In October, the Conference of State Bank Supervisors made a controversial move to issue a final rule with proposed prudential standards for nonbank mortgage servicers – standards that, if enacted, have some stakeholders worried.

The proposed rule addressed capital, liquidity, governance, policy related to entity survivorship and more.

But now, the Urban Institute is warning that the rule could have unintended consequences.

“Nonbank regulation should be structured in a manner that not only keeps the system safe and sound but maximizes efficiency by eliminating redundancy and inconsistency,” the Urban Institute wrote. “A fragmented regulatory regime that includes the federal government, states, Fannie Mae, Freddie Mac and Ginnie Mae is not conducive the achieving those outcomes. Additionally, given that the CSBS’s proposed capital and liquidity requirements are modeled after Federal Housing Finance Agency requirements, it is unclear how applying the same standards at the state level would improve safety materially.”

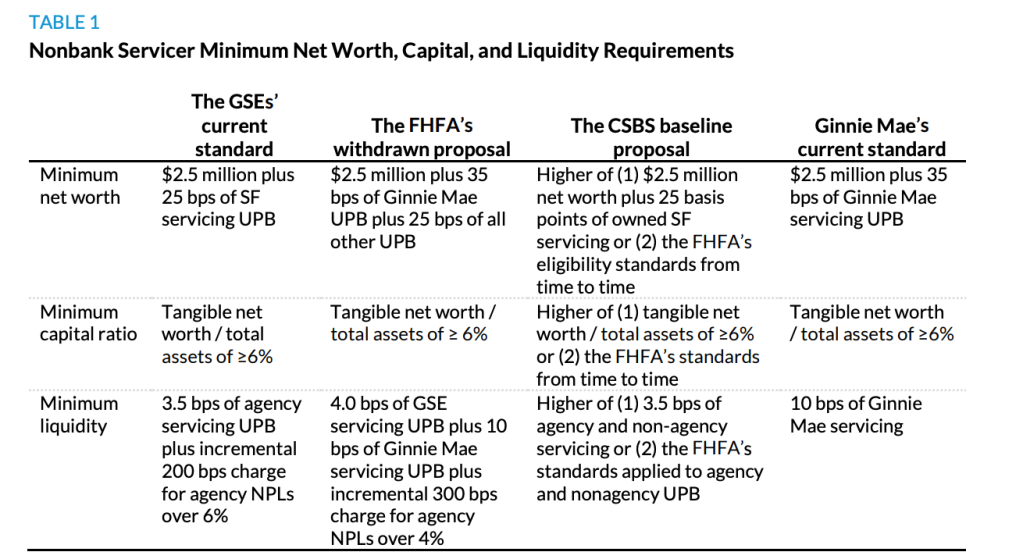

The table below shows the CSBS sets standards in net worth, capital ratio and liquidity that are either equal to the FHFA or say to follow FHFA standards if they are higher at the time:

What about mortgages that are not federally backed? The Urban Institute argues that those shouldn’t be of great concern given the already numerous regulators.

How servicers are navigating changing compliance guidelines

Servicers must ensure their work remains in compliance not only with standard regulations but with the CARES Act and ever-evolving guidelines.

Presented by: Wolters Kluwer Financial Services

“To the extent the CSBS is concerned about the non–federally backed portion of the servicing market, we note that depositories – which service most non-agency mortgages – are already subject to stringent regulation, supervision and examination by the Federal Reserve, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp.,” it wrote.

The Urban Institute argued in its report that because of its history in mortgage regulation, the FHFA would be a much better alternative to regulate nonbank mortgage servicers.

“Taking these factors into consideration, it seems obvious that nonbank prudential regulation is best accomplished via a single federal regulator that supersedes state regulators,” it stated. “This will be more effective and more efficient. Given that the FHFA already has significant experience overseeing the mortgage market through its regulation of Fannie Mae, Freddie Mac and the Federal Home Loan Banks, it would be the natural regulator for nonbank servicers. The FHFA could easily leverage the monitoring and reporting infrastructure the GSEs have put in place over the years. The FHFA could also leverage Ginnie Mae’s monitoring and stress-testing framework and work with stakeholders to create a standard framework that could be applied nationally.”

The Urban Institute argued that allowing the FHFA to supervise nonbank servicers would create a much more streamlined and effective regulatory regime.

The Urban Institute pointed out there are other potentially problematic pieces to the CSBS’ proposed rule, such as its proposal to align its capital liquidity requirements with current and future FHFA requirements.

“As an example, the FHFA’s current requirement includes an incremental nonperforming loan charge of 200 basis points on delinquencies above 6%,” the Urban Institute stated. “Although well intentioned, this would be counterproductive because it would require nonbanks to shore up liquidity at precisely the wrong time (namely, after defaults have risen), and raising new capital is more expensive and difficult. This provision is clearly problematic for GSE loans, but it will be even more of an issue for government loans. Because Federal Housing Administration and U.S. Department of Veterans Affairs delinquency rates tend to rise faster and stay more elevated compared with GSE delinquencies, servicers with a larger concentration of these loans would cross the 6% threshold sooner.”

This could, in turn, create a reduction of FHA lending or increase rates for FHA loans, which are the predominant mortgages used for low- to moderate-income families and first-time homebuyers.

When CSBS first proposed its rule earlier this year, former Mortgage Bankers Association Chairman and CEO David Stevens wrote his thoughts on it, agreeing that an increase in regulation for nonbank servicers would not necessarily increase liquidity or safety in the mortgage market.

“Nonbanks do not set the rules of lending,” Stevens said at the time. “They sell all of their loans to investors. This means that the correspondent channels of balance sheet lenders, the GSEs, the GNMA/HUD lending programs, and what exists in the PLS sector is driving whatever risk exists in the mortgage market. Is the CSBS taking the time to focus on this sector as much as they are the nonbanks?”

“Nonbank servicing is actually not owned by them,” he continued. “Nonbanks obtain the right to service under the authority of Freddie Mac, Fannie Mae, and GNMA. These institutions own the servicing and give the rights to the servicer. Why this bottom-up form of rulemaking is being pursued is something of keen interest.”