Now that we are heading toward the end of 2021, what can we say about the U.S. housing market this year? No question it has been another year of ups and downs with seemingly conflicting data, which could indicate a coming boom or a bust depending on how you decide to parse it. If we stick to the facts, however, we can glean a few important take-homes as to what risks the housing market faces for 2021 and beyond.

First and foremost, it is important to remember that more Americans are buying homes with mortgages in 2020 and 2021 than any single year from 2008-2019. If you are familiar with my work, this will not be a surprise. From 2008 to 2019 we had the weakest housing recovery ever, following a bust. Following these years of doldrums, in the years 2020 to 2024 we have the best housing demographic patch ever recorded in history.

These solid demographics for housing will provide stable, built-in replacement demand. Don’t expect a buying or construction boom during this period. Mature economies are like large ocean liners. They have limits on how fast they can maneuver and what they can and can’t do. This is why my line in the sand for total sales (new & existing homes) for the years 2020 to 2024 is 6.2 million. If new and existing home sales combined get above this number during these golden years then they will beat my expectations. We had no chance of reaching this number during the years 2008 to 2019.

Based on our demographics, our two sweet spot years will be 2022 and 2023. During this time we will have a lot of people of first-time home-buying age that will need shelter. But housing demand won’t just be from millennials and Gen Z coming into home-buying age: we will also have our move-up, move-down, cash and investor buyers adding to the demand.

If you are in need of a good laugh, ask anyone who is claiming home sales are going to crash for their existing home sales forecast. Expect hilarity to ensue! Remind the joker that existing home sales under 4 million, even during the doldrum years, was a rare thing. Presently, and for the next few years, we just have a lot more people.

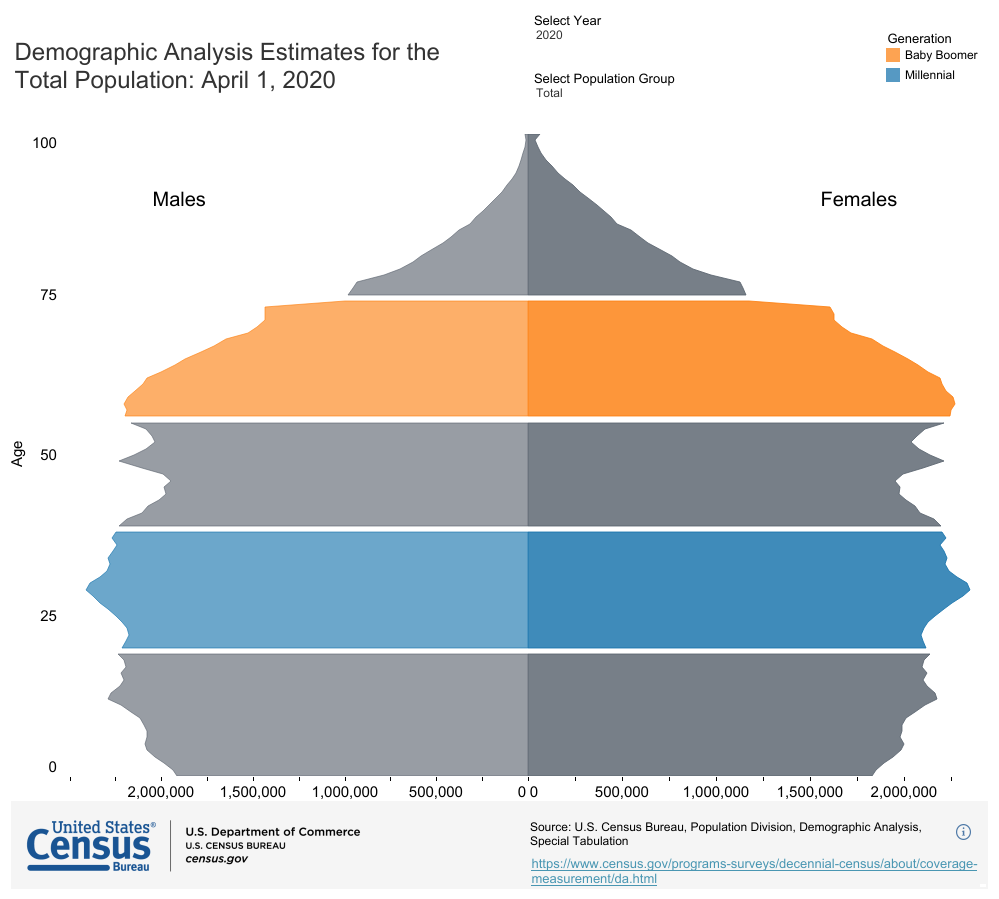

Demographic factors are removing some risk from the housing market for the next several years. As you can see from the chart below, ages 28 are 34 a massive group that will keep our economy moving forward.

Mortgage rates risk

Housing affordability is a risk we will need to contend with during this demographic sweet spot. When mortgage rates rise, housing becomes less affordable. The price gains we have already seen due to low inventory are not going to reverse one for one when mortgage rates go up. In the previous expansions of 2013-2014 and 2018-2019, mortgage rate increases did cool the rate of price growth and reduced demand, but prices did not go down.

Housing demand got hit noticeably when rates rose in 2018, more in the new home sales market than the existing home market. When rates rose in 2013, purchase applications fell to the lowest levels, adjusting to population, in 2014, and prices still didn’t go negative. In 2018 and 2019, when mortgage rates got to 5%, sales cooled from 5.72 million in November 2017 to 4.98 million in January 2019 on the monthly sales prints. Even though nominal home prices never went negative, real home prices did go negative briefly in 2019, when compared to the previous year.

Higher rates do matter – they reduce demand, but they didn’t reduce prices in a meaningful way in the previous expansion. Thus, once the 10-year yield breaks over 1.94% and mortgage rates get over 3.75%, some of the narratives around the housing market will change. But don’t expect mortgage rates to increase anytime soon. This was not part of my 2021 forecast and I am holding to that. More on if and when rates will go over 4%, can be found here.

Stock market risk

Historically, the upper end of the housing market is impacted when the stock market gets weaker. Higher income households are more likely to have assets tied up in stocks and to buy their homes with stock options. This segment of the market, therefore, is at risk by a stock market correction or crash.

We haven’t had even a 10% stock market correction since March 2020. This is not normal. In the previous expansion, which was the longest economic and job expansion in history, we had many stock market corrections of 10% or greater and two near-20% declines.

Currently, the markets have been calm, but stock market volatility is a potential risk for the upper end of the housing market. The St. Louis Financial Stress Index was an important element to my AB recovery model, where I detailed what factors and in what timeframes the economy would recover from the COVID recession.

Recently, this index has been dozing off, at -0.8858% when normal stress is zero. When this data line breaks over 1.21%, it indicates a recession. It tends to move pretty fast, though, so it is something to keep an eye on as historically the markets don’t stay this calm.

Corporate profits have been on fire, but don’t expect another 6 trillion plus in disaster relief to come anytime soon. The recent spending bill looks like it will be watered down and the spending is going to be over a 10-year period, where the disaster relief aid was much more upfront.

We can see a clear deviation on retail sales, something that hasn’t happened in recent economic history. This data line will moderate in time to a more sustainable trend.

Housing construction risk

Higher mortgage rates tend to dampen new home sales and reduced new-home demand will slow construction growth. For now, new home sales are growing and monthly supply is still below 6.5 months on a three-month average, which means demand is hot enough to keep builders building. However, the new home sales market is one area that is at risk if rates rise.

Low inventory in the existing home sales market, and the multiple bid situations this creates for purchasers, drive some buyers into the new home market. But this is true for only a small percentage of buyers who are seeking all the bells and whistles of a new home and have more money to spend. The existing home market is much bigger and cheaper than the new home market and so is the choice of most homebuyers.

Nevertheless, when we talk about housing economics, the new home market is what feeds the economy with construction jobs and the purchase of big-ticket items. Even though the existing home market is much bigger, the benefit to the economy is limited to the transfer of commissions, moving vans and remodeling work.

Higher rates will impact the new-home sector first, so always be mindful that monthly supply over 6.5 months will cause the builders to pause. They’re dealing with a lot of higher costs so this isn’t a marketplace that is booming in any big fashion currently.

2021 forbearance crash risk

Simply put, forbearance programs are not a risk to the housing market. The latest Black Knight report showed the biggest decline in home in forbearance programs in over 12 months. The near 5 million home loans in forbearance early in the COVID-19 crisis has collapsed to 1.39 million. I originally anticipated that we would be under 1 million loans in forbearance by some point in 2022, but now I believe we have a good shot of getting under 1 million loans in forbearance before the year is out: I wasn’t bullish enough.

This is a victory for the United States of America, and a huge miss for the housing bubble boys and the forberance crash bros, who make their livelihoods by trolling the internet with conspiracy housing crash theories during the pandemic. More on this can be found here.

From Black Knight:

As the job market improves and unemployment falls, loans in forbearance have also fallen. It should have never been a surprise that when jobs came back people stayed in their homes. The loan profiles in America looked solid going into this crisis and have kept on looking better and better. The only housing data that had the biggest risk of collapsing was forbearance, and it did.

We still have nearly 5 million jobs left to gain to get back to February 2020 levels, and I make my case here for September of 2022 to be the date that we should get there.

As more and more Americans get their jobs back, more people will exit forbearance. This doesn’t mean that we will clear 100% on all forbearance loans without any pain. However, the risk of a forbearance housing market crash in 2021 is dead — may it rest In peace.

Price growth

The risks to the housing market I have discussed thus far pale in comparison to our greatest risk: price growth. Moderate home price growth is considered by most homeowners as a good thing, but not when the growth is so fast that even buyers and sellers are worried about being left without a place to live.

We knew that the years 2020-2024 were going to be different than what we saw from 2008 to 2019. When demand for housing broke out in February 2020, before COVID-19 hit, median prices were already rising 8%. In addition, housing inventory has been falling since 2014 and purchase application data has been rising since 2014.

Healthy growth during the years 2020-2024, in my opinion is under 4.6% nominal growth per year with five-year cumulative peak growth of up to 23%. But we have had this price growth in in less than 2 years. This is why I say this is the unhealthiest housing market post-2010; prices are growing way too fast and days on market are too low.

My fear is that I could be wrong about inventory levels eventually breaking higher and reducing the rate of growth of pricing, which I am rooting for now. I will be extremely happy to see prices cool to get things back in line, but inventory needs to rise. The inventory increases we have seen this year are just the traditional seasonal push that we get every year, which typically fades in the fall and winter. I am really hoping that we hold some of these inventory gains going into 2022.

,

Until inventory total levels get to 1.52-1.93 million and the bidding wars end, I fear my rate of cooling growth just won’t be fast enough. To get housing back in line to my five-year price growth trend, I need flat pricing for the next three years. As you can see, I am now in a rough spot. The risk for housing is the same risk I talked about on Bloomberg at the start of the year: home prices are overheating.

Like everything in economics, you must look at the economy one day at a time. The housing market will have its ups and downs. Despite our current demographic goldmine, the housing market is not immune to a turn of fortune. When primary resident mortgage demand fades, so will our hot housing market. We don’t have a Wall Street moat protecting the housing market as some believe.

However, right now the biggest concern is not increasing mortgage rates, or homes in forbearance crashing the market — it is prices staying too hot. We should all be rooting for a B&B market — boring and balanced. That is the kind of market that we all can fall in love with, not this lightning-fast market we are dealing with today.

Editor’s note: The numbers in this sentence were updated shortly after publishing to reflect the latest revisions from NAR: “In 2018 and 2019, when mortgage rates got to 5%, sales cooled from 5.72 million in November 2017 to 4.98 million in January 2019 on the monthly sales prints.“