This article is part of our HousingWire 2022 forecast series. After the series wraps, join us on Feb. 8 for the HW+ Virtual 2022 Forecast Event. Bringing together some of the top economists and researchers in housing, the event will provide an in-depth look at the predictions for next year, along with a roundtable discussion on how these insights apply to your business. The event is exclusively for HW+ members, and you can go here to register.

The supply-demand imbalance fueling the housing market shows no signs of abating in 2022, even as homebuilders attempt to bridge the gap. An under-supplied market has strong implications for house prices, particularly during a time when prices seemingly set new records every month. Any market characterized by rising demand against insufficient supply is Econ 101 for price growth. In November 2021, the supply of homes for sale nationwide as a percentage of occupied residential inventory remained near historic lows at 1.19% — meaning only 119 in every 10,000 homes were for sale — much lower than the historical average of 2.5%.

2022 Forecast series

Homebuilders responded to the shortage of homes for sale, accelerating new home construction, even as they face severe supply-side challenges, including rising building material costs and supply-chain bottlenecks, a lack of affordable lots, and difficulty in finding skilled labor. Many of these supply-side challenges facing builders existed prior to the pandemic but have worsened considerably over the course of the pandemic. However, the underbuilding and resulting accumulation of housing stock “deficits” relative to growing housing demand preceded the pandemic by several years.

Measuring the housing deficit

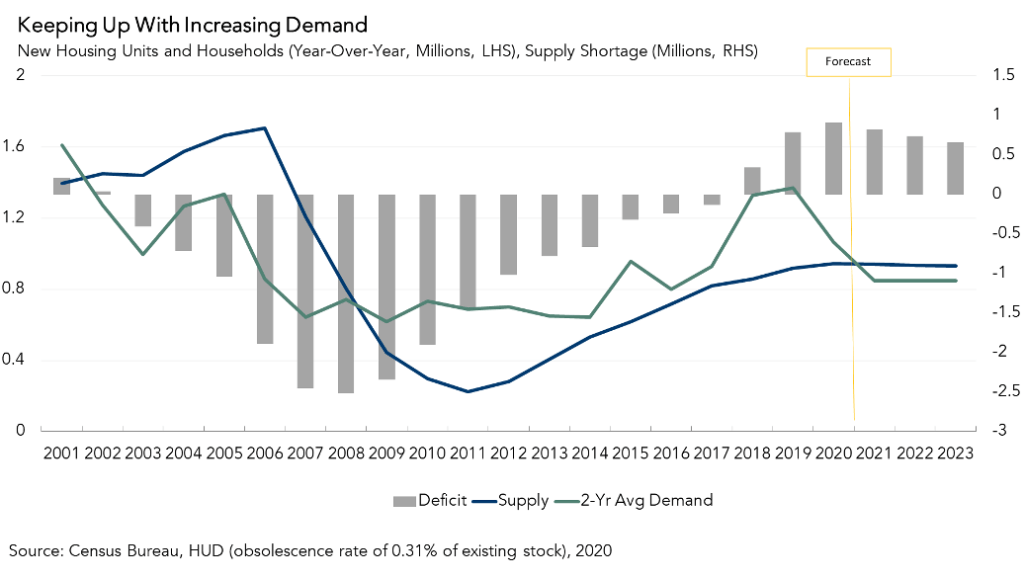

One way to measure whether the housing market is under- or over-supplied is by comparing new household formation (rental and owned), which represents new demand for housing, with total new housing units completed and added to the housing stock, which represents new housing supply. In the analysis graphed below, the two-year moving average of new household formation is compared with the total new housing units completed, accounting for the replacement of a small fraction of the old stock for obsolescence.

Assuming that the housing market had a balanced supply of homes relative to demand in the year 2000 (no deficit or surplus), we can track the surplus or shortage of housing supply relative to demand cumulatively over time with the grey bars. While we overbuilt relative to demand in the housing boom as household formation was slowing, we have been underbuilding since 2008. Since 2018, the housing supply deficit has been growing.

The pandemic may have slowed household formation in 2020, but the pre-pandemic trend was rising household formation. And, if we project the amount of total homebuilding for 2021-2023 at the 2020 pace and use recent projections that the annual household formation will be about 850,000 (slower than pre-pandemic pace), then the housing shortage is here to stay. According to this analysis, while it’s true that there has been lower household formation in the last decade, there has been even less homebuilding.

What about existing homes?

The majority of the supply of homes for sale come from existing homes, not new construction. Yet, many existing homeowners have withdrawn supply for fear of finding nothing to buy. The result has been that the average amount of time someone lives in their home has soared to a historic high of 10.7 years, which means there are fewer homes on the market as fewer homeowners sell their homes. Furthermore, while rising equity may prompt some existing homeowners to move out and up in 2022, many owners were able to refinance into rock-bottom mortgage rates over the course of the pandemic. As mortgage rates rise, it costs more to borrow the same amount of money, so an increase in mortgage rates can leave existing homeowners feeling ‘rate locked-in’, disincentivizing them from selling their homes.

You can’t buy what’s not for sale

It’s not all bad news, however. Homebuilders have a lot of homes in the backlog that they haven’t completed and brought to market due to the supply-chain disruptions. If supply chain issues ease, those new homes will come to market and add some modest supply relief, but today’s acute supply shortage will be hard to undo. It will take years of accelerated new-home construction to close the gap from a decade of underbuilding. Millennials will continue to age into their prime home-buying years in 2022, but they will be met with limited inventory, which will continue to put upward pressure on prices. While price acceleration may slow as some buyers pull back from the market due to declining affordability, the supply-demand imbalance means that house prices remain poised to rise further. In short, the housing supply shortage is here to stay, so we can expect house prices will remain elevated in 2022.