Home prices in the U.S. have been skyrocketing since 2020, however, I often like to remind people that no matter how crazy home-price growth is in America, at least we aren’t Canada. When it comes to home prices — and especially home prices compared to income — our neighbors up north are like Godzilla to our gecko.

Over the weekend, I tweeted several charts, showing people the big divergence between home price growth and real disposable income in the two countries. The average home in Canada is now nearly $650,000 in U.S. dollars, which is more than nine times household income.

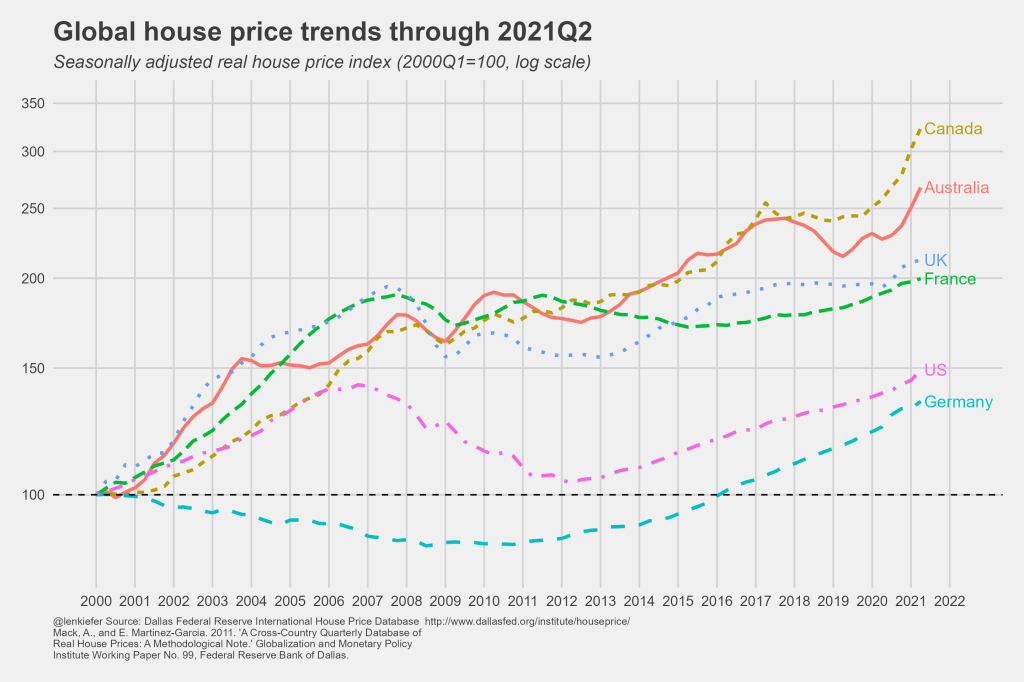

This divergence isn’t limited to Canada — we aren’t like a lot of other countries around the world either. As you can see below, home prices have deviated from disposable income in a much larger fashion in other parts of the world, making the U.S. look very cheap.

Knowing this reality, my priority before 2020 was trying to convince people that the U.S. wasn’t in a second housing bubble. To persuade people of this, probably one of the most important articles I have ever written in my life was in 2019, titled: Housing Bubble 2019? This was my best attempt to convince the housing bubble boys that what they believed in is more fabrication than reality before the years 2020-2024.

It’s now evident that housing did not collapse and in fact home prices are savagely unhealthy. And it’s not just here in America. As you can see above, other countries have experienced steep home-price growth and Canada is leading the way. Will the U.S. housing market follow Canada?

In short, the answer is no, we won’t have the type of home-price velocity that Canada has experienced because our housing market is more diverse than theirs. What I mean by that is Canada’s home-price growth has been significantly — even overwhelmingly — influenced by its two major cities: Vancouver and Toronto. While the U.S. has its high-priced metro areas, our size and diversity mean that our national home price index won’t ever be driven by just two cities.

In addition, the U.S. housing market is more tied to mortgage buyers. Unlike those two cities in Canada, we aren’t as reliant on foreign buyers to such a great extent. Just last month, Canada’s prime minister proposed a two-year ban on some foreign investors buying Canadian real estate to try to tame price growth. Here in the U.S., foreign buyers have always been less than 300,000 of total home sales for many years. When you think about our total home sales being between 5-6 million, foreign investment isn’t that much.

Size also matters. Canada’s population is near 38 million, whereas the U.S. population is near 332 million. We are a monster compared to them in population and the majority of homebuyers in America use mortgages.

When mortgage rates rise, two things always happen here in America.

1. The days on market grow, which gives people more choices and less forced bidding.

2. The growth rate of home prices slows down.

We saw this in 2013-2014 and 2018-2019. Home prices cooled down, and the days on the market grew. Even though nominal home prices never declined, the growth rate in pricing cooled. This should not change.

I’ve tried to stress that we need to worry about home prices getting overheated in 2020-2024, but not because of some massive credit boom like we saw from 2002 to 2005. As we can see below, our current situation isn’t about mortgage credit getting out of hand. This year purchase application data will have its first real year-over-year decline since 2014.

Because the largest number of homebuyers in America are mortgage buyers, this will keep home prices in check when rates rise. Knowing that demand in the years 2020-2024 has had the potential to break out, I set a firm five-year home-price growth model of 23%. Breaking that threshhold would mean we are in unhealthy home-price growth land. That level lasted only two years, and home-price growth worsened early in 2022.

Luckily, all we needed was the 10-year yield to get above 1.94% to create balance, and since home-price growth has been so hot since 2020, we will see some balance in home-price growth. This will prevent America from experiencing a parabolic growth of home prices breaking above disposable Income, as Canada has experienced.

What I see in the chart below is beautiful; yields are rising and taking some of the excesses out of the economy! The timing of this rise in yields was unique as It was early in February of this year that I went into “team higher rates” mode. On Feb. 20 I pinned a video on my Twitter account as a desperate plea that we needed higher rates to stick. Bond yields and rates took off from that point.

Home-price growth has seen many levels post-1996; the reality is that demand has been stable enough to keep inventory at bay (outside the housing bubble credit boom and bust).

Another factor in our low house prices (compared to other countries) is that other countries never had the excess credit leverage we saw in the U.S. from 2002-to 2005, which led to forced credit selling. This is why I believe Canada and other parts of the world have had continued home-price growth, while the U.S. had to deal with its credit bust.

As we can see below, we needed to deleverage a lot of housing debt as credit in America was getting worse in 2005 through 2008. Then, after all that, the great financial crisis happened. A lot of mortgage debt went away due to foreclosures and short sales, bringing home prices way down.

Currently, the balance sheet of the U.S. homeowner looks great, in fact it’s never been better. The housing crash premise that home prices have to go back to 2012 levels is crazy. Housing debt doesn’t work like margin stock debt. A stock can fall 40% in one day, whereas a home doesn’t have that kind of velocity. One of the reasons homeowners can’t sell their homes at a 50%-80% discount so freely is because the bank won’t allow them to if the home value goes below the house’s debt. The homeowner would have negotiated with the lender on this.

The leverage margin debt trading on stocks, on the other hand, can go up and down much more quickly. This has been a reality with supply for some time now; homeowners would need to have a job loss recession to be forced to sell their homes. With all the nested equity built in, a foreclosure process at scale would have to occur in a deep job loss recession with loans done late in an economic expansion. Those loans with a small downpayment risk foreclosure or short sale if home prices fall quickly during a job loss recession. However, most of the stock of homeowners is doing well, over 40% of homes in America don’t even have mortgages, and the nested equity is massive now.

While the home-price growth in Canada and other countries shows the potential for American home prices to skyrocket, I believe we have limits here in the U.S. Most homebuyers are mortgage buyers, so rates and credit limitations matter. We see a lot of home-price growth in parts of the U.S where more wealthy homeowners are moving, and that is part of the unhealthy home-price growth data we have seen since 2020.

However, even that has limits compared to Canada’s massive home-price growth versus disposable incomes. Our biggest homebuyers are the millennials, so housing demand has limits. Also, mortgage rates have been falling over 2% every new cycle since 1981 to a new low, which would mean if this trend continues, which I doubt, mortgage rates would have to fall to 0.125% – 0.50% in the next recession. This is not likely anytime soon since the low mortgage rates were 2.50% recently and we are over 5% today.

This is why if total home sales in America get to 6.2 million or higher in 2020-2024, consider that a beat and view this period as having a healthy amount of replacement buyers but no credit sales boom. With the massive home-price growth we have seen since 2020, this totally new and existing home sales level that I have been focused on is at risk with higher rates. As you can see below with the homebuyer profile from NAR, most of our buyers are millennials and Gen X. In time, Gen Z will be old enough to buy more, but we’re not there just yet.

From NAR:

Home prices have accelerated too much, in my view, but with rates now rising, we should see a cooldown in demand. What happens with higher rates is that we see more days on the market, and the growth rate in pricing cools down. I know it’s fun on social media to compare the home price growth in Canada versus the United States, but in reality, I don’t see us having similar dynamics so that the U.S. would boom in prices so much that we would catch up to Canada’s home-price growth levels versus disposable incomes.

So, yes, it’s a good thing we aren’t Canada because we would be having a much harder housing affordability crisis if we did!