CTO at Sagent Lending

The 2020 economy is full of curious contrasts. Millions of Americans sought COVID mortgage relief like forbearances while millions more capitalized on refis and flocked to suburbs to buy new or bigger homes at record low rates. And COVID lockdowns led to the worst Q2 and best Q3 GDP quarters in U.S. history. This is also why housing policies were extremely accommodating in Q2 but relatively quiet in Q3. Such is the absurd new normal in this pandemic economy. Now lenders face a K-shaped economic recovery and two key housing relief policies expiring soon.

Let’s review the state of how a fintech strategy helps, starting with a briefing on election implications.

How election results impact lender fintech decisions

As President-elect Joe Biden prepares to take office in January, we’re seeing leadership change signals at the Consumer Financial Protection Bureau.

Biden already appointed Leandra English to lead his CFPB transition team and, as the hand-picked successor of former CFPB Director Richard Cordray, English is expected to be tapped to head up the agency.

My Sagent colleague Matt Tully explained recently that this shift likely won’t be too drastic. Biden’s CFPB will revert to previous regulatory standards rather than moving originators and servicers into uncharted territory.

No signals yet on whether Federal Finance Housing Agency Director Mark Calabria would continue in a Biden White House, but this is another key housing regulatory role the President can appoint.

As for the GSEs that FHFA regulates, experts predict Biden will utilize Fannie Mae and Freddie Mac as “instruments of public policy” with a regulatory approach that favors consumers and focuses on environmental, consumer, and workplace regulation. And the Fannie and Freddie conservatorship debate will likely slog on.

I think Matt Tully explained it well: “Ultimately, the system works, whether people like it or not. When you hear economists say we’re going to have a $3.39 trillion housing market this year, [the Fannie/Freddie issue] doesn’t sound like something we need to solve when there are other, more pressing issues out there.”

As for Congress, the fate of COVID relief and other housing-related policy is subject to Senate majorities, which are in play until Georgia Senate run-offs happen on Jan. 5, 2021.

Here are the two COVID housing relief policy expirations to watch for now:

- COVID foreclosure moratoriums expire on Jan. 31, 2021 (extended from its initial December 31 deadline)

- CARES Act long-term forbearances expire in April 2021

Both of these policies mean servicers must be ready for forbearances potentially escalating into default scenarios.

Before I delve into how servicers can prepare, let’s define and examine implications of a K-shaped economic recovery.

How a K-Shaped economy impacts two classes of consumer

At the outset of the pandemic (and every time vaccine news looks positive), optimists predicted a V-shaped recovery and cynics braced for a U-shaped recovery. The more likely scenario is a K-shaped economic recovery where the ‘haves’ thrive and ‘have-nots’ struggle.

Higher work-from-home earners now spend less but earn the same. Lower-paid workers in hospitality, retail, and other hard-hit sectors were already paycheck-to-paycheck, and now must contend with lost or reduced incomes.

Research from Harvard economist Raj Chetty shows the top quarter of income earners have completely recovered the job losses experienced earlier in the year.

Meanwhile, employment for the bottom quarter of earners (those making less than $27k per year) is still down 21% compared to early 2020. And PEW reports that 56% of lower-income adults who previously lost their job due to COVID remain unemployed at the end of 3Q20.

Again, this means lenders must care for folks doing well and folks who are struggling. Let’s look at each one.

Group 1: Borrowers doing well

The solution for folks on the up-side of the K-shaped economic recovery is all about modern consumer engagement and a convergence of servicing and originations mindsets.

Figure 1 below shows how servicing comprises the vast majority of a customer’s borrowing lifecycle, with comparatively little time spent in the origination process. And here’s the convergence part: if lenders get servicing engagement right, it leads to more new originations — instead of losing 4 of 5 refinances like they do today.

Figure 1

I believe that if mortgage originators are the finders of customers, servicers must be the keepers of those customers.

Servicing will always be about risk management and ROI optimization for each borrower’s loan. But lifetime customer experience must also be a primary focus — getting this right means you can get all of each borrower’s loans over time, not just one loan.

Borrowers will have questions when they want to refinance, when their escrow/impound accounts change, and when they want to sell their home.

Group 2: Struggling borrowers

Lenders serve homeowners on the downside of the K too.

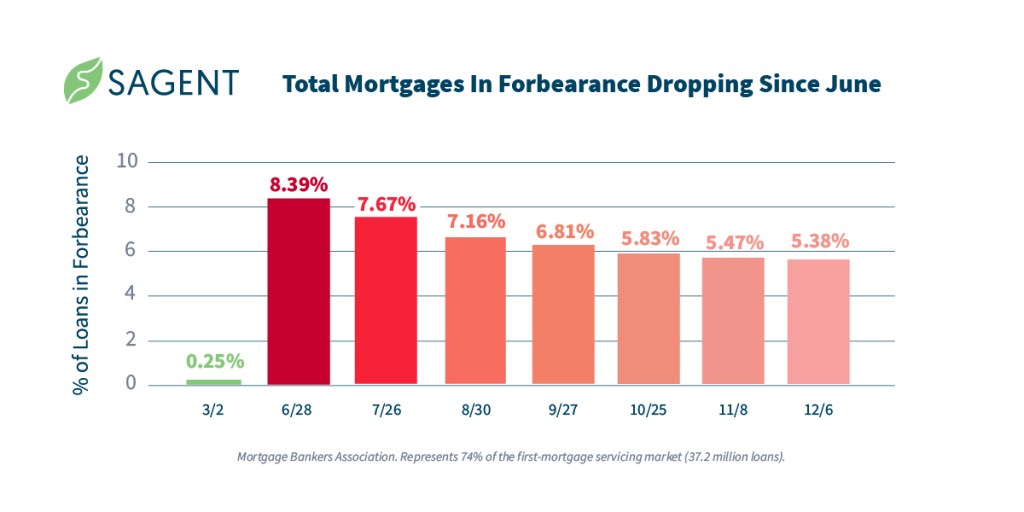

Though forbearance volume has slowly been declining since June, according to the MBA, there are still 2.7 million borrowers in forbearance as of Dec. 6.

Figure 2

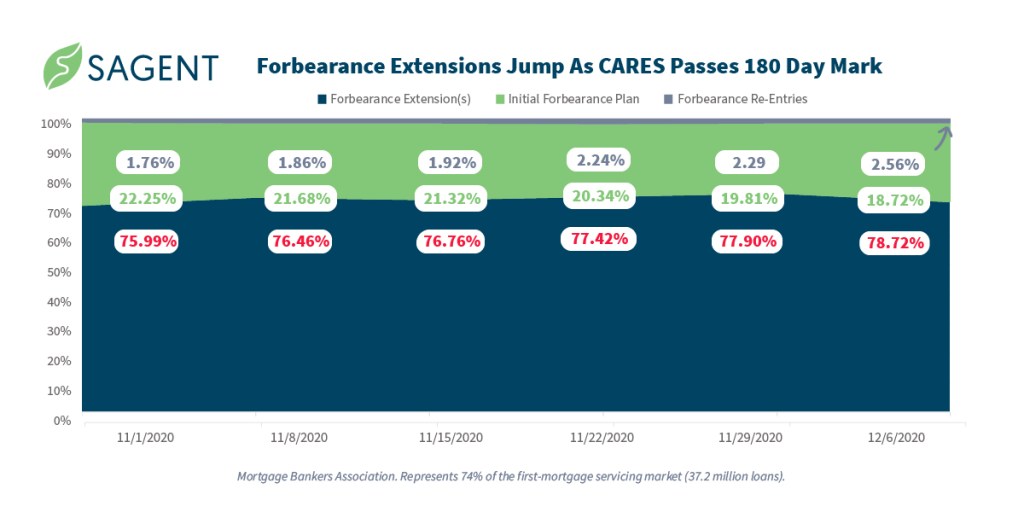

In early October, the initial wave of borrowers who entered forbearance under the CARES Act were faced with a choice: exit or extend.

Though the CARES Act provides up to a year of forbearance without penalty, it’s broken into two 180-day forbearance periods, and forbearance extensions don’t happen automatically after the first six months — the borrower must reach out to their servicer to request the forbearance extension.

Thus far, 78.72% of these folks have extended their forbearance as of Dec. 6. (see Figure 3).

Figure 3

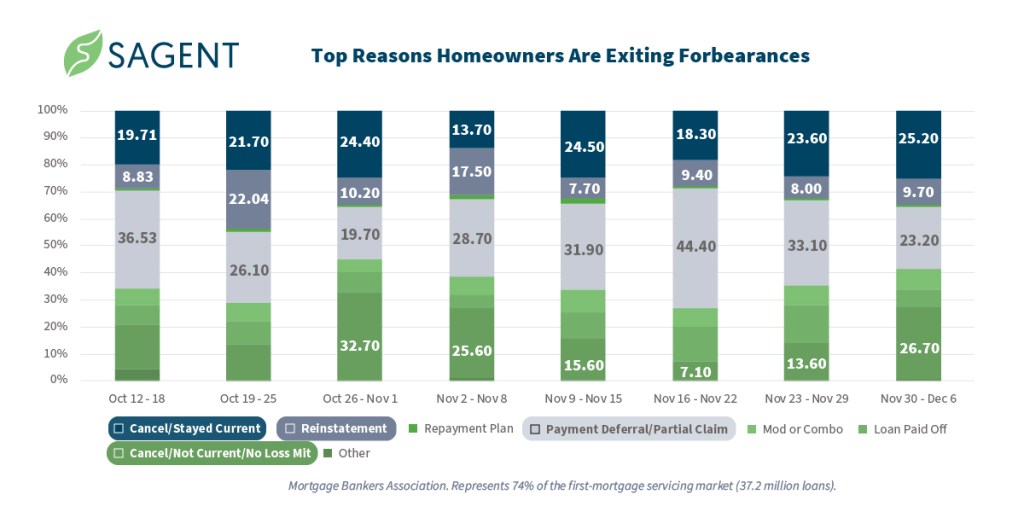

And as for those who have exited forbearance, a few common exit strategies emerge.

If you look at Figure 4 below, you can see that of all the ways borrowers can exit, three reasons constitute the majority of how borrowers are exiting: 1) exit by remaining current on their loan, 2) exit via a lump sum repayment, and 3) exit via payment deferral (aka relief their servicer gave them).

Figure 4

Over the last few weeks, though, a new and worrisome trend has emerged: borrowers are exiting forbearance without taking either an additional six months of forbearance or utilizing one of the loss mitigation options made available to them by servicers (the darkest green bar in Figure 4 above).

Or, as Millennials and Gen Z might say: borrowers are ‘ghosting’ their servicers, and ignoring servicers’ attempts to reach out to help.

To engage these borrowers, servicers’ consumer-facing tech should:

- Offer easy “bank-on-your-phone” customer care and self-service

- Provide immediate requesting and processing of forbearance exit strategies

- Seamlessly integrate into default decisioning systems

- Keep borrowers informed of forbearance and/or loss mit options and status

If they do so, they can help borrowers regardless of what market or political cycle we’re in.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Uday Devalla at [email protected]

To contact the editor responsible for this story:

Brena Nath at [email protected]