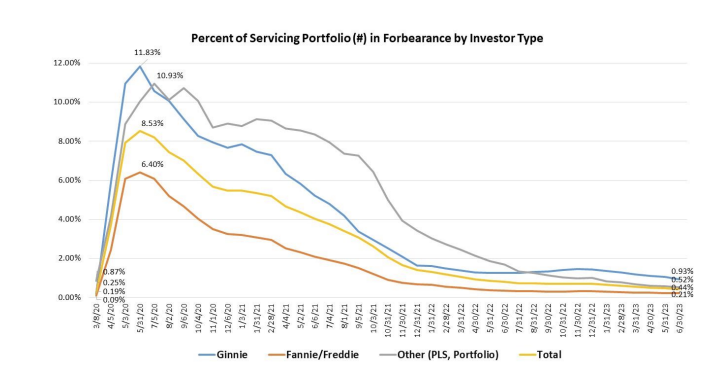

The share of mortgage loans in forbearance decreased by five basis points in June 2023 relative to May 2023 to 0.44% from 0.49%, according to the Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey.

Since March 2020, mortgage servicers have provided forbearance to approximately 7.9 million borrowers and 220,000 homeowners are currently in forbearance plans.

“Mortgage forbearance has declined because most homeowners have maintained or improved their financial health,” said Marina Walsh, the MBA’s vice president of industry analysis. “Recent reporting by the U.S. Bureau of Labor Statistics shows continued job growth in June, and a 3.6% unemployment rate. The employment situation tracks with homeowners’ ability to make mortgage payments.”

Walsh also added, “MBA forecasts a slowing in the economy that could give rise to higher unemployment and mortgage delinquencies later in the year. Forbearance remains a viable loss mitigation option for homeowners who may struggle under more challenging economic conditions.”

Sorted by investor type, the share of Ginnie Mae loans in forbearance decreased relative to the prior month to 0.93% from 1.06%. The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior month to 0.21% from 0.23%. The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased relative to the prior month to 0.52% from 0.58%.

Sorted by servicing portfolio volume, the share loans in forbearance for independent mortgage banks dropped to 0.56% from 0.64% in May. The share of loans in forbearance in depositories on the other hand decreased to 0.32% from 0.34%.

The vast majority of borrowers found themselves in such a place because of COVID-19 related repercussions (78.3%). Other major reasons were natural disasters (6.1%) and other temporary hardships such as a death, a divorce, a job loss or a disability.

In June, 34.9% of total loans in forbearance were in the initial forbearance plan stage, while 54.5% were in a extension. The remaining 12.6% were re-entries, including re-entries with extensions.

Washington, Idaho, Colorado, Oregon and California were the states with the highest rates of borrowers who were current. Mississippi, Louisiana, New York, Indiana and West Virginia had the lowest. Total loans that were current (not delinquent or in foreclosure) as a percentage of servicing portfolio volume was flat at 96.12% from the previous month.