After last week’s enormous bond and stock rally, I wondered when the Federal Reserve would make a statement to try to reverse some of that momentum. Well, it didn’t take long: on Sunday Federal Reserve Governor Christopher Waller made comments at an economic conference in Australia that made their position clear.

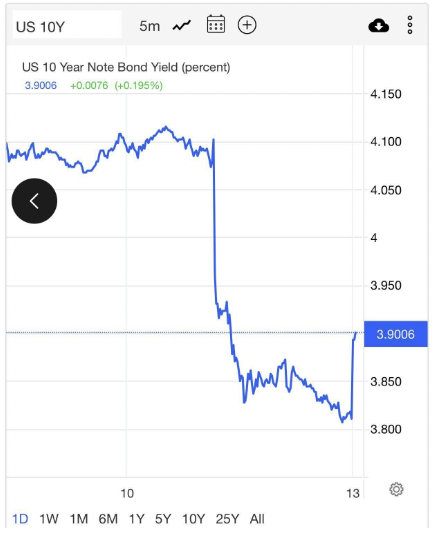

This is the second time this year that the Fed empire has struck back after mortgage rates made a move lower. Currently, the 10-year yield has made a reversal and is already heading higher toward 3.90%.

Here are some of the comments Waller made, according to tweets of Nick Timiraos of the Wall Street Journal:

“The market seemed to get waaaa-aaaay out in front…. I just cannot stress this is one data point.”

“We’ve still got a ways to go.”

The Federal Reserve is very upset with the market’s reaction; they know housing is in a recession and jobs are being lost. If mortgage rates started to go toward 5% and stay there, their job-loss recession forecast would be harder to obtain next year. Note the language use of “waaaa-aaay out in front.”

I understand that last week’s market rally in stocks and bonds was extreme — I believe people were on the other side of the trade, thinking that the CPI report would be hotter than average. People got out of that trade when that didn’t happen, and the markets ran with it.

However, the Fed doesn’t think that way. They were very upset about mortgage rates heading lower earlier in the summer, and they will do their best to create more pain for American households.

Timiraos further tweets:Waller on loosening of financial conditions that followed Thursday’s market reaction: “This is exactly the situation we had gotten into in July.” Back then, there was “A loosening of financial conditions that we were trying not to do.” 7.7% CPI Inflation “is enormous.”

In July, mortgage rates fell from 6.25% to 5%; housing found some stabilizing for the brief period when we were in the lows 5s and the Federal Reserve members hated it. They went on a full media blitz making sure people knew they were not kidding around that Americans needed more pain, the labor market was too tight, and wage growth was too strong.

The Fed, to their credit, presented a united front on this, making their case that the best way to fight inflation is for Americans to lose their jobs and for labor markets to get so weak that wage growth slows.

It’s now November, but the Fed hasn’t changed its playbook: any chance of trying to avoid a recession or even attempting to reverse the housing recession will be met by a similar coordinated media blitz. This weekend is the second time the Fed has shown it was upset with the market move. However, this time mortgage rates went from 7.373% to 6.60% — far from the 5% level we saw earlier.

Waller also made the point that If you use a Taylor-type policy rule, short-term interest rates aren’t that high. “We’re not that tight. Real rates are barely positive a year out.”

The Atlanta Fed defines the Taylor rule as “an equation John Taylor introduced in a 1993 paper that prescribes a value for the federal funds rate—the short-term interest rate targeted by the Federal Open Market Committee (FOMC)—based on the values of inflation and economic slack such as the output gap or unemployment gap. Since 1993, alternative versions of Taylor’s original equation have been used and called ‘simple (monetary) policy rules.'”

I won’t bore you with all the historical stock market and Taylor Rule references over the decades. However, it’s clear the Fed is saying ‘Listen, the Fed funds rate isn’t that high, so stop crying. We don’t care that housing is in a recession.’ That was the point of the housing reset statement.

As someone who has followed the markets since 1996, I have to say this is a clever way for Waller to talk to the markets. It shows that the Fed means what it says: they have a 4.4% unemployment rate forecast for next year, and they intend to use all their tools to make sure the labor market gets weaker and weaker.

From Timiraos: Waller: The FOMC statement in November was designed to signal a potential step down to 50 basis point. “We knew the markets were going to jump for joy.” So the Fed used Powell’s press conference to “drive the point home” that it’s the ultimate level for rates that matters.

I believe the Federal Reserve is getting closer and closer to the end of its Fed rate hike cycle, and they want the financial conditions to be as tight as possible to get the job-loss recession to happen. Once the job loss recession occurs, they have to be more accommodative because that is their dual mandate.

My target for the Fed pivot is when jobless claims get above 323,000 on the four-week moving average. At that level, the job-loss recession has started, and the Fed would have achieved its goal of getting their job loss recession to break inflation.

With inflation levels well above their 2% target level, the Fed has to sound as tough as possible now. All these aggresive push-backs by Fed members when rates go lower and stocks go higher will end when we have a job-loss recession.

From multiple sources: “Everybody should just take a deep breath, calm down — we have a ways to go yet.”

As you can see, the Fed isn’t happy about the move in the stock or mortgage markets. So when they say calm down, they’re saying, all that smoke about a soft landing — we don’t want a soft landing. If they did, they wouldn’t make such a big deal when mortgage rates fall, and stocks rise.

My advice: don’t buy the talk that the Fed wants a soft landing; they want a higher unemployment rate and will try to talk the market into higher rates and lower stock values when they feel the need to do so. As the saying goes, “Fool me once, shame on you. Fool me twice, shame on me.”

Breaking market news quoted Waller as saying: Housing markets in the U.S. will be fine.

The housing market went into recession in June of this year: sales were down, production was down, jobs were lost and incomes were lost. See, even with the housing market in a recession and jobs being lost, the Fed doesn’t care. To say a sector of the economy is fine while it’s in a downturn shows some disconnection from the real world.

Ladies and gentlemen, I give you the Federal Reserve in its purest form when they say housing will be fine while it’s in a recession. If it were me, I would have at least acknowledged that the housing market is in a recession and jobs are being lost. Then after that statement, I would talk about how I believe that it’s critical for the housing market to get balance, which is occurring right now.

Not acknowledging that jobs are being lost in such a large sector of the economy makes you sound heartless and disconnected from reality.

After the big stock market rally on Thursday and noticeable drop in mortgage rates, I wondered if the Fed would make a statement to try to talk the markets back. The Fed did make their statements this weekend, so get used to this type of reaction from the Federal Reserve until the job-loss recession happens.

“ Ladies and gentlemen, I give you the Federal Reserve in its purest form…”

Great article, Logan.

Would that Fed spokespeeps would get out sooner rather than later, particularly after new CPI prints.

Robert, I believe the Federal Reserve wants to keep the financial conditions as tight as possible until the job loss recession happens. Then, they can remove their aggressive stance. So, when mortgage rates go lower and stock rallies, they find that to go against their goal for now.

Excellent article, Logan. I think we have at least another 100bps to 150bps to go on the overnight rate before this current rate hike cycle is done. I will be watching the jobless claims closely…

Chance, The Fed is targeting between 4.5% -5.25% as their stay-at-home rate, then they let the economic data run it’s course then, so they’re almost done with their rate hikes