The worst times for mortgage originations may be over as the market appears to be turning, but it’s still an unaffordable environment for younger borrowers in particular, according to a fourth-quarter 2023 lending report from Maxwell.

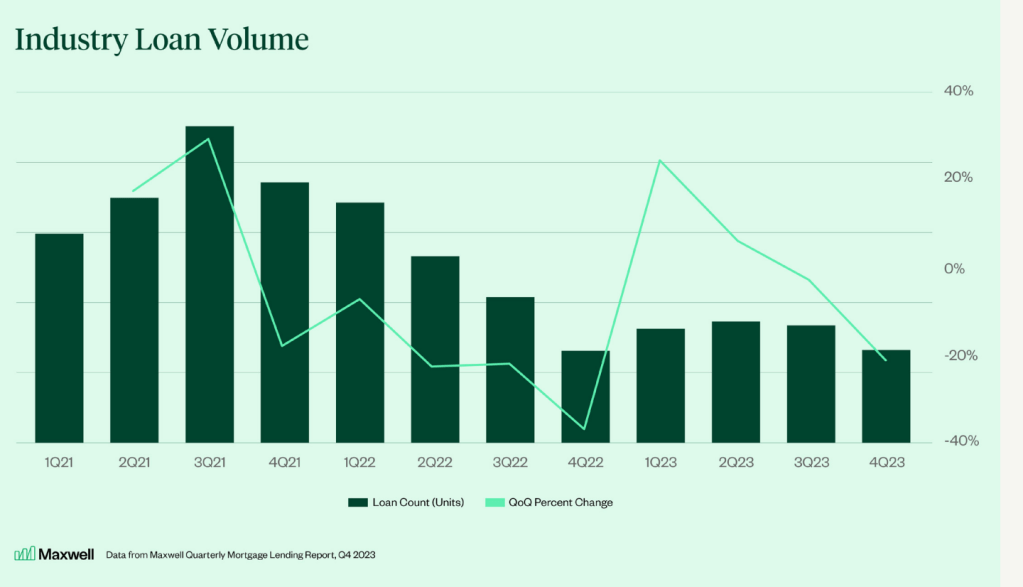

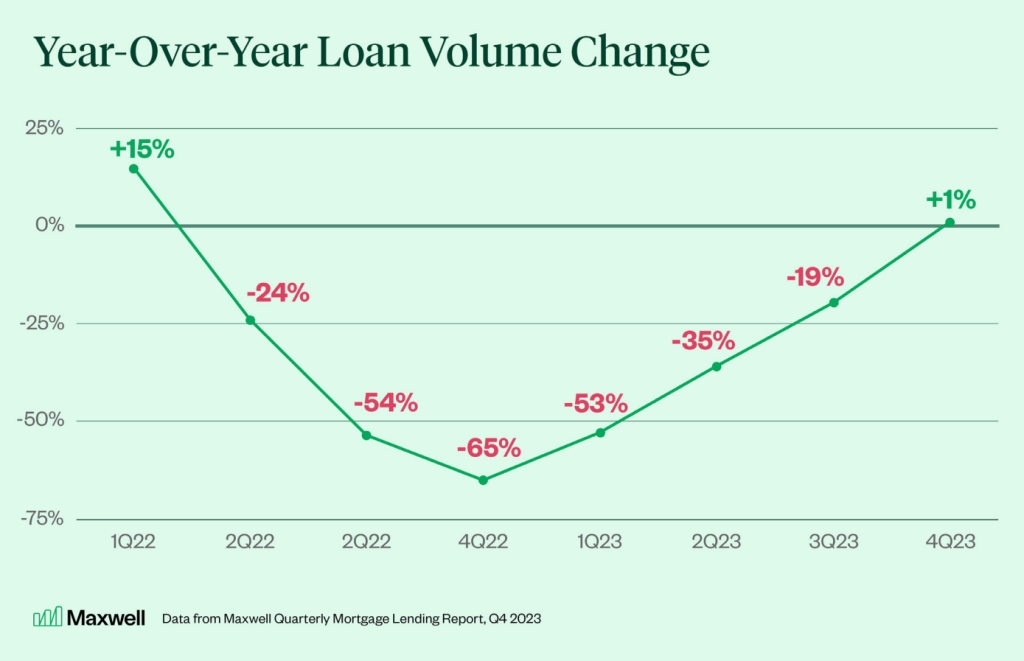

Loan volume between the third and fourth quarters declined by 21%, but that was far less than the 37% drop from Q3 2022 to Q4 2022, the report showed.

Meanwhile, loan volume in the fourth quarter was up by 1% year over year, a significant increase from the annualized decline of 65% in Q4 2022. And it marks the first year-over-year loan growth for any three-month period since Q1 2022.

“The fact that year-over-year loan volume is no longer in the red is a powerful early sign that the industry recovery is at its early stages,” John Paasonen, co-founder and CEO of Maxwell, said in the report. “While the pace of recovery in 2024 is still uncertain, our data indicates we’re past the worst of the current market cycle.”

Maxwell’s mortgage lending report leverages data from its business intelligence platform, which derives trends from more than $300 billion in loan volume transacted on the Maxwell platform across 300-plus lenders, according to the company.

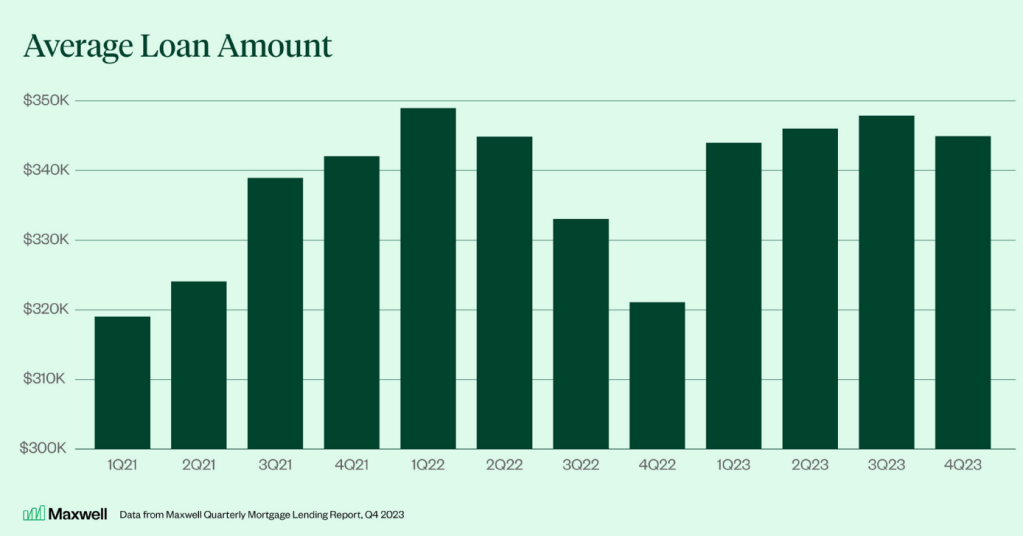

The average monthly income of homebuyers jumped nearly 30% over the past three years, with December 2023 marking a record-high of $12,100.

Similarly, the average loan amount rose to an average of $345,000 in the fourth quarter.

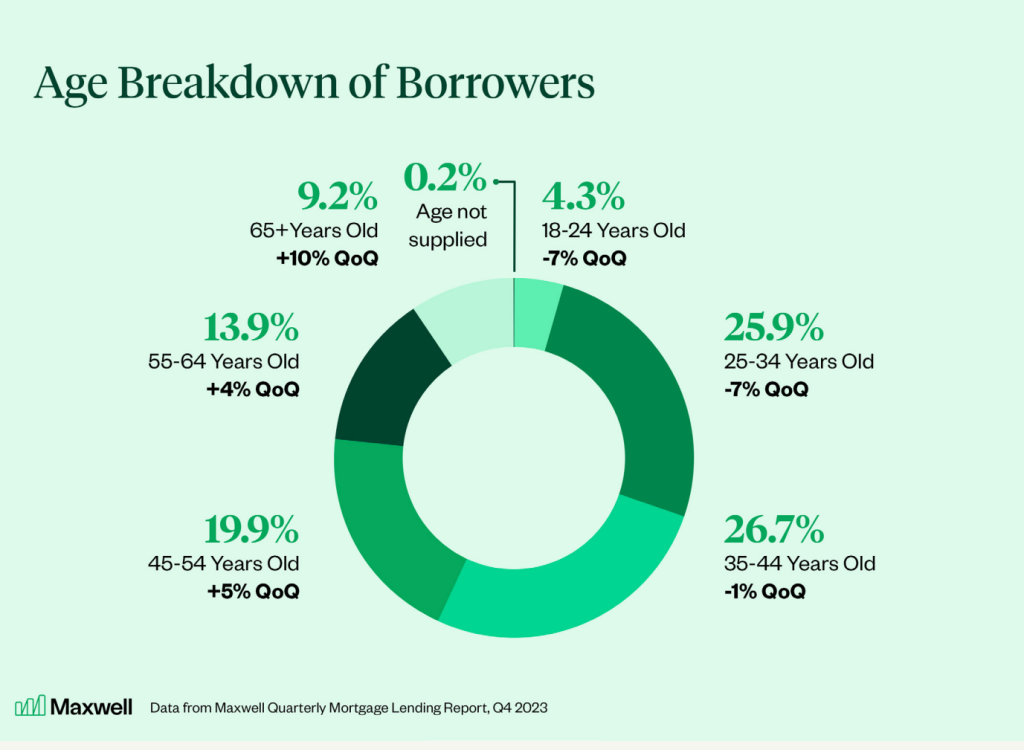

“In response, borrowers in younger age brackets lost traction in Q4 2023, edged out of the market by lack of affordability,” the report stated.

“If home prices and lending costs moderate in 2024, significant demand could flow into the market. That demand may be impeded by low inventory, but lenders should still ready their businesses to capture available loan volume.”

In today’s recovering market, borrowers continue to look for outside-the-the box options that make sense within the current financial reality, the report highlighted.

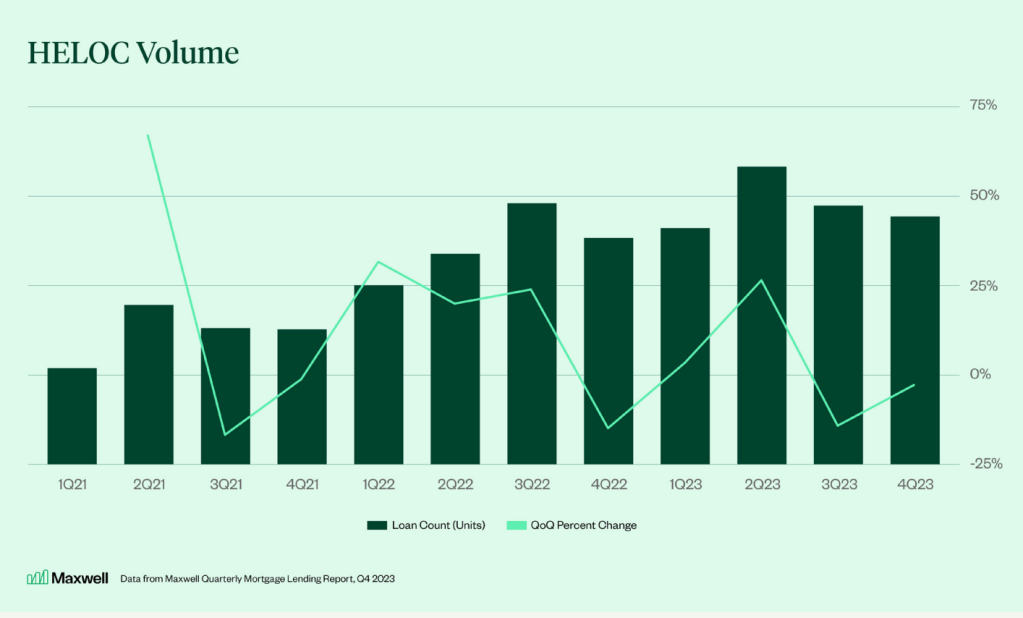

Home equity line of credit (HELOC) volume was down slightly between the third and fourth quarters of last year but remained elevated by 9% on year-over-year basis.

“With many predicting home prices to decline this year, HELOC demand may fall; still, as shown by Maxwell data, volume currently remains strong, and lenders may find continued opportunity in this loan type,” the report stated.

Balances on HELOCs rose for seven consecutive quarters and stood at $360 billion in Q4 2023, according to recent data from the Federal Reserve Bank of New York.

While HELOC balances have been on the rise, a boon for existing homeowners, borrower age trended up from Q3 2023.

All age groups of 44 and below saw their borrower share decline from Q3 to Q4, while age groups of 45 and above increased their shares. Still, those 44 and younger account for 57% of all borrowers.

“Today, the Baby Boomer generation holds almost $19 trillion of American real estate — more than twice as much as millennials,” Paasonen said in the report.

“In terms of units, that means Boomers own nearly 40% of the housing stock in our country. As Boomers age, they’ll likely downsize or move into retirement communities and facilities, freeing up millions of homes across the country. At the same time, we’ll witness one of the largest wealth transfers from Boomers to their children, growing investable assets that their children will use for down payments on houses.”