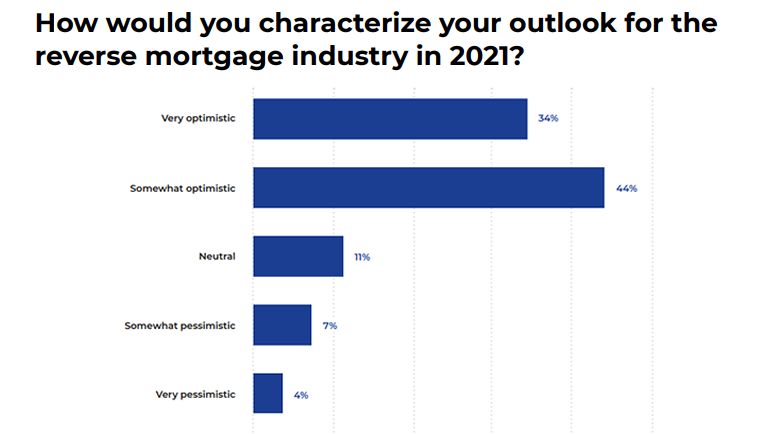

Over 150 industry participants gave their insights for the survey’s results, and in terms of industry optimism, it appears to be very high. More than 75% of survey respondents indicated they are somewhat optimistic or very optimistic about the year ahead, with just 11% reporting they are pessimistic in their industry outlook. Year-over year, the general industry outlook has improved when compared to RMD’s Outlook survey results as we headed into 2020.

More than 60% of industry respondents say their outlook has improved in the last 12 months, with about one third indicating their outlook has stayed the same.

Some of this is further exemplified by recent interviews that RMD has been conducting with reverse mortgage originators over the past several weeks, as many have related that business in the earliest parts of the new year has not slowed down to any meaningful degree when compared with 2020, and that many originator pipelines remain full, though manageable.

“The phone is ringing every day, I can’t write them fast enough” said Tim Kennedy, director of business development at U.S. Mortgage Corporation in Long Island, N.Y. to RMD earlier this month. “Increasing the lending limit has helped. Where I’ve had borrowers in the past that didn’t qualify or didn’t get enough money, I’ve now been able to call them back and rerun the numbers. What’s happening is they’re a year or two older, their house value has gone up a little bit more. Or, if it’s over the $822,375 they get that much more money.”

Respondents: pandemic is boosting volume in 2021, and will continue to

Additionally, More than 70% of respondents believe the COVID-19 pandemic will lead to an increase in reverse mortgage volume in 2021, with just 5% projecting a decrease as a result of the pandemic. The belief in either maintenance of volume or in an additional increase also conforms with what originators have been telling RMD recently, based on what they’re seeing in their own businesses.

“I think things are going to stay along the same lines,” said Brandi Braley with Neighborhood Mortgage in Bellingham, Wash. earlier this month. “I know that there’s still, as always, the need for reverse mortgages. But also, there’s more people that have been out of jobs, so if you’ve got anyone that was going into retirement and was still working and then maybe lost a job, this is probably going to be an option for them. So, I think we’re going to have people looking at [the product] in that sense. So, I think things are going to be pretty much the same as last year, I think we’re going to see the same trend.”

For many in the industry, day-day-work was not largely disrupted by COVID-related changes in 2020, according to the survey results. Yet for around one third of respondents, the day-to-day was largely impacted which may be due to the face-to-face nature of originations for some, while many are accustomed to working remotely or by phone.

In conversation with RMD, some originators have reported that certain seniors, particularly in areas of the country that were hard-hit by the effects of COVID-19, remain wary of re-engaging in in-person activities with them since as noted by the Centers for Disease Control and Prevention (CDC), the disease that can result from the virus can affect older people more severely than younger people. However, others also report that some of those concerns have also understandably fueled a desire to find solutions that can allow for aging in place.

“The pandemic […] heightened many older Americans’ desires to age in place and they are seeking financial solutions to make that arrangement,” said Melanie Parks, VP of national field sales at American Advisors Group (AAG) to RMD at the end of 2020. “Whether that be creating a safety net alongside their retirement funds, completing home renovations, funding in-home nursing care or even downsizing to a smaller home, home equity is emerging as a viable solution.”