As we all know, younger generations want to take a dip into the homeownership pool, but many can’t afford to due to student loan payments and other factors.

But there’s good news, as American homeowners are reportedly not feeling the burden of housing costs like they used to.

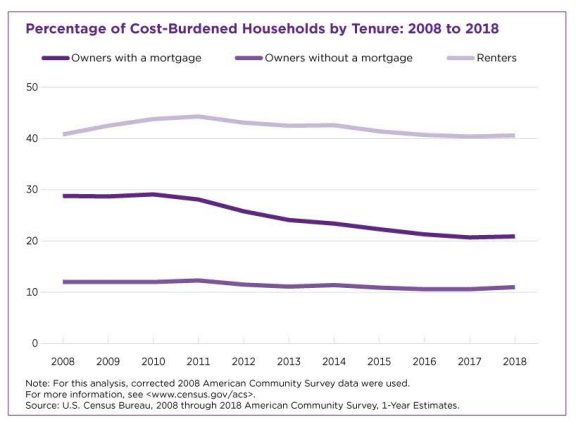

According to the U.S. Census Bureau’s American Community Survey, approximately 21% of homeowners with a mortgage said they were cost-burdened in 2018.

Cost-burdened, by the Census Bureau’s definition, means that at least 35% of a person’s income went towards housing costs, which include mortgage payments, utility bills, real estate taxes, property insurance, and any required condominium or mobile home fees.

A decade ago, when the financial crisis was at its peak, nearly 29% of people said they were burdened by their housing costs.

At that time, in 2008, there were 43 metro areas where at least 40% of homeowners with a mortgage were burdened.

But that figure has dropped dramatically in the last 10 years. In fact, as of last year’s data, there were zero markets in the U.S. where at least 40% of homeowners with a mortgage were burdened.

According to the Census data, there were 77.7 million owner-occupied housing units in the United States in 2018.

Approximately 62% of these homeowners had a mortgage, down 6.5 percentage points from 2008, the Census Bureau said.

The homeownership rate in 2008 was 67.9%, whereas now it’s 64.8%.

And that decline in homeownership has obviously coincided with a rise in renting, as people are either choosing to rent for lifestyle or being forced to for finances.

According to the Census Bureau, the rental population has reached its peak, due to younger generations delaying their entrance into the homebuying market.

But renting isn’t exactly a cost-effective option for many people, as the Census Bureau claims that 40.6% of renters spent at least 35% of their monthly income on rent and utility bills in 2018.

That figures is basically the same as it was in 2008, when it was 40.8%.

This causes renters to struggle to save for a down payment on a home, making it harder to become a homeowner, pushing it back by an average of buying their first home by seven years.

Freedom Debt Relief conducted a survey earlier this year that claimed 29% of people think homeownership makes them feel anxious and stressed, while 26% said the cost of owning a home is a burden and they wished they were renting instead.

That study also concluded that when it comes to affording house payments, it was Millennials and Gen Z homeowners who said they are struggling the most. Half of these homeowners said property taxes turned out to be higher than they expected, while 52% said their monthly mortgage payments are too high.